Fcatb Chambersburg Extension Form

What is the Fcatb Chambersburg Extension

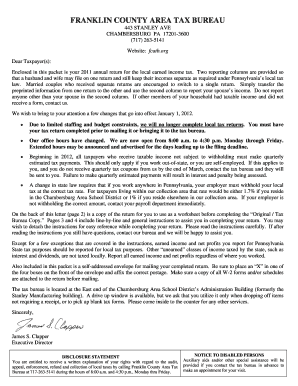

The Fcatb Chambersburg Extension is a specific form used for tax purposes, allowing eligible individuals or entities to extend their filing deadline for certain tax obligations. This extension is particularly relevant for taxpayers in the Chambersburg area, providing them with additional time to prepare and submit their tax returns without incurring penalties. Understanding the purpose and function of this form is essential for compliance with tax regulations.

How to use the Fcatb Chambersburg Extension

Using the Fcatb Chambersburg Extension involves a straightforward process. Taxpayers must first determine their eligibility for the extension. Once confirmed, they can complete the form, providing necessary information such as personal details and the type of tax return being extended. After filling out the form, it should be submitted to the appropriate tax authority, either electronically or via mail, depending on the specific guidelines provided by the IRS or state tax agency.

Steps to complete the Fcatb Chambersburg Extension

Completing the Fcatb Chambersburg Extension requires several key steps:

- Gather necessary information, including your tax identification number and details about your income.

- Obtain the form from the relevant tax authority's website or office.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Legal use of the Fcatb Chambersburg Extension

The legal use of the Fcatb Chambersburg Extension is governed by tax regulations that outline the conditions under which an extension can be granted. This form must be used correctly to ensure that the extension is recognized by tax authorities. Failure to comply with the legal requirements can result in penalties or denial of the extension, making it crucial for taxpayers to understand the legal implications of their submission.

Key elements of the Fcatb Chambersburg Extension

Several key elements define the Fcatb Chambersburg Extension. These include:

- Eligibility criteria: Specific conditions that must be met to qualify for the extension.

- Filing deadlines: The dates by which the extension must be submitted to avoid penalties.

- Required information: Details that must be included on the form, such as taxpayer identification and tax year.

Form Submission Methods (Online / Mail / In-Person)

The Fcatb Chambersburg Extension can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission: Many tax authorities allow for electronic filing, which can expedite the process.

- Mail: Taxpayers can print the completed form and send it via postal service to the designated address.

- In-person submission: Some may choose to deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete fcatb chambersburg extension

Prepare Fcatb Chambersburg Extension effortlessly on any device

Online document management has increasingly become popular among businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents promptly and without complications. Handle Fcatb Chambersburg Extension on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and electronically sign Fcatb Chambersburg Extension with ease

- Find Fcatb Chambersburg Extension and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Fcatb Chambersburg Extension and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fcatb chambersburg extension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fcatb chambersburg extension and how does it work?

The fcatb chambersburg extension is a feature within airSlate SignNow that streamlines the document signing process. It allows users to send, sign, and manage their documents electronically with ease. This extension enhances productivity by providing a cost-effective solution for businesses looking to optimize their document workflows.

-

How much does the fcatb chambersburg extension cost?

Pricing for the fcatb chambersburg extension is designed to be budget-friendly, offering various plans to accommodate different business needs. Users can choose from monthly or annual subscriptions, ensuring that they find a solution that fits their financial goals. It’s recommended to visit the airSlate SignNow website for detailed pricing information and potential discounts.

-

What features does the fcatb chambersburg extension provide?

The fcatb chambersburg extension includes several features such as template creation, automated workflows, and secure e-signatures. Additionally, it allows users to track document statuses and set reminders, enhancing the overall signing experience. These features work together to simplify document management for users.

-

How can the fcatb chambersburg extension benefit my business?

By using the fcatb chambersburg extension, businesses can save time and reduce costs associated with traditional paper-based signing processes. This extension increases efficiency by allowing quick access to documents and real-time tracking of signing status. Ultimately, it empowers teams to focus on what matters most while ensuring compliance and security.

-

Can I integrate the fcatb chambersburg extension with other software?

Yes, the fcatb chambersburg extension supports integrations with various platforms such as Google Drive, Dropbox, and CRM systems. This flexibility helps businesses streamline their workflows by connecting disparate processes into one cohesive system. Consequently, users can enjoy enhanced productivity through seamless data sharing.

-

Is the fcatb chambersburg extension secure for sensitive documents?

Absolutely! The fcatb chambersburg extension is designed with security in mind, employing strong encryption methods to protect your sensitive documents. Users can be confident that their data is secure throughout the signing process. Additionally, airSlate SignNow adheres to industry security standards to ensure compliance and trust.

-

What support options are available for the fcatb chambersburg extension?

airSlate SignNow offers multiple support options for users of the fcatb chambersburg extension, including a comprehensive help center, email support, and live chat assistance. Whether you have questions about functionality or need troubleshooting help, support representatives are available to guide you. The goal is to ensure that users can maximize their experience with the extension.

Get more for Fcatb Chambersburg Extension

Find out other Fcatb Chambersburg Extension

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile