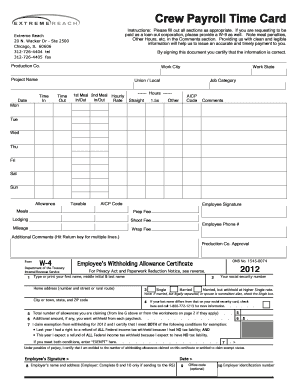

Crew Payroll Time Card Extreme Reach Form

Understanding the Illinois W-4 Form

The Illinois W-4 form, officially known as the Employee's Illinois Withholding Allowance Certificate, is a crucial document for employees in Illinois. It is used to determine the amount of state income tax that should be withheld from an employee's paycheck. By accurately completing this form, employees can ensure that their tax withholdings align with their personal financial situations, potentially avoiding underpayment or overpayment of taxes.

Steps to Complete the Illinois W-4 Form

Filling out the Illinois W-4 form involves several key steps:

- Personal Information: Begin by entering your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, which can affect your withholding amount. Options include single, married, or head of household.

- Allowances: Calculate your allowances based on your personal and financial circumstances. The more allowances you claim, the less tax will be withheld.

- Additional Withholding: If you wish to have additional amounts withheld from your paycheck, specify that amount in the appropriate section.

- Signature: Finally, sign and date the form to validate it.

Legal Use of the Illinois W-4 Form

The Illinois W-4 form is legally binding once it is completed and submitted to your employer. It is important to ensure that all information provided is accurate to avoid any legal issues related to tax compliance. Employers are required to keep this form on file for their records, and it may be subject to review by tax authorities.

Filing Deadlines and Important Dates

While the Illinois W-4 form does not have a specific filing deadline, it is essential to submit it to your employer as soon as you start a new job or when your financial situation changes. This ensures that your tax withholdings are adjusted promptly. Additionally, being aware of the state tax filing deadlines can help you manage your overall tax obligations effectively.

Form Submission Methods

The completed Illinois W-4 form can be submitted to your employer in several ways. Most commonly, it is handed in directly during the onboarding process. Some employers may also allow electronic submissions through their payroll systems. It is advisable to check with your employer regarding their preferred method of receiving this form.

Key Elements of the Illinois W-4 Form

Several key elements are essential to understand when completing the Illinois W-4 form:

- Personal Information: Accurate details about the employee.

- Filing Status: Determines the tax rate applicable.

- Allowances Claimed: Directly impacts the withholding amount.

- Additional Withholding: Option for those who wish to withhold more tax.

Penalties for Non-Compliance

Failure to submit a completed Illinois W-4 form can lead to incorrect tax withholdings, which may result in penalties. If too little tax is withheld, employees may face a tax bill at the end of the year, along with potential penalties for underpayment. It is crucial to keep the form updated, especially after significant life changes such as marriage or having children.

Quick guide on how to complete crew payroll time card extreme reach

Manage Crew Payroll Time Card Extreme Reach effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage Crew Payroll Time Card Extreme Reach on any platform using the airSlate SignNow Android or iOS applications and optimize any document-centered process today.

The easiest way to modify and eSign Crew Payroll Time Card Extreme Reach with ease

- Obtain Crew Payroll Time Card Extreme Reach and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Crew Payroll Time Card Extreme Reach to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crew payroll time card extreme reach

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois W 4 form and why do I need it?

The Illinois W 4 form is a state-specific withholding form that employees in Illinois use to determine their state income tax withholding. Properly completing this form ensures that the right amount of taxes is withheld from your paycheck, helping you avoid penalties or owing money at tax time.

-

How can airSlate SignNow help me with the Illinois W 4 form?

airSlate SignNow provides an efficient platform to easily fill out, sign, and send your Illinois W 4 form electronically. With our user-friendly interface, you can complete the form swiftly and ensure that it signNowes your employer securely without the hassle of printing and mailing.

-

Can I integrate airSlate SignNow with other payroll systems for the Illinois W 4 form?

Yes, airSlate SignNow offers seamless integrations with various payroll and HR systems, making it easier to manage your Illinois W 4 form alongside your payroll processes. This integration streamlines your tax withholding setup and improves efficiency across your organization.

-

Is there a cost associated with using airSlate SignNow for the Illinois W 4 form?

airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solution allows you to choose a plan that suits your requirements for managing documents such as the Illinois W 4 form efficiently.

-

What features does airSlate SignNow offer for managing the Illinois W 4 form?

airSlate SignNow provides robust features such as eSignature, document storage, and secure sharing for the Illinois W 4 form. These features ensure that your form is not only easy to complete but also safe and accessible whenever you need it.

-

Can I save a copy of my completed Illinois W 4 form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to save a copy of your completed Illinois W 4 form securely in your account. This feature provides easy access to your document for future reference or modifications.

-

Is it legal to eSign my Illinois W 4 form using airSlate SignNow?

Yes, electronic signatures are legally binding in the state of Illinois, allowing you to eSign your Illinois W 4 form securely with airSlate SignNow. Our platform complies with electronic signature laws, ensuring that your documentation is valid and enforceable.

Get more for Crew Payroll Time Card Extreme Reach

Find out other Crew Payroll Time Card Extreme Reach

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation