Estimated Payments Kansas Fill in Form K 40es

What is the Estimated Payments Kansas Fill In Form K 40es

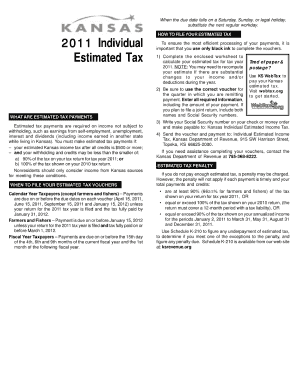

The Estimated Payments Kansas Fill In Form K 40es is a document used by taxpayers in Kansas to report and pay estimated income taxes. This form is essential for individuals who expect to owe tax of $500 or more when filing their annual return. It allows taxpayers to make quarterly payments towards their expected tax liability, ensuring they meet state tax obligations and avoid penalties for underpayment.

How to use the Estimated Payments Kansas Fill In Form K 40es

To effectively use the Estimated Payments Kansas Fill In Form K 40es, taxpayers should first gather necessary financial information, including income estimates and deductions. The form requires users to calculate their expected tax liability for the year and divide it into quarterly payments. Each payment should be submitted by the specified due dates to remain compliant with Kansas tax regulations.

Steps to complete the Estimated Payments Kansas Fill In Form K 40es

Completing the Estimated Payments Kansas Fill In Form K 40es involves several key steps:

- Gather your financial documents, including previous tax returns and income estimates.

- Calculate your expected annual income and applicable deductions.

- Determine your estimated tax liability based on your calculations.

- Divide the total estimated tax by four to find your quarterly payment amount.

- Fill out the K 40es form with your personal information and calculated payment amounts.

- Submit the completed form and payment by the due dates.

Legal use of the Estimated Payments Kansas Fill In Form K 40es

The Estimated Payments Kansas Fill In Form K 40es is legally binding when completed accurately and submitted on time. It is important to ensure that all information provided is truthful and reflects your financial situation. Filing this form correctly helps avoid penalties and interest charges that may arise from underpayment or late payments. Compliance with state tax laws is crucial for maintaining good standing with the Kansas Department of Revenue.

Filing Deadlines / Important Dates

Taxpayers must be aware of the deadlines associated with the Estimated Payments Kansas Fill In Form K 40es. Typically, estimated payments are due on the 15th of April, June, September, and January of the following year. Missing these deadlines can result in penalties, so it is vital to mark these dates on your calendar and ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Estimated Payments Kansas Fill In Form K 40es can be submitted in several ways. Taxpayers have the option to file online through the Kansas Department of Revenue's website, which allows for quick processing and confirmation. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so choose the one that best fits your needs.

Quick guide on how to complete estimated payments kansas fill in form k 40es

Effortlessly prepare Estimated Payments Kansas Fill In Form K 40es on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without complications. Handle Estimated Payments Kansas Fill In Form K 40es on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Estimated Payments Kansas Fill In Form K 40es with ease

- Find Estimated Payments Kansas Fill In Form K 40es and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent parts of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and press the Done button to confirm your changes.

- Select how you wish to share your form, through email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Estimated Payments Kansas Fill In Form K 40es and facilitate effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estimated payments kansas fill in form k 40es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Estimated Payments Kansas Fill In Form K 40es?

The Estimated Payments Kansas Fill In Form K 40es is a document used by individuals and businesses in Kansas to estimate and report their state income tax payments. This form helps taxpayers ensure they are making the correct estimated payments throughout the year. airSlate SignNow offers a user-friendly platform to complete and eSign this form efficiently.

-

Why should I use airSlate SignNow for the Estimated Payments Kansas Fill In Form K 40es?

Using airSlate SignNow for the Estimated Payments Kansas Fill In Form K 40es provides a simple and cost-effective solution to manage your tax documentation. Our platform streamlines the eSigning process, making it easy to fill in and submit your forms quickly. You'll save time and minimize errors with our easy-to-use tool.

-

Is there a cost associated with using airSlate SignNow for the Estimated Payments Kansas Fill In Form K 40es?

Yes, airSlate SignNow offers various pricing plans that cater to individual and business needs. The pricing is designed to be competitive while providing access to features that simplify filling in forms, including the Estimated Payments Kansas Fill In Form K 40es. Check our website for specific details on plans and pricing.

-

What features does airSlate SignNow offer for the Estimated Payments Kansas Fill In Form K 40es?

airSlate SignNow offers features such as document templates, seamless eSigning, and secure storage for the Estimated Payments Kansas Fill In Form K 40es. Our solution also allows you to collaborate with others on your forms and provides tracking options to monitor the submission status. All of these features facilitate a smooth user experience.

-

Can I fill in and sign the Estimated Payments Kansas Fill In Form K 40es on my mobile device?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to fill in and eSign the Estimated Payments Kansas Fill In Form K 40es from your smartphone or tablet. This mobility ensures you can manage your tax documents anytime and anywhere, which is perfect for busy individuals and professionals.

-

Does airSlate SignNow integrate with other software for the Estimated Payments Kansas Fill In Form K 40es?

Yes, airSlate SignNow provides integration options with various business software and applications. This ensures that your data flows seamlessly between systems, enabling you to manage the Estimated Payments Kansas Fill In Form K 40es alongside other documents and tools. Check our integrations page for more details.

-

What are the benefits of using airSlate SignNow for tax forms like the Estimated Payments Kansas Fill In Form K 40es?

The main benefits of using airSlate SignNow include increased efficiency, reduced paperwork, and enhanced security for your tax documents. Our platform simplifies the process of handling forms like the Estimated Payments Kansas Fill In Form K 40es, ensuring you can focus on your financial planning with ease. Enjoy peace of mind with our secure and compliant solution.

Get more for Estimated Payments Kansas Fill In Form K 40es

- Hawaii advance health care directive fillable form

- Satisfaction judgment 5370817 form

- Presidential volunteer service award community service log rhumc form

- Msh claim form 448997538

- Michigan department of treasury form 4632

- Assignment of benefits form 354137379

- Enquiries district hrp annexure f gde 0001 app form

- In the circuit court of the state of oregon for th form

Find out other Estimated Payments Kansas Fill In Form K 40es

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors