DR 0204 Tax Year Ending Computation of Penalty Due Based 2022

What is the DR 0204 Tax Year Ending Computation Of Penalty Due Based

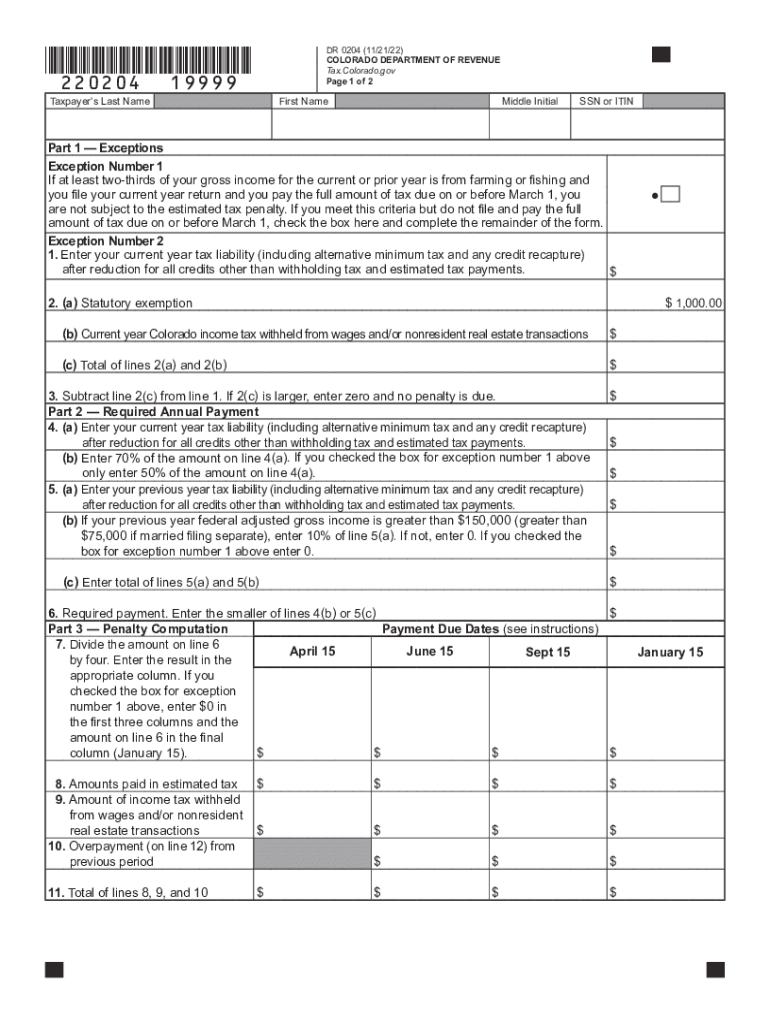

The DR 0204 form is utilized to compute penalties for underpayment of Colorado state taxes for the year 2014. This form is particularly important for taxpayers who did not pay enough tax throughout the year, leading to a potential penalty. The computation is based on the amount of tax owed versus the amount paid, taking into account any estimated payments made during the tax year. Understanding this form is crucial for ensuring compliance with state tax laws and avoiding unnecessary penalties.

Steps to complete the DR 0204 Tax Year Ending Computation Of Penalty Due Based

Completing the DR 0204 form involves several key steps:

- Gather all relevant financial documents, including income statements and records of any estimated tax payments made during the year.

- Calculate the total tax liability for the year based on your income and applicable deductions.

- Determine the total amount of tax that has been paid, including any withholdings and estimated payments.

- Subtract the total payments from the total tax liability to find the underpayment amount.

- Use the underpayment amount to calculate the penalty based on the state’s guidelines for the 2014 tax year.

Legal use of the DR 0204 Tax Year Ending Computation Of Penalty Due Based

The DR 0204 form is legally binding when filled out correctly and submitted to the Colorado Department of Revenue. It serves as an official record of the taxpayer's computations regarding underpayment penalties. To ensure legal validity, it is essential to provide accurate information and complete all required sections of the form. Additionally, using a reliable eSigning platform can enhance the legal standing of the submitted document, ensuring compliance with electronic signature laws.

Filing Deadlines / Important Dates

For the 2014 tax year, the filing deadlines for the DR 0204 form align with the general state tax filing deadlines. Typically, taxpayers must submit their forms by April 15 of the following year. However, extensions may apply, and it is important to stay informed about any changes to deadlines or additional requirements set by the Colorado Department of Revenue. Timely submission can help avoid additional penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failing to file the DR 0204 form or submitting it with incorrect information can result in significant penalties. The state imposes fines based on the amount of underpayment, which can accumulate over time. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden. It is crucial for taxpayers to understand these penalties and take the necessary steps to comply with all filing requirements to avoid complications.

Examples of using the DR 0204 Tax Year Ending Computation Of Penalty Due Based

Consider a scenario where a taxpayer owed a total of $2,000 in state taxes but only paid $1,500 throughout the year. The underpayment amount would be $500. If the penalty for underpayment is calculated at a specific rate, the taxpayer would need to fill out the DR 0204 form to determine the exact penalty owed. This form can also be used by self-employed individuals or business owners who need to report underpayment penalties based on their specific tax situations.

Quick guide on how to complete dr 0204 tax year ending computation of penalty due based

Complete DR 0204 Tax Year Ending Computation Of Penalty Due Based effortlessly on any device

Digital document management has gained traction with organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without any holdups. Manage DR 0204 Tax Year Ending Computation Of Penalty Due Based across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign DR 0204 Tax Year Ending Computation Of Penalty Due Based without hassle

- Find DR 0204 Tax Year Ending Computation Of Penalty Due Based and then select Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow has designed specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign DR 0204 Tax Year Ending Computation Of Penalty Due Based and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 0204 tax year ending computation of penalty due based

Create this form in 5 minutes!

How to create an eSignature for the dr 0204 tax year ending computation of penalty due based

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the pricing options for the airSlate SignNow platform?

The pricing for airSlate SignNow is competitive and designed to fit various budget needs. Depending on your business size and requirements, you can find plans that cater to your estimated yearly document volumes, including a detailed analysis for 2014 Colorado estimated costs.

-

How does airSlate SignNow enhance document signing processes?

airSlate SignNow streamlines the document signing process with intuitive features that allow users to send, sign, and manage documents effortlessly. For those estimating their operational costs, such as the 2014 Colorado estimated expenses, this platform offers signNow time savings and reduces paper waste.

-

Can airSlate SignNow integrate with other business applications?

Yes, airSlate SignNow can seamlessly integrate with multiple applications like Google Drive, Salesforce, and Microsoft Office. This functionality is beneficial for businesses evaluating their 2014 Colorado estimated software solutions, providing a cohesive digital experience.

-

What security features does airSlate SignNow offer?

airSlate SignNow prioritizes document security with robust measures including AES-256 bit encryption and secure user authentication. understanding the security aspects is crucial for organizations considering their 2014 Colorado estimated data compliance needs.

-

Is mobile access available on the airSlate SignNow platform?

Absolutely! airSlate SignNow offers a user-friendly mobile application that enables users to sign documents on the go. This feature caters to the needs of professionals who rely on quick access to documents while evaluating their 2014 Colorado estimated resources.

-

What types of documents can be signed with airSlate SignNow?

Users can sign various document types, including contracts, agreements, and forms through airSlate SignNow. This versatility allows businesses to assess their 2014 Colorado estimated document management needs effectively.

-

Does airSlate SignNow provide customer support?

Yes, airSlate SignNow offers excellent customer support through multiple channels, including chat, email, and a comprehensive knowledge base. Having dedicated support is especially beneficial for users looking to streamline their 2014 Colorado estimated operations.

Get more for DR 0204 Tax Year Ending Computation Of Penalty Due Based

- General warranty deed individual to four individuals texas form

- General warranty deed conveying a life estate from a family trust to an individual texas form

- Deed two one 497327420 form

- Deed to trust 497327421 form

- Texas lien form

- Quitclaim deed from individual to corporation texas form

- Warranty deed from individual to corporation texas form

- Lady warranty deed form

Find out other DR 0204 Tax Year Ending Computation Of Penalty Due Based

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document