BOE571L P4 REV 24 0518Kristen Spears, Placer 2022-2026

Understanding the 571L Form

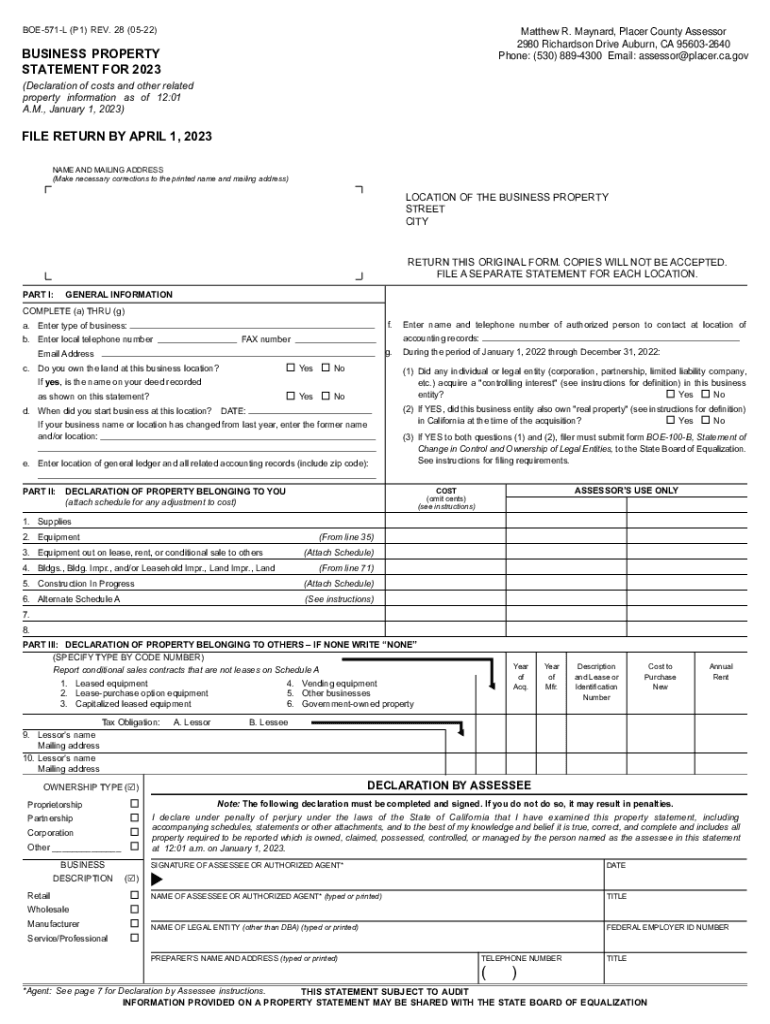

The 571L form, also known as the California Business Property Statement, is a crucial document for businesses in California. It is used to report personal property owned by businesses to the county assessor. This form helps ensure that businesses are accurately assessed for property taxes. Completing the 571L form is essential for compliance with local tax laws and can impact the overall tax liability of a business.

Steps to Complete the 571L Form

Filling out the 571L form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information about your business, including the type of property owned and its value.

- Access the 571L form, available in both digital and printable formats.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to your local county assessor's office.

Legal Use of the 571L Form

The 571L form holds legal significance as it is a formal declaration of personal property for tax purposes. When completed correctly, it serves as a binding document that can be used in legal contexts, such as tax assessments or disputes. Ensuring compliance with the regulations surrounding this form is vital for businesses to avoid penalties or legal issues.

Filing Deadlines for the 571L Form

Timeliness is critical when submitting the 571L form. The filing deadline typically falls on April first of each year. Businesses must ensure that their form is submitted by this date to avoid late penalties. It is advisable to check with the local county assessor's office for any specific deadlines or extensions that may apply.

Form Submission Methods

The 571L form can be submitted through various methods, providing flexibility for businesses. Common submission methods include:

- Online submission through the county assessor's website.

- Mailing a hard copy of the completed form to the appropriate office.

- In-person submission at the local county assessor's office.

Required Documents for the 571L Form

When completing the 571L form, certain documents may be required to support the information provided. These documents can include:

- Purchase receipts for property items.

- Previous tax returns that include personal property information.

- Any relevant financial statements that detail the value of the property.

Key Elements of the 571L Form

Understanding the key elements of the 571L form is essential for accurate reporting. Important sections typically include:

- Business identification information, such as name and address.

- A detailed list of personal property owned, including descriptions and values.

- Signature and date lines to certify the accuracy of the information provided.

Quick guide on how to complete boe571l p4 rev 24 0518kristen spears placer

Manage BOE571L P4 REV 24 0518Kristen Spears, Placer effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle BOE571L P4 REV 24 0518Kristen Spears, Placer on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign BOE571L P4 REV 24 0518Kristen Spears, Placer with ease

- Obtain BOE571L P4 REV 24 0518Kristen Spears, Placer and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign BOE571L P4 REV 24 0518Kristen Spears, Placer and assure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct boe571l p4 rev 24 0518kristen spears placer

Create this form in 5 minutes!

How to create an eSignature for the boe571l p4 rev 24 0518kristen spears placer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 571 l form?

The 571 l form is used for specific tax purposes, allowing individuals to report income and applicable deductions. This form is an essential part of ensuring compliance with tax regulations. Properly filling out the 571 l form can help maximize your tax benefits.

-

How can airSlate SignNow help with the 571 l form?

airSlate SignNow simplifies the process of preparing and signing the 571 l form. With its user-friendly interface, you can easily fill out, eSign, and share this document securely. This helps streamline your tax preparation while ensuring that your 571 l form is completed accurately.

-

Is airSlate SignNow cost-effective for managing the 571 l form?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective solution for managing the 571 l form. The platform provides various subscription plans to fit different business needs, ensuring that you can handle your documents without breaking the bank. Opting for airSlate SignNow can save you time and resources during tax season.

-

What features does airSlate SignNow offer for the 571 l form?

airSlate SignNow includes features like customizable templates, eSigning capabilities, and secure document storage for your 571 l form. These tools not only enhance efficiency but also provide a secure way to manage sensitive information. With these features, you can ensure compliance and speed up your workflow.

-

Can I integrate airSlate SignNow with other software for my 571 l form?

Yes, airSlate SignNow offers integrations with various software applications, making it easier to work with the 571 l form. Whether you use CRM systems, cloud storage, or accounting software, airSlate SignNow can seamlessly connect to enhance your document management process. This flexibility can signNowly improve your workflow efficiency.

-

Is it safe to eSign the 571 l form with airSlate SignNow?

Absolutely, eSigning the 571 l form with airSlate SignNow is secure and compliant with legal regulations. The platform employs advanced encryption and security measures to protect your sensitive data. You can trust that your signed documents are safe and securely stored.

-

What are the benefits of using airSlate SignNow for the 571 l form?

Using airSlate SignNow for the 571 l form provides numerous benefits, including increased efficiency, enhanced security, and ease of use. The platform streamlines the signing process, allowing for faster turnaround times. This can be especially important during tax seasons when timely submissions are critical.

Get more for BOE571L P4 REV 24 0518Kristen Spears, Placer

Find out other BOE571L P4 REV 24 0518Kristen Spears, Placer

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile