OMB Control Number 0560 0297 2020-2026

Understanding the OMB Control Number 0

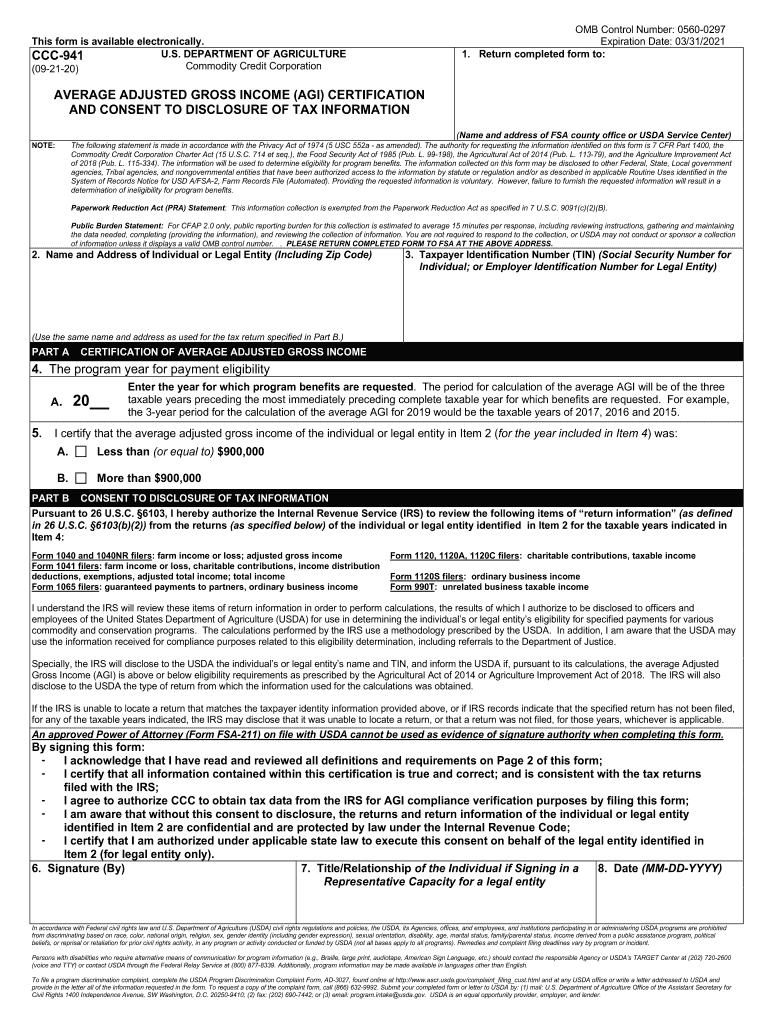

The OMB Control Number 0 is a unique identifier assigned by the Office of Management and Budget (OMB) to the FSA 941 form. This number is essential for tracking and managing the collection of information from the public by federal agencies. It ensures compliance with the Paperwork Reduction Act, which aims to minimize the burden of paperwork on individuals and businesses. The OMB Control Number serves as a reference point for users to verify that the form is approved and that the information requested is necessary for the agency’s operations.

Steps to Complete the OMB Control Number 0

Completing the FSA 941 form requires careful attention to detail. Here are the key steps to ensure accurate submission:

- Gather necessary information, including your USDA adjusted gross income and any relevant financial documents.

- Access the form, either in a fillable format online or through a printed version.

- Fill out each section of the form, ensuring that all required fields are completed accurately.

- Review the form for any errors or omissions before finalizing.

- Submit the completed form according to the specified submission methods, which may include online, mail, or in-person options.

Legal Use of the OMB Control Number 0

The legal use of the OMB Control Number 0 is crucial for ensuring that the information collected through the FSA 941 form is valid and compliant with federal regulations. This number indicates that the form has undergone the necessary review and approval process, making it a legally recognized document. Users should ensure that they are using the most current version of the form and that it is properly filled out to avoid any legal issues.

Filing Deadlines / Important Dates

Timely submission of the FSA 941 form is essential to avoid penalties and ensure compliance with USDA requirements. Key filing deadlines typically align with agricultural reporting periods, and users should be aware of specific dates relevant to their operations. It is advisable to check the USDA website or official communications for the most current deadlines to ensure your submission is on time.

Required Documents for Submission

When completing the FSA 941 form, certain documents may be required to support your claims. These documents include:

- Proof of income, such as tax returns or financial statements.

- Documentation of any relevant agricultural activities.

- Identification information, including your Social Security number or Employer Identification Number (EIN).

Having these documents ready can streamline the form completion process and ensure that all necessary information is provided.

Form Submission Methods

The FSA 941 form can be submitted through various methods to accommodate different user preferences. Common submission methods include:

- Online submission through the USDA’s electronic services.

- Mailing the completed form to the designated USDA office.

- In-person submission at local USDA offices, allowing for immediate assistance if needed.

Choosing the right submission method can help ensure that your form is received and processed efficiently.

Quick guide on how to complete omb control number 0560 0297

Complete OMB Control Number 0560 0297 effortlessly on any device

Online document administration has become widely embraced by businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to discover the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage OMB Control Number 0560 0297 on any platform with airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign OMB Control Number 0560 0297 with ease

- Locate OMB Control Number 0560 0297 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searching, or errors that necessitate reprinting new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from a device of your choice. Edit and eSign OMB Control Number 0560 0297 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct omb control number 0560 0297

Create this form in 5 minutes!

How to create an eSignature for the omb control number 0560 0297

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fsa 941 form, and why is it important?

The fsa 941 form is a quarterly tax return that employers in the United States must file to report wages paid and taxes withheld. It is crucial for maintaining compliance with federal tax laws and ensuring proper reporting of payroll taxes. Understanding the fsa 941 is essential for businesses to manage their tax liabilities effectively.

-

How can airSlate SignNow simplify fsa 941 document signing?

airSlate SignNow provides a user-friendly platform for electronically signing the fsa 941 form. Our eSignature solution allows businesses to quickly obtain necessary signatures without the hassle of paper documents. With airSlate SignNow, you can enhance efficiency and ensure that your fsa 941 forms are processed swiftly.

-

What features does airSlate SignNow offer for managing fsa 941 forms?

airSlate SignNow includes features like templates for the fsa 941 form, bulk sending options, and real-time tracking of document status. These tools help streamline the document management process, reduce errors, and save time. With our platform, you can easily customize and send your fsa 941 forms as needed.

-

Is airSlate SignNow a cost-effective solution for businesses filing fsa 941?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing your fsa 941 and other document-related needs. We offer flexible pricing plans to accommodate businesses of all sizes, ensuring you have access to essential features without overspending. Save resources while staying compliant with your fsa 941 filing.

-

What are the benefits of using airSlate SignNow for fsa 941 processes?

Using airSlate SignNow for your fsa 941 processes offers several benefits, including increased speed of processing, enhanced security, and easier collaboration among team members. You can effortlessly send and receive documents securely, minimizing the risks associated with physical paperwork. This leads to better compliance and a more streamlined workflow.

-

Can airSlate SignNow integrate with other software for fsa 941 management?

Yes, airSlate SignNow seamlessly integrates with various software applications that businesses may use for managing their fsa 941 filing. These integrations enhance productivity by allowing for smoother data transfer and enabling more comprehensive workflow automation. Simplify your fsa 941 management by connecting our platform with your existing tools.

-

How does airSlate SignNow ensure the security of my fsa 941 documents?

airSlate SignNow employs robust security measures to protect your fsa 941 documents. Our platform utilizes encryption technology to safeguard your data and offers features such as authentication protocols and audit trails. This ensures that your fsa 941 forms remain confidential and secure throughout the signing process.

Get more for OMB Control Number 0560 0297

Find out other OMB Control Number 0560 0297

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online