AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual

What is the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual

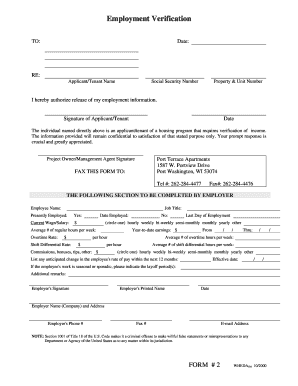

The AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual is a critical document used in the context of housing assistance programs governed by the Wisconsin Housing and Economic Development Authority (WHEDA). This form serves to verify the employment status and income of individuals applying for housing under Section 42 of the Internal Revenue Code, which relates to low-income housing tax credits. It ensures compliance with federal and state regulations aimed at providing affordable housing options. The form collects essential information about the applicant's employment, including job title, salary, and duration of employment, which is necessary for determining eligibility for housing assistance.

How to use the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual

Using the AHTC Form 400 involves several straightforward steps. First, ensure you have the most current version of the form, which can typically be obtained from WHEDA's official website or local housing authorities. Next, complete the form by providing accurate employment and income details as required. It is essential to gather supporting documentation, such as pay stubs or tax returns, to validate the information provided. After filling out the form, submit it to the appropriate housing authority or organization overseeing the application process. Be mindful of any specific submission guidelines they may have, including deadlines and preferred submission methods.

Steps to complete the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual

Completing the AHTC Form 400 requires careful attention to detail. Follow these steps for successful completion:

- Download the latest version of the AHTC Form 400 from a reliable source.

- Fill out the applicant's personal information, including name, address, and contact details.

- Provide employment details, such as the employer's name, address, and contact information.

- Detail the applicant's income, including salary, bonuses, and any other relevant earnings.

- Attach necessary documentation, such as recent pay stubs or tax forms, to support the information provided.

- Review the completed form for accuracy before submission.

- Submit the form to the designated housing authority or organization.

Legal use of the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual

The legal use of the AHTC Form 400 is governed by both federal and state regulations. It is crucial that the information provided on the form is truthful and accurate to avoid potential legal repercussions. Misrepresentation of income or employment status can lead to penalties, including denial of housing assistance or legal action. The form must be completed in accordance with the guidelines set forth by WHEDA and should comply with the requirements of Section 42 of the Internal Revenue Code. Ensuring that the form is signed and dated by both the applicant and the employer is also vital for its legal validity.

Key elements of the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual

Several key elements are essential for the successful completion of the AHTC Form 400. These include:

- Applicant Information: Full name, address, and contact details.

- Employer Information: Name and address of the employer, along with contact information.

- Income Details: Comprehensive breakdown of the applicant's income, including base salary and additional earnings.

- Employment Verification: Confirmation of employment status, including job title and duration of employment.

- Supporting Documentation: Required documents that substantiate the information provided, such as pay stubs or tax returns.

Examples of using the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual

Examples of using the AHTC Form 400 can vary based on individual circumstances. For instance, a family applying for low-income housing may use the form to demonstrate their eligibility by providing detailed employment and income information. Similarly, a single parent seeking assistance may utilize the form to verify their income and employment status to qualify for affordable housing options. Each example highlights the importance of accurate and honest reporting to ensure compliance with WHEDA guidelines and to facilitate access to necessary housing resources.

Quick guide on how to complete ahtc form 400 employment verification wheda section 42 compliance manual

Complete AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The simplest way to edit and eSign AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual without any hassle

- Obtain AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual and click Get Form to begin.

- Use the tools available to fill out your form.

- Highlight relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual and guarantee effective communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ahtc form 400 employment verification wheda section 42 compliance manual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual?

The AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual is a document used to verify employment for individuals applying for housing under Wisconsin's Section 42 program. This form helps ensure compliance with WHEDA regulations and is essential for landlords and property management companies.

-

How does airSlate SignNow help with the AHTC Form 400 process?

airSlate SignNow streamlines the completion and submission of the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual by allowing users to easily create, send, and eSign documents. Our platform simplifies the verification process and enhances compliance tracking for all parties involved.

-

What features does airSlate SignNow offer for managing the AHTC Form 400?

AirSlate SignNow offers various features for managing the AHTC Form 400, including customizable templates, secure eSignature capabilities, and real-time document tracking. These tools help users efficiently manage employment verification while ensuring compliance with the WHEDA Section 42 Compliance Manual.

-

Is airSlate SignNow a cost-effective solution for handling AHTC Form 400 submissions?

Yes, airSlate SignNow provides a cost-effective solution for handling AHTC Form 400 submissions. By eliminating the need for paper documentation and reducing turnaround times, users can save on operational costs while maintaining compliance with the WHEDA Section 42 Compliance Manual.

-

Can airSlate SignNow integrate with other software I use for AHTC Form 400 management?

Absolutely! airSlate SignNow offers seamless integrations with various CRM systems, accounting software, and property management tools. These integrations enhance the overall handling of the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual, making document management more efficient.

-

How does airSlate SignNow ensure the security of the AHTC Form 400?

AirSlate SignNow employs advanced encryption and security protocols to protect all documents, including the AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual. Our platform is compliant with industry standards to ensure that your sensitive information remains secure throughout the verification process.

-

What are the benefits of using airSlate SignNow for the AHTC Form 400?

Using airSlate SignNow for the AHTC Form 400 provides numerous benefits, including faster processing times, reduced paperwork, and improved compliance tracking. Our user-friendly interface allows all parties to engage in a smooth verification process, adhering to the WHEDA Section 42 Compliance Manual requirements.

Get more for AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual

- Check in check out form

- Meeting sign in sheet transport workers union local 591 form

- Tenant verification form paste recent jorhat police jorhatpolice

- Kinship certificate form

- Per diem employment agreement template form

- Centra financial assistance form

- Form 760es estimated income tax payment vouchers for individuals form 760es estimated income tax payment vouchers for

- Completing direct deposit form the hacc thehacc

Find out other AHTC Form 400, Employment Verification WHEDA Section 42 Compliance Manual

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure