Income Tax Full Year Resident Forms Current Year Department 2022

What is the Income Tax Full Year Resident Forms Current Year Department

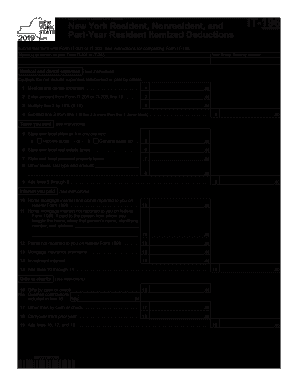

The Income Tax Full Year Resident Forms Current Year Department refers to the specific documentation required for individuals who are considered full-year residents for tax purposes in the United States. These forms are essential for accurately reporting income, claiming deductions, and fulfilling tax obligations. Full-year residents typically reside in one state for the entire tax year and must adhere to that state's tax laws. Understanding the purpose and requirements of these forms helps ensure compliance with tax regulations and facilitates the proper filing of income tax returns.

Steps to Complete the Income Tax Full Year Resident Forms Current Year Department

Completing the Income Tax Full Year Resident Forms involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, review the specific form instructions provided by the state tax department. Fill out the form carefully, ensuring all information is accurate and complete. After completing the form, double-check for any errors or omissions. Finally, submit the form by the specified deadline, either electronically or via mail, depending on your state’s submission guidelines.

Legal Use of the Income Tax Full Year Resident Forms Current Year Department

The legal use of the Income Tax Full Year Resident Forms is governed by state and federal tax laws. These forms must be filled out truthfully and accurately to avoid penalties or legal issues. Electronic signatures are recognized as legally binding under the ESIGN Act and UETA, provided that the e-signature process complies with specific security measures. It is crucial to retain copies of submitted forms and any supporting documentation for your records, as they may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Full Year Resident Forms vary by state but generally align with the federal tax deadline. Typically, the deadline for filing individual income tax returns is April 15th of the following year. It is important to be aware of any extensions or changes to these dates, as some states may offer different deadlines or require early submissions for specific circumstances. Staying informed about these dates helps ensure timely filing and avoids potential penalties.

Required Documents

To complete the Income Tax Full Year Resident Forms, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income sources, such as rental income or dividends

- Documentation for deductions, such as mortgage interest statements and medical expenses

- Previous year’s tax return for reference

Having these documents organized and readily available can streamline the filing process and help ensure accuracy.

Who Issues the Form

The Income Tax Full Year Resident Forms are typically issued by the state tax department or revenue agency. Each state has its own set of forms and guidelines for residents. It is essential to obtain the correct form from the official state tax website or office to ensure compliance with local tax laws. Federal forms, such as the IRS Form 1040, may also be relevant for residents, depending on their income sources and tax obligations.

Quick guide on how to complete income tax full year resident forms current year department

Complete Income Tax Full year Resident Forms current Year Department effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without any delays. Handle Income Tax Full year Resident Forms current Year Department on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to edit and eSign Income Tax Full year Resident Forms current Year Department with ease

- Locate Income Tax Full year Resident Forms current Year Department and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing out new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Income Tax Full year Resident Forms current Year Department and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax full year resident forms current year department

Create this form in 5 minutes!

How to create an eSignature for the income tax full year resident forms current year department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Income Tax Full year Resident Forms current Year Department?

Income Tax Full year Resident Forms current Year Department are essential documents that individuals residing in a state for the entire year must complete for tax purposes. These forms help ensure compliance with state tax laws and facilitate accurate tax filings. Utilizing these forms can streamline your tax preparation process and avoid potential penalties.

-

How can airSlate SignNow assist with eSigning Income Tax Full year Resident Forms current Year Department?

airSlate SignNow offers a user-friendly platform that allows you to eSign Income Tax Full year Resident Forms current Year Department efficiently. With its secure electronic signature capabilities, you can sign documents anytime and from anywhere. This eliminates the need for physical signatures and helps expedite your filing timeline.

-

What pricing plans are available for airSlate SignNow when dealing with Income Tax Full year Resident Forms current Year Department?

airSlate SignNow provides several pricing plans tailored to meet diverse needs, especially for handling Income Tax Full year Resident Forms current Year Department. Whether you're a solo taxpayer or a business needing multiple users, there’s a plan that suits your requirements without breaking the bank. You can find pricing details on our website to determine which option is best for you.

-

Are there features in airSlate SignNow that specifically cater to tax preparation for Income Tax Full year Resident Forms current Year Department?

Yes, airSlate SignNow includes features specifically designed for tax preparation, including template storage for Income Tax Full year Resident Forms current Year Department. The platform allows users to create, manage, and send tax documents easily, ensuring that you have all necessary forms ready for filing. Additionally, features like reminders and notifications streamline the process further.

-

Can I integrate airSlate SignNow with my existing accounting software for Income Tax Full year Resident Forms current Year Department?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, enabling smoother handling of Income Tax Full year Resident Forms current Year Department. This integration allows you to manage documents and signatures directly from your accounting tools, enhancing efficiency and reducing the potential for errors during tax preparation.

-

What are the benefits of using airSlate SignNow for Income Tax Full year Resident Forms current Year Department?

Utilizing airSlate SignNow for your Income Tax Full year Resident Forms current Year Department offers numerous benefits, such as convenience, security, and cost-effectiveness. The platform simplifies the eSigning process, allowing you to focus on other important aspects of your tax filing. Moreover, its legally binding signatures ensure compliance with regulations.

-

Is using airSlate SignNow secure for processing Income Tax Full year Resident Forms current Year Department?

Yes, security is a top priority for airSlate SignNow when processing Income Tax Full year Resident Forms current Year Department. The platform employs advanced encryption protocols and follows best practices to protect sensitive information. Users can confidently send and receive documents knowing their data is secure.

Get more for Income Tax Full year Resident Forms current Year Department

Find out other Income Tax Full year Resident Forms current Year Department

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online