Kubota Commercial Credit Application 2020-2026

What is the Kubota Commercial Credit Application

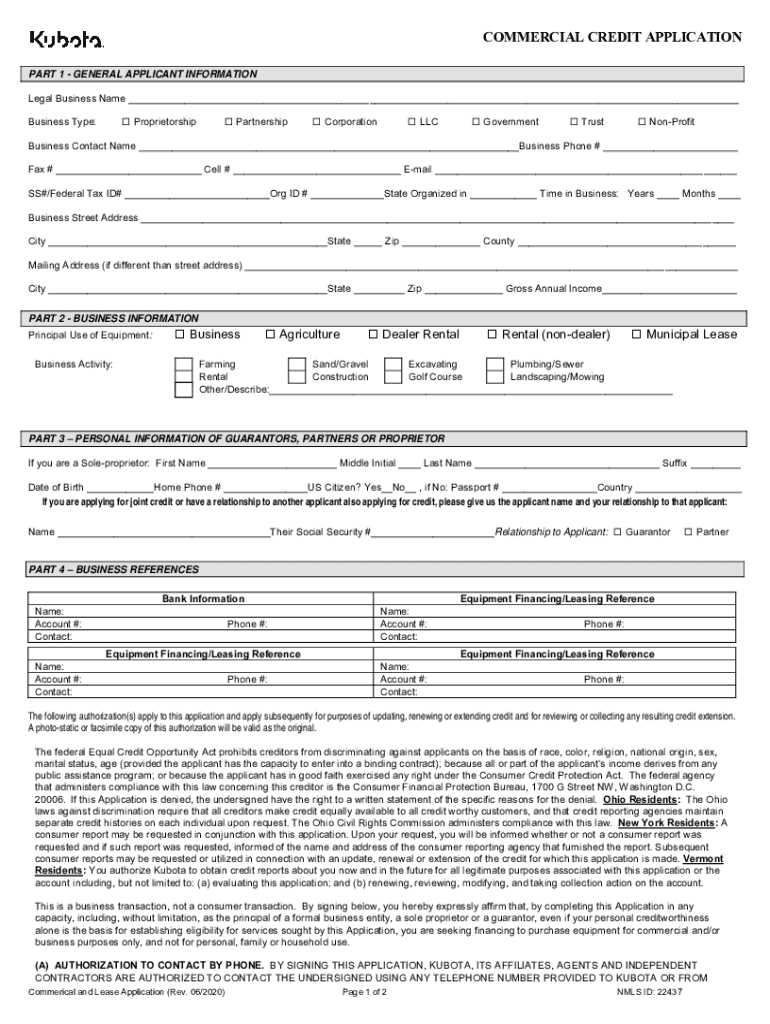

The Kubota Commercial Credit Application is a formal document used by businesses seeking financing options for purchasing Kubota equipment. This application allows potential borrowers to provide essential information regarding their business, financial status, and credit history. Completing this form is a crucial step in the financing process, as it helps Kubota assess the creditworthiness of the applicant and determine loan eligibility.

How to use the Kubota Commercial Credit Application

Using the Kubota Commercial Credit Application involves several straightforward steps. First, gather all necessary information, including business details, financial statements, and personal identification. Next, access the application form, which can typically be found on the Kubota website or through authorized dealers. Fill out the form carefully, ensuring that all information is accurate and complete. Once completed, submit the application according to the provided instructions, either online or through traditional mail.

Steps to complete the Kubota Commercial Credit Application

Completing the Kubota Commercial Credit Application requires attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, such as tax returns, bank statements, and business licenses.

- Provide accurate business information, including the legal name, address, and type of business entity.

- Detail your financial history, including income, expenses, and existing debts.

- Review the application for completeness and accuracy before submission.

- Submit the application through the designated method, ensuring you keep a copy for your records.

Legal use of the Kubota Commercial Credit Application

The legal use of the Kubota Commercial Credit Application is governed by various regulations that ensure the protection of both the lender and the borrower. It is essential to understand that the information provided in the application must be truthful and complete. Misrepresentation can lead to legal consequences, including denial of credit or potential fraud charges. By using the application as intended and complying with all relevant laws, businesses can secure financing responsibly.

Eligibility Criteria

Eligibility for the Kubota Commercial Credit Application typically depends on several factors. Businesses must demonstrate a stable financial history, including a good credit score and sufficient income to support loan repayment. Additionally, the type of business entity, such as sole proprietorship, partnership, or corporation, may influence eligibility. Kubota may also consider the purpose of the financing and the specific equipment being purchased when evaluating applications.

Required Documents

When applying for credit through the Kubota Commercial Credit Application, certain documents are generally required to support the application. These may include:

- Business financial statements, such as profit and loss statements.

- Tax returns for the past two to three years.

- Personal financial statements of business owners or guarantors.

- Business licenses and registrations.

- Any additional documentation that demonstrates the business's creditworthiness.

Application Process & Approval Time

The application process for the Kubota Commercial Credit Application involves several stages. After submitting the application, it will be reviewed by Kubota's financing team, who will assess the information provided. Approval times can vary based on the complexity of the application and the volume of requests being processed. Generally, applicants can expect to receive a decision within a few business days to a couple of weeks. Prompt communication from the financing team will help keep applicants informed throughout the process.

Quick guide on how to complete kubota commercial credit application 572028344

Complete Kubota Commercial Credit Application effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the features you need to create, modify, and eSign your documents swiftly without delays. Manage Kubota Commercial Credit Application across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Kubota Commercial Credit Application with ease

- Locate Kubota Commercial Credit Application and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or censor sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the stress of misplaced or missing documents, tedious form searches, or mistakes that require creating new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Kubota Commercial Credit Application and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kubota commercial credit application 572028344

Create this form in 5 minutes!

How to create an eSignature for the kubota commercial credit application 572028344

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the kubota commercial credit application process?

The kubota commercial credit application process is designed to be straightforward and user-friendly. You can easily fill out the application online, providing necessary business information and financial details. Once submitted, you will receive prompt feedback to help you understand your financing options.

-

What are the benefits of using the kubota commercial credit application?

Using the kubota commercial credit application allows businesses to access financing options tailored to their needs. This process enhances cash flow management and enables quick decisions, allowing you to focus on growing your business. Additionally, it's an efficient way to secure funding for necessary equipment.

-

Are there any fees associated with the kubota commercial credit application?

Typically, there are no upfront fees associated with the kubota commercial credit application. However, it's important to review the terms and conditions as certain loan agreements may have associated costs or interest rates. This helps ensure transparency and understanding of your financing agreement.

-

What information do I need to complete the kubota commercial credit application?

To complete the kubota commercial credit application, you'll need to provide general business information, personal identification, and financial statements. Having your documentation ready helps streamline the process. Ensuring accuracy will improve your chances of quick approval.

-

How long does it take to get approved for a kubota commercial credit application?

Approval times for the kubota commercial credit application can vary, typically ranging from one to several business days. Once your application is submitted, you will receive updates regarding its status. Many applications are processed quickly, allowing you to act on purchasing machinery without unnecessary delays.

-

Is the kubota commercial credit application available for all businesses?

Yes, the kubota commercial credit application is designed to accommodate various types of businesses, from small startups to large enterprises. As long as you meet the eligibility criteria, you can take advantage of the financing opportunities it offers. Check the specific requirements to ensure your application meets all criteria.

-

Can I track the status of my kubota commercial credit application?

Absolutely! You can track the status of your kubota commercial credit application online through your customer portal. This feature helps you stay informed and prepared for the next steps in your financing process. You will also receive notifications about your application's progress.

Get more for Kubota Commercial Credit Application

Find out other Kubota Commercial Credit Application

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form