Form 571 L Marin County 2013

What is the Form 571 L Marin County

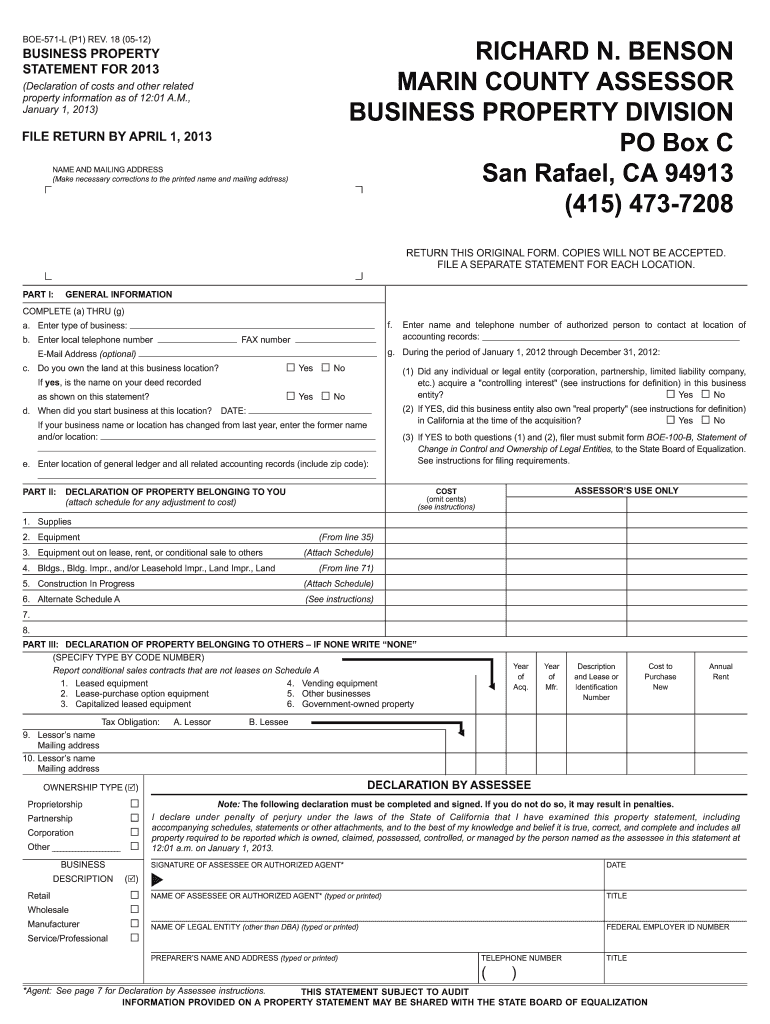

The Form 571 L Marin County is a property tax assessment form utilized by property owners to report the value of their personal property to the Marin County Assessor's Office. This form is essential for ensuring accurate property tax assessments and is typically required for businesses that own personal property, such as equipment, machinery, and furnishings. By submitting this form, property owners provide the necessary information for the county to determine the assessed value of their assets, which in turn affects the property taxes owed.

How to use the Form 571 L Marin County

Using the Form 571 L Marin County involves a straightforward process. Property owners must first obtain the form, which can be accessed online or through the Marin County Assessor's Office. After acquiring the form, the next step is to accurately fill it out, providing details about the personal property owned, including descriptions, purchase dates, and values. Once completed, the form must be submitted to the Assessor's Office by the specified deadline to ensure compliance with local regulations.

Steps to complete the Form 571 L Marin County

Completing the Form 571 L Marin County requires several key steps:

- Obtain the form from the Marin County Assessor's Office or their website.

- Gather necessary information about your personal property, including descriptions and values.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Assessor's Office by the deadline.

Legal use of the Form 571 L Marin County

The legal use of the Form 571 L Marin County is governed by state and local property tax laws. Properly completing and submitting this form is crucial for compliance, as it provides the necessary information for the county to assess property taxes accurately. Failure to submit the form or providing inaccurate information can result in penalties, including fines or increased assessments. Therefore, it is important for property owners to understand their responsibilities and ensure that the form is used correctly.

Key elements of the Form 571 L Marin County

Key elements of the Form 571 L Marin County include:

- Property owner information, including name and address.

- Detailed descriptions of personal property owned.

- Purchase dates and values of the property.

- Signature of the property owner or authorized representative.

- Submission date to ensure timely processing.

Required Documents

When submitting the Form 571 L Marin County, property owners may need to provide additional documentation to support the information reported. This may include:

- Invoices or receipts for purchased equipment and furnishings.

- Previous assessment notices for reference.

- Any relevant financial statements that detail property values.

Form Submission Methods (Online / Mail / In-Person)

The Form 571 L Marin County can be submitted through various methods to accommodate property owners' preferences. These methods include:

- Online submission via the Marin County Assessor's Office website.

- Mailing the completed form to the Assessor's Office address.

- In-person submission at the Assessor's Office during business hours.

Quick guide on how to complete form 571 l marin county 2013

Complete Form 571 L Marin County effortlessly on any device

Online document management has become widely embraced by organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Form 571 L Marin County on any device with the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign Form 571 L Marin County effortlessly

- Obtain Form 571 L Marin County and click on Get Form to begin.

- Leverage the tools we offer to fill out your document.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 571 L Marin County and ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 571 l marin county 2013

Create this form in 5 minutes!

How to create an eSignature for the form 571 l marin county 2013

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the Form 571 L Marin County and why do I need it?

The Form 571 L Marin County is an important property tax document that homeowners must file annually to report the valuation of their personal property. Accurate completion of this form ensures that you comply with local tax regulations and helps to avoid potential penalties.

-

How can airSlate SignNow help me with the Form 571 L Marin County?

airSlate SignNow streamlines the process of signing and sending the Form 571 L Marin County by providing a user-friendly platform for eSigning. You can easily upload your completed form, send it for signatures, and track its status all in one place, making it efficient and stress-free.

-

What are the pricing options for using airSlate SignNow for the Form 571 L Marin County?

airSlate SignNow offers various pricing plans tailored to different needs, including individual and business options. Each plan includes essential features that facilitate the completion and signing of documents like the Form 571 L Marin County, making it a cost-effective solution.

-

Is airSlate SignNow secure for handling my Form 571 L Marin County?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form 571 L Marin County and other documents are protected. With advanced encryption and authentication protocols, you can confidently eSign and send sensitive information.

-

Can I integrate airSlate SignNow with other software for managing the Form 571 L Marin County?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, including CRM and document management systems. This enables you to manage your Form 571 L Marin County and other documents more effectively within your existing workflows.

-

What features does airSlate SignNow provide for completing the Form 571 L Marin County?

airSlate SignNow provides features like templated document creation, in-app editing, and collaborative signing for the Form 571 L Marin County. These tools help simplify the process, making it easier to prepare and submit your property tax document.

-

How quickly can I get my Form 571 L Marin County processed with airSlate SignNow?

With airSlate SignNow, you can expedite the processing of your Form 571 L Marin County thanks to its efficient eSigning capabilities. This means that you can send your form out for signatures and receive them back quickly, ensuring you meet submission deadlines.

Get more for Form 571 L Marin County

- Brighthouse eforms fill online printable fillable blank

- Bak rebate form caridcom

- 15 printable form 5498 sa templates fillable samples in

- Health delivery organization hdo application form

- Short term disability claim form initial report of teamcare

- We are pleased to welcome you as a patient of middlesex hospital primary care form

- Instructions for form i 9 uscis

- Transcript request form legacy students fordham university

Find out other Form 571 L Marin County

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast