Fannie Mae Loan Number 2019-2026

What is the Fannie Mae Form 236?

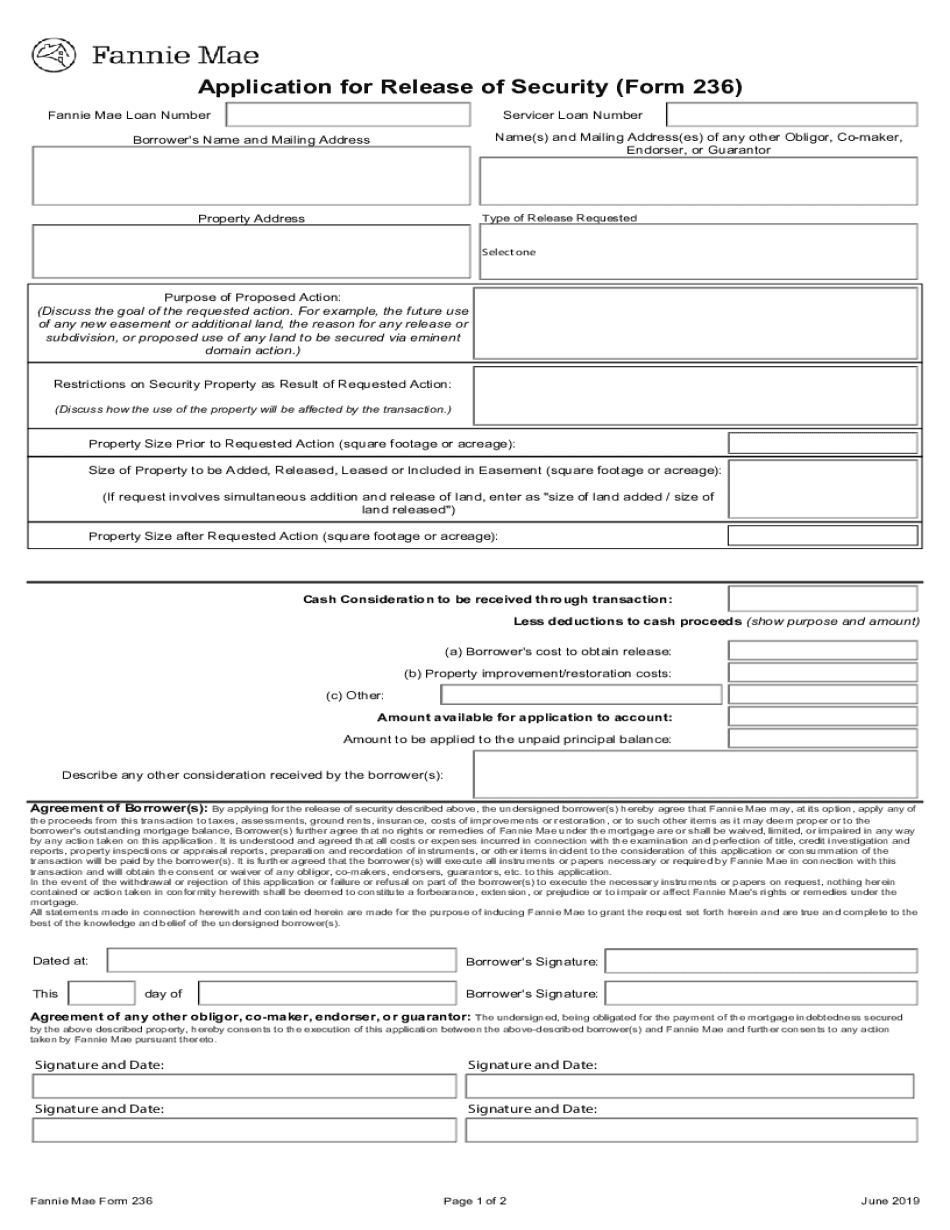

The Fannie Mae Form 236, also known as the Application for Release of Security, is a critical document used in the mortgage industry. This form is primarily utilized by borrowers seeking to release a security interest in a property that is held by Fannie Mae. The form ensures that the necessary legal and financial obligations are met before the release can occur. Understanding the specifics of this form is essential for both lenders and borrowers to navigate the mortgage process effectively.

Steps to Complete the Fannie Mae Form 236

Completing the Fannie Mae Form 236 requires careful attention to detail. Here are the steps to ensure proper completion:

- Begin by entering the borrower’s personal information, including name, address, and contact details.

- Provide the property information, including the address and any relevant loan numbers.

- Clearly state the reason for the release of security, providing any necessary supporting documentation.

- Sign and date the form, ensuring that all required signatures are obtained from relevant parties.

- Review the completed form for accuracy before submission.

Legal Use of the Fannie Mae Form 236

The Fannie Mae Form 236 is legally binding when filled out correctly and submitted according to the guidelines set forth by Fannie Mae. To ensure its legality, the form must comply with federal and state regulations regarding mortgage documentation. Additionally, electronic signatures are recognized under the ESIGN Act, provided that the signing process adheres to the legal standards for eSignature use. This compliance is crucial for the form to be accepted by courts and financial institutions.

Required Documents for Form Submission

When submitting the Fannie Mae Form 236, certain documents may be required to support the application. These documents can include:

- A copy of the original mortgage agreement.

- Identification documents of the borrower.

- Any relevant correspondence with Fannie Mae regarding the loan.

- Proof of payment or fulfillment of loan obligations, if applicable.

Gathering these documents in advance can streamline the submission process and help avoid delays.

Who Issues the Fannie Mae Form 236?

The Fannie Mae Form 236 is issued by Fannie Mae, a government-sponsored enterprise that plays a significant role in the U.S. housing finance system. This organization provides liquidity and stability to the mortgage market by purchasing loans from lenders, which allows them to offer more loans to borrowers. Understanding the role of Fannie Mae is essential for anyone involved in the mortgage process, particularly when dealing with forms like the 236.

Digital vs. Paper Version of the Fannie Mae Form 236

The Fannie Mae Form 236 can be completed in both digital and paper formats. The digital version offers several advantages, such as ease of access, the ability to save and edit information, and faster submission through electronic channels. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods or lack access to digital tools. Regardless of the format chosen, it is important to ensure that all information is accurate and complete to avoid processing delays.

Quick guide on how to complete fannie mae loan number

Complete Fannie Mae Loan Number effortlessly on any device

Digital document management has become widely accepted among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed materials, allowing you to access the right format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without delays. Manage Fannie Mae Loan Number on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-driven task today.

The easiest way to edit and eSign Fannie Mae Loan Number without hassle

- Obtain Fannie Mae Loan Number and click Get Form to initiate the process.

- Utilize the features we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred delivery method for your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing fresh copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Fannie Mae Loan Number and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fannie mae loan number

Create this form in 5 minutes!

How to create an eSignature for the fannie mae loan number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fannie Mae Form 236?

The Fannie Mae Form 236 is a crucial document used in the mortgage process, specifically for reporting information on loans. It provides essential details about the borrower's loan and its terms, serving as a key resource for lenders. Using airSlate SignNow, you can easily manage and eSign the Fannie Mae Form 236, streamlining your mortgage documentation process.

-

How can airSlate SignNow help with the Fannie Mae Form 236?

airSlate SignNow simplifies the handling of the Fannie Mae Form 236 by providing a user-friendly platform for eSigning and document management. Our solution allows users to fill out, sign, and send the form securely and quickly, ensuring compliance and efficiency in the mortgage process. This helps reduce paperwork and speed up loan closings.

-

Is there a cost associated with using airSlate SignNow for the Fannie Mae Form 236?

Yes, airSlate SignNow offers several pricing plans tailored to meet the needs of different organizations. Users looking to manage the Fannie Mae Form 236 can select a plan that fits their budget, with features designed to enhance document eSigning and management. Pricing is competitive, making it a cost-effective choice for businesses.

-

Are there any specific features for the Fannie Mae Form 236 in airSlate SignNow?

AirSlate SignNow provides various features that enhance the handling of the Fannie Mae Form 236, including document templates, customizable workflows, and secure cloud storage. These features allow users to efficiently manage the entire signing process, ensuring that the Fannie Mae Form 236 is completed accurately and on time.

-

Can I integrate airSlate SignNow with other tools for managing the Fannie Mae Form 236?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications used in the mortgage industry, allowing you to effectively manage the Fannie Mae Form 236 alongside your existing systems. This flexibility ensures that you can streamline your workflow while maintaining customization and functionality.

-

What are the benefits of using airSlate SignNow for the Fannie Mae Form 236?

Using airSlate SignNow for the Fannie Mae Form 236 enhances efficiency, reduces errors, and simplifies the signing process. Our platform helps users save time and enhance collaboration with stakeholders in the mortgage process, ensuring that all parties can access and sign documents whenever necessary. It's a reliable solution that boosts productivity.

-

How secure is airSlate SignNow when handling the Fannie Mae Form 236?

Security is a top priority at airSlate SignNow, particularly when it comes to sensitive documents like the Fannie Mae Form 236. Our solution employs high-level encryption and complies with industry standards to protect your data throughout the signing process. You can confidently manage and eSign documents knowing they are secure.

Get more for Fannie Mae Loan Number

- Publix vendor application form

- Form 706 see rule 74 applicant for the enrolment as a sales tax

- Current event sheet 245560044 form

- Nys rabies exemption form

- Axis bank signature verification form

- Hong leong increase credit limit form

- How agri produce marketing works in indian mandies form

- Fundraising event planning template form

Find out other Fannie Mae Loan Number

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure