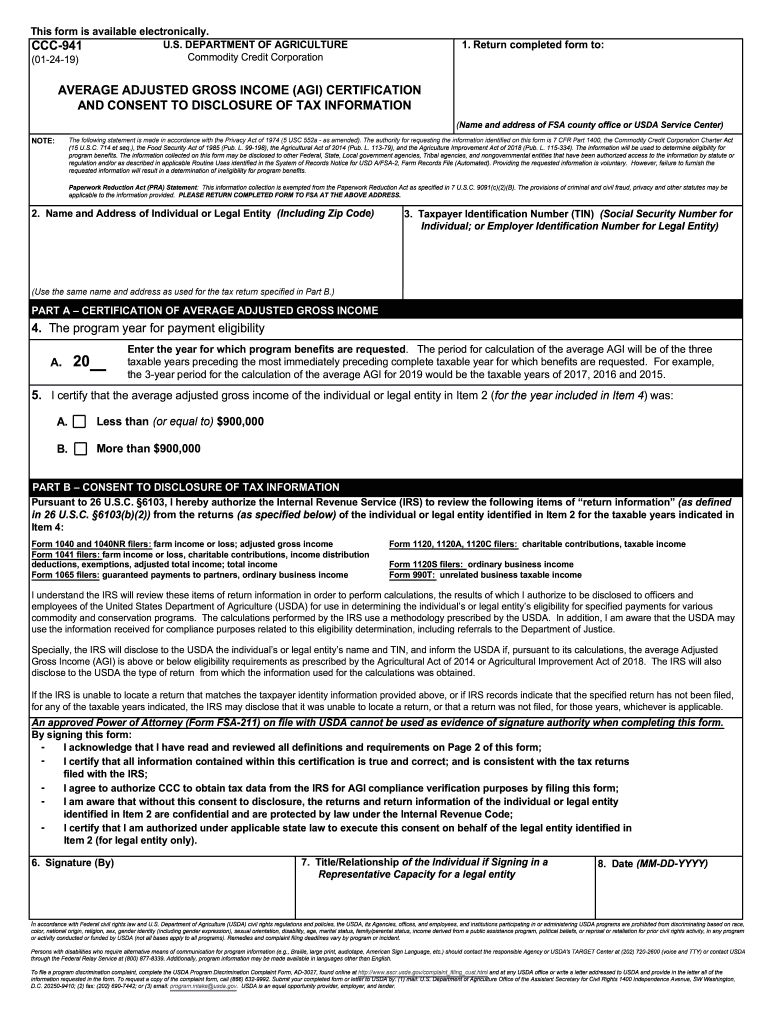

How to Ccc 941 2019

Understanding the Agriculture Adjusted AGI

The agriculture adjusted AGI (Adjusted Gross Income) is a crucial metric for farmers and agricultural businesses in the United States. It reflects the total income from farming activities after certain adjustments, which can affect eligibility for various government programs and benefits. This adjusted figure is particularly important when applying for loans, grants, or subsidies related to agriculture.

Key Elements of the Agriculture Adjusted AGI

To accurately calculate the agriculture adjusted AGI, several key elements must be considered:

- Gross Income: This includes all income derived from farming operations, including sales of crops and livestock.

- Adjustments: Certain deductions, such as business expenses, depreciation, and losses, can be applied to arrive at the adjusted figure.

- Tax Credits: Available tax credits can also impact the final AGI, influencing the overall tax liability for the individual or business.

Steps to Complete the Agriculture Adjusted AGI Calculation

Calculating the agriculture adjusted AGI involves several steps:

- Gather all income statements related to farming activities.

- Identify and document all allowable deductions and adjustments.

- Calculate the gross income from farming operations.

- Subtract the total adjustments from the gross income to determine the adjusted AGI.

Legal Use of the Agriculture Adjusted AGI

The agriculture adjusted AGI is often required for compliance with various federal and state regulations. It is used to determine eligibility for programs administered by the USDA and other agencies. Proper calculation and reporting are essential to avoid penalties and ensure access to financial assistance.

Filing Deadlines and Important Dates

Filing deadlines for forms related to agriculture adjusted AGI can vary. Generally, it is advisable to consult the IRS guidelines or USDA announcements for specific dates relevant to your situation. Staying informed about these deadlines helps ensure compliance and avoids potential late fees.

Form Submission Methods

Submitting forms related to agriculture adjusted AGI can typically be done through various methods:

- Online: Many forms can be completed and submitted electronically through authorized platforms.

- Mail: Traditional mail submissions are still accepted, but ensure that all documents are sent well before the deadline.

- In-Person: Some individuals may prefer to submit forms in person at local USDA offices, providing an opportunity for immediate assistance.

Quick guide on how to complete how to ccc 941

Prepare How To Ccc 941 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents promptly without delays. Manage How To Ccc 941 across any platform using airSlate SignNow Android or iOS applications and enhance any document-related activity today.

How to edit and electronically sign How To Ccc 941 with ease

- Locate How To Ccc 941 and click on Get Form to begin.

- Make use of the tools we supply to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form—via email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign How To Ccc 941 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to ccc 941

Create this form in 5 minutes!

How to create an eSignature for the how to ccc 941

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is agriculture adjusted agi?

Agriculture adjusted AGI refers to the modified adjusted gross income calculated specifically for agricultural businesses. This figure is crucial as it helps in determining eligibility for various farm-related benefits and programs. Understanding agriculture adjusted AGI is essential for farmers and stakeholders navigating financial assistance opportunities.

-

How can airSlate SignNow assist with managing agriculture adjusted agi documents?

airSlate SignNow simplifies the process of managing documents related to agriculture adjusted AGI through its user-friendly eSignature platform. Users can quickly send, sign, and store vital documents securely. This ensures that important financial records are easily accessible and compliant with regulatory requirements.

-

Is there a cost associated with using airSlate SignNow for agriculture adjusted agi documents?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of businesses managing agriculture adjusted AGI documents. These plans are designed to be cost-effective and provide excellent value given the features and support offered. Users can select the plan that best fits their requirements and budget.

-

What features does airSlate SignNow provide for handling agriculture adjusted agi paperwork?

airSlate SignNow includes features such as customizable templates, automated workflows, and robust security measures for handling agriculture adjusted AGI paperwork. The platform allows businesses to streamline document management processes, reducing time spent on paperwork. Additionally, its mobile functionality ensures that users can manage documents on-the-go.

-

Can I integrate airSlate SignNow with other software for agriculture adjusted agi management?

Absolutely! airSlate SignNow seamlessly integrates with various applications commonly used in agriculture financial management. By connecting with other software, users can enhance their ability to manage agriculture adjusted AGI documents without disrupting their existing workflow. This integration capability promotes efficiency and productivity.

-

What are the benefits of using airSlate SignNow for agriculture adjusted agi documents?

Using airSlate SignNow for agriculture adjusted AGI documents streamlines the signing process, cuts down on paper waste, and enhances security. Users benefit from faster turnaround times on document approvals, which is essential for timely financial assessments. The ease of use also encourages higher adoption rates among team members involved in the documentation process.

-

How secure is airSlate SignNow in handling sensitive agriculture adjusted agi information?

airSlate SignNow prioritizes the security of sensitive agriculture adjusted AGI information by using bank-grade encryption and secure cloud storage. The platform ensures compliance with major data protection regulations, giving users peace of mind. Regular security audits are performed to maintain high standards in data safety.

Get more for How To Ccc 941

Find out other How To Ccc 941

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will