Rv F1306901 Application Sales Tax Form

What is the Rv F1306901 Application Sales Tax

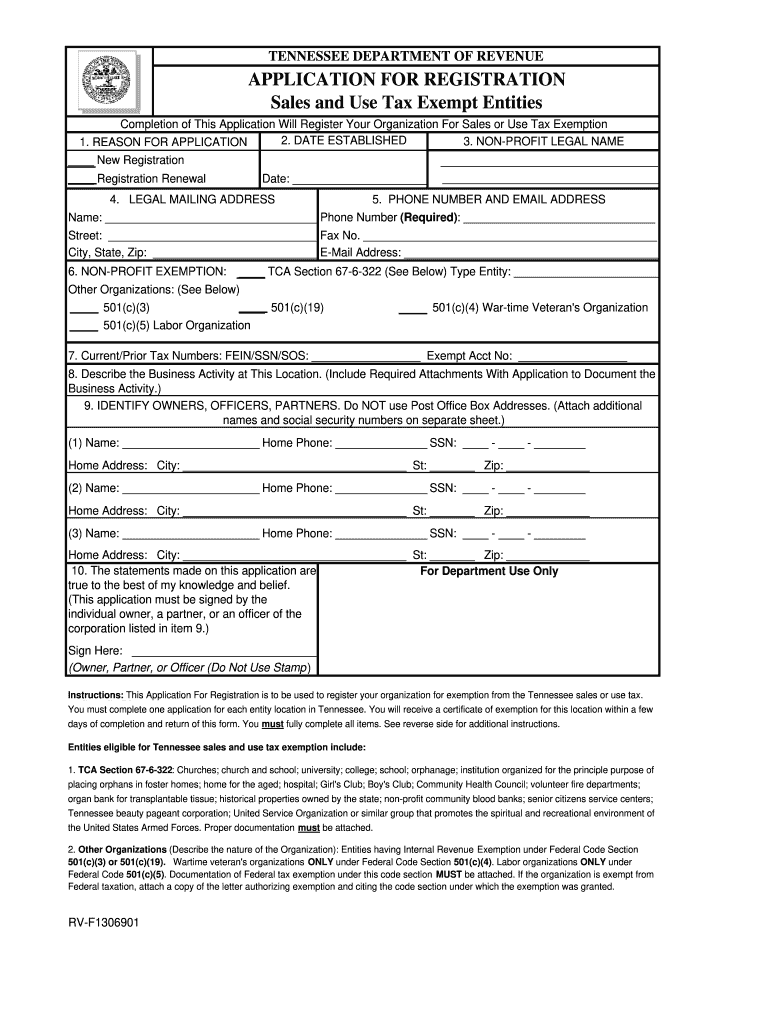

The Rv F1306901 Application Sales Tax form is a specific document used in the United States for reporting sales tax related to the purchase of recreational vehicles. This form is essential for individuals and businesses to ensure compliance with state tax regulations when acquiring RVs. It captures necessary information about the buyer, the vehicle, and the applicable sales tax to be paid. Understanding this form is crucial for avoiding penalties and ensuring that all tax obligations are met accurately.

How to use the Rv F1306901 Application Sales Tax

Using the Rv F1306901 Application Sales Tax form involves several steps to ensure proper completion. First, gather all necessary information, including personal details, vehicle identification numbers, and purchase prices. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. After completing the form, it is important to review it for accuracy before submitting it to the appropriate state tax authority. This careful approach helps in preventing errors that could lead to complications or additional fees.

Steps to complete the Rv F1306901 Application Sales Tax

Completing the Rv F1306901 Application Sales Tax form involves a systematic approach:

- Gather required information, including your name, address, and the details of the RV.

- Fill out the form with accurate data, ensuring all fields are completed.

- Calculate the sales tax based on the purchase price and applicable state rates.

- Review the form for any errors or missing information.

- Submit the completed form to the relevant state tax authority, either online, by mail, or in person.

Legal use of the Rv F1306901 Application Sales Tax

The Rv F1306901 Application Sales Tax form is legally recognized in the United States, provided it is filled out correctly and submitted in accordance with state regulations. Compliance with local tax laws is essential to avoid potential legal issues, including fines or audits. The form serves as a formal declaration of sales tax obligations and must be retained for record-keeping purposes. Understanding the legal implications of this form can help ensure that all transactions involving RV purchases are conducted lawfully.

Required Documents

When completing the Rv F1306901 Application Sales Tax form, certain documents are typically required to support your application. These may include:

- A copy of the purchase agreement or bill of sale for the RV.

- Proof of identity, such as a driver's license or state ID.

- Any previous tax documents related to the vehicle, if applicable.

- Documentation of any trade-ins or discounts that may affect the sales tax calculation.

Form Submission Methods

The Rv F1306901 Application Sales Tax form can be submitted through various methods, depending on the regulations of the state in which you reside. Common submission methods include:

- Online submission through the state tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete rv f1306901 application sales tax

Complete Rv F1306901 Application Sales Tax seamlessly on any device

Digital document handling has gained signNow traction among businesses and individuals. It offers a perfect environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, amend, and eSign your documents swiftly without delays. Manage Rv F1306901 Application Sales Tax on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest method to adjust and eSign Rv F1306901 Application Sales Tax effortlessly

- Locate Rv F1306901 Application Sales Tax and click Obtain Form to initiate.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finish button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing out new copies. airSlate SignNow addresses all your document handling needs in just a few clicks from any device you choose. Adjust and eSign Rv F1306901 Application Sales Tax and guarantee effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rv f1306901 application sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RV F1306901 application sales tax?

The RV F1306901 application sales tax is a specific form utilized for reporting sales tax related to vehicle sales in the state of Michigan. Understanding how to fill out this application can help streamline your sales tax process. Using the airSlate SignNow platform simplifies this process with eSignature capabilities, making it quick and efficient.

-

How does airSlate SignNow help with the RV F1306901 application sales tax?

airSlate SignNow offers a seamless way to complete and eSign your RV F1306901 application sales tax form online. Our platform ensures all necessary fields are filled out accurately, and with just a few clicks, you can electronically sign and send the document. This saves time and reduces errors typically associated with manual processes.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides various pricing plans to suit different business needs, including options for individual users and larger teams. Our plans are cost-effective, ensuring that you’re getting value while managing tasks like the RV F1306901 application sales tax. Visit our pricing page for detailed information about each plan's features and benefits.

-

Is airSlate SignNow user-friendly for completing forms like the RV F1306901 application sales tax?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy to fill out forms such as the RV F1306901 application sales tax. Our intuitive interface provides step-by-step guidance, ensuring that users of all technical abilities can navigate the platform with ease. This makes completing and submitting forms straightforward.

-

Can I integrate airSlate SignNow with my existing software for processing the RV F1306901 application sales tax?

Absolutely! airSlate SignNow offers integrations with various applications and software to streamline your workflow, including those specifically related to sales tax processes. This means you can easily sync your data for the RV F1306901 application sales tax, enhancing efficiency and accuracy in your operations.

-

What are the benefits of eSigning the RV F1306901 application sales tax with airSlate SignNow?

eSigning your RV F1306901 application sales tax with airSlate SignNow offers several benefits including faster turnaround times and enhanced security. Our platform enables you to send, receive, and store signed documents securely and conveniently. This not only reduces paperwork but also ensures compliance with legal requirements.

-

Is my data secure when using airSlate SignNow for the RV F1306901 application sales tax?

Yes, your data security is a top priority at airSlate SignNow. We employ advanced security protocols and encryption to protect sensitive information associated with documents like the RV F1306901 application sales tax. You can rest assured that your data is safe while using our eSigning services.

Get more for Rv F1306901 Application Sales Tax

- Gv79 form download

- Local land and sea breezes answer key form

- Imo pre authorization network request form carrollton

- Cvse0013 form

- Meiosis pogil activities for high school biology form

- By a fine of not more than 10 000 or imprisonment form

- U s department ofhomeland securityu s coast gu form

- Cbp form 7553 notice of intent to export destroy or

Find out other Rv F1306901 Application Sales Tax

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later