Enhanced Form it 196, New York Resident, Nonresident, and Part Year 2022

What is the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year

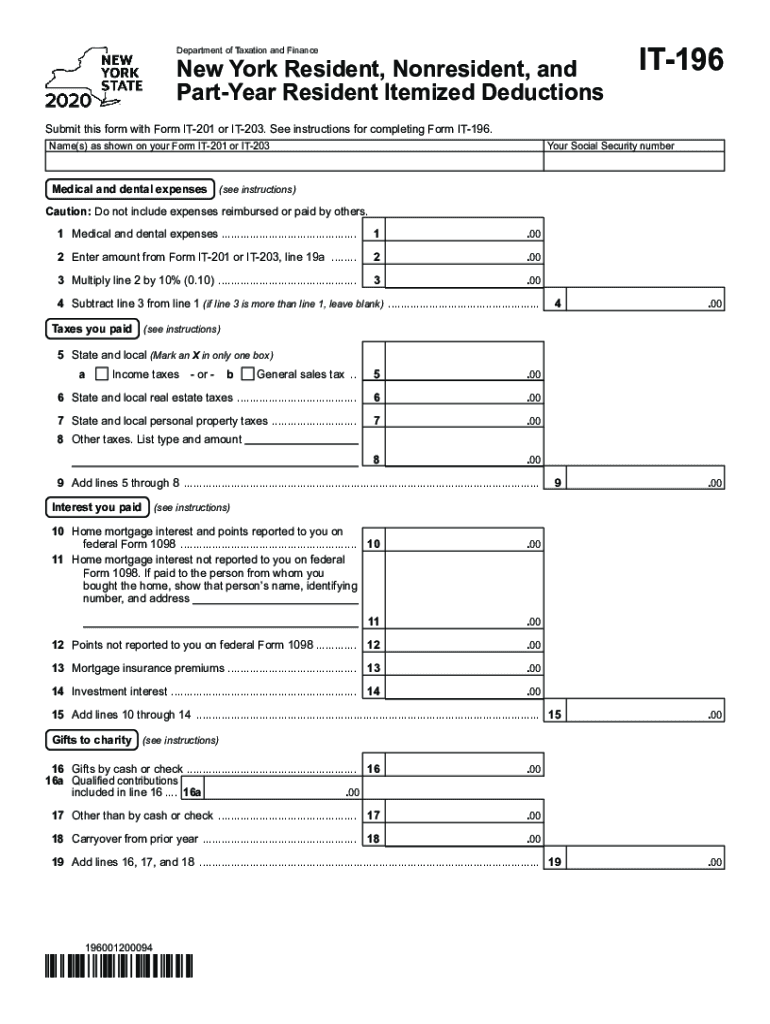

The Enhanced Form IT 196 is a crucial tax document for individuals in New York who are residents, nonresidents, or part-year residents. This form is primarily used to report and calculate tax credits and refunds for eligible taxpayers. It helps determine the amount of tax owed or refunded based on the individual's residency status and income sources. Understanding this form is essential for accurate tax filing and compliance with state regulations.

Steps to complete the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year

Completing the Enhanced Form IT 196 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, determine your residency status for the tax year, as this will influence the information you provide. Fill out the form by entering your personal information, income details, and any applicable deductions or credits. Finally, review the completed form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Legal use of the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year

The Enhanced Form IT 196 has legal standing when filed correctly and on time. It is essential to adhere to all state regulations regarding its use. The form must be signed and dated to validate the information provided. Failure to comply with the legal requirements can result in penalties, including fines or additional tax liabilities. Therefore, understanding the legal implications of this form is critical for all taxpayers in New York.

Filing Deadlines / Important Dates

Filing deadlines for the Enhanced Form IT 196 are crucial for taxpayers to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay updated on any changes to these dates, as they can vary from year to year.

Required Documents

To successfully complete the Enhanced Form IT 196, certain documents are required. Taxpayers should have their W-2 forms, 1099 forms, and any other income-related documents readily available. Additionally, documentation supporting any deductions or credits claimed on the form should be included. Having these documents organized will facilitate a smoother filing process and help ensure accuracy.

Examples of using the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year

Examples of how to use the Enhanced Form IT 196 can vary based on individual circumstances. For instance, a New York resident who worked part of the year in another state may use this form to claim a credit for taxes paid to that state. Similarly, a nonresident who earned income in New York but resides elsewhere can use the form to report their earnings and claim any applicable credits. These examples illustrate the form's versatility in handling different taxpayer situations.

Digital vs. Paper Version

Taxpayers have the option to complete the Enhanced Form IT 196 either digitally or on paper. The digital version offers benefits such as easier data entry, automatic calculations, and quicker submission through e-filing. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, ensuring that the form is filled out accurately is paramount for compliance and potential refunds.

Quick guide on how to complete enhanced form it 196 new york resident nonresident and part year

Effortlessly Prepare Enhanced Form IT 196, New York Resident, Nonresident, And Part Year on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Enhanced Form IT 196, New York Resident, Nonresident, And Part Year on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The Easiest Way to Modify and eSign Enhanced Form IT 196, New York Resident, Nonresident, And Part Year with Ease

- Find Enhanced Form IT 196, New York Resident, Nonresident, And Part Year and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Enhanced Form IT 196, New York Resident, Nonresident, And Part Year and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct enhanced form it 196 new york resident nonresident and part year

Create this form in 5 minutes!

How to create an eSignature for the enhanced form it 196 new york resident nonresident and part year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year?

The Enhanced Form IT 196, New York Resident, Nonresident, And Part Year is a tax form used by New York State residents and nonresidents to report their income and claim credits. This form ensures accurate filing and compliance with state tax regulations, making the process easier for individuals with varying residency statuses.

-

How can airSlate SignNow help with filing the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year?

airSlate SignNow offers a seamless and efficient way to eSign and send the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year. With its user-friendly interface, users can easily complete and submit their tax documents securely online, streamlining the filing process.

-

What features does airSlate SignNow provide for managing the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year?

airSlate SignNow provides features such as easy document editing, secure eSigning, automated workflows, and real-time tracking to manage the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year. These features enhance productivity and ensure that all documents meet compliance requirements.

-

Is there a cost associated with using airSlate SignNow for the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs when managing the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year. Users can choose from different subscription models that provide access to essential features and capabilities at a competitive rate.

-

What are the benefits of using airSlate SignNow for the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year?

Using airSlate SignNow for the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year provides advantages such as reduced paperwork, increased efficiency, and enhanced security. The platform simplifies the signing process, making it quicker and more reliable for taxpayers.

-

Does airSlate SignNow integrate with other platforms for filing the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year?

Yes, airSlate SignNow offers integrations with various accounting and tax software solutions, making it easy to manage the Enhanced Form IT 196, New York Resident, Nonresident, And Part Year alongside other financial documents. This integration helps businesses maintain organized records and streamlines workflow processes.

-

Can I track the status of my Enhanced Form IT 196, New York Resident, Nonresident, And Part Year submissions through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking capabilities, allowing users to monitor the status of their Enhanced Form IT 196, New York Resident, Nonresident, And Part Year submissions. This feature enhances communication and ensures that all parties are informed throughout the document signing process.

Get more for Enhanced Form IT 196, New York Resident, Nonresident, And Part Year

Find out other Enhanced Form IT 196, New York Resident, Nonresident, And Part Year

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile