8693 Form

What is the 8693 Form

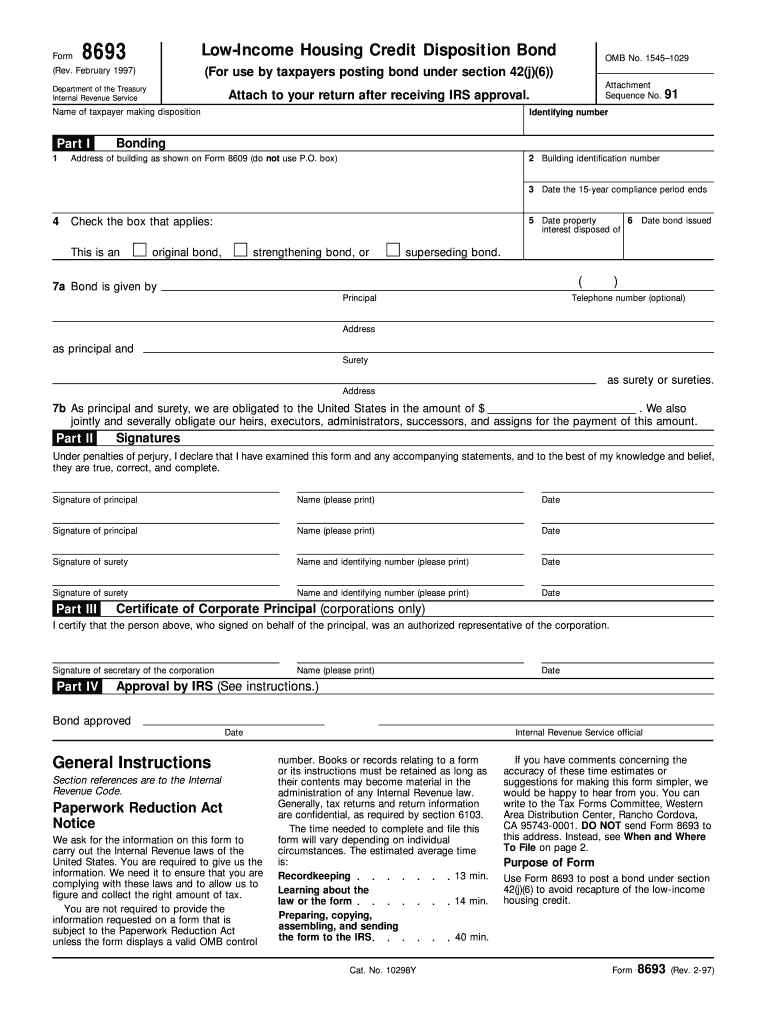

The 8693 form, officially known as the IRS 8693 form, is utilized for reporting the credit disposition of certain assets. This form is important for taxpayers who are claiming a credit for the disposition of specific property, ensuring compliance with federal tax regulations. Understanding the purpose of this form is essential for individuals and businesses looking to accurately report their financial activities related to asset disposition.

How to use the 8693 Form

Using the IRS 8693 form involves several steps to ensure proper completion and submission. First, gather all relevant financial documents and information regarding the asset in question. Next, fill out the form accurately, providing details such as the asset's description, the credit amount, and any pertinent dates. It's crucial to review the completed form for accuracy before submission, as errors can lead to delays or penalties.

Steps to complete the 8693 Form

Completing the 8693 form requires attention to detail. Here are the steps to follow:

- Begin by downloading the form from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide detailed information about the asset, including its type, acquisition date, and disposition date.

- Calculate the credit amount you are claiming based on the asset's value and applicable tax regulations.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the 8693 Form

The IRS 8693 form is legally binding when completed and submitted according to IRS guidelines. To ensure its legal validity, it is essential to comply with all relevant tax laws and regulations. This includes accurate reporting of information and timely submission of the form. Using a reliable electronic signature solution, such as signNow, can further enhance the legal standing of your completed form by providing a secure and verifiable signature.

Filing Deadlines / Important Dates

Filing deadlines for the 8693 form are crucial for compliance. Typically, the form must be submitted by the tax return due date for the year in which the asset was disposed of. It's important to stay informed about any changes to deadlines, as they can vary based on specific circumstances or IRS updates. Keeping track of these dates helps avoid penalties and ensures that credits are claimed in a timely manner.

Required Documents

To complete the IRS 8693 form, several documents are necessary. These may include:

- Proof of asset acquisition, such as purchase receipts or contracts.

- Documentation of the asset's disposition, including sale agreements or transfer records.

- Financial statements that support the credit amount being claimed.

Having these documents ready will facilitate a smoother completion process and help ensure that all information reported is accurate and verifiable.

Quick guide on how to complete 8693 form

Effortlessly Prepare 8693 Form on Any Device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage 8693 Form seamlessly on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Modify and eSign 8693 Form with Ease

- Find 8693 Form and click on Get Form to start.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches, or mistakes that require you to print new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign 8693 Form to ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8693 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8693 and how can airSlate SignNow help with it?

Form 8693 is a tax form used by businesses to report specific financial information to the IRS. airSlate SignNow streamlines the process of completing and signing form 8693 by allowing users to easily fill out, eSign, and share the document securely, ensuring compliance and efficiency.

-

How much does it cost to use airSlate SignNow for form 8693?

airSlate SignNow offers various pricing plans that cater to different business needs, starting at an affordable monthly rate. Each plan includes features that help manage documents like form 8693 efficiently, ensuring you get great value for the investment.

-

Can I integrate airSlate SignNow with other applications to manage form 8693?

Yes, airSlate SignNow allows seamless integrations with various applications, which enhances your workflow for managing form 8693. You can connect it with platforms like Google Drive, Salesforce, and more to streamline document management and ensure smoother collaboration.

-

What features does airSlate SignNow offer for filling out and signing form 8693?

airSlate SignNow provides a user-friendly interface that allows you to easily fill out form 8693, add electronic signatures, and collaborate with other users. Additional features like template creation and automatic reminders help ensure that the completion and submission of the form are timely and organized.

-

Is airSlate SignNow secure for handling sensitive documents like form 8693?

Absolutely. airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect sensitive documents like form 8693. This ensures that your business information remains confidential and compliant with industry regulations.

-

Can I access airSlate SignNow on mobile devices to work on form 8693?

Yes, airSlate SignNow is fully accessible on mobile devices, enabling you to manage form 8693 on the go. This mobile functionality allows you to fill out, sign, and send documents wherever you are, providing greater flexibility for your business.

-

Are there templates available for form 8693 in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates for form 8693, making it easier for users to get started. These templates help you save time and ensure that all necessary fields are completed accurately before signing.

Get more for 8693 Form

- Stephen covey mission statement worksheet form

- City of opa locka building department form

- Playground maintenance checklist form

- Saxbys application form

- 3 compartment sink temperature log form

- Formulaire lsv swisscom pdf

- Auction contract template form

- Nurse practitioner residency program reference verification form

Find out other 8693 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors