CITY of YORK ACCOMMODATIONS TAX REPORTING FORM Tax 2021-2026

What is the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

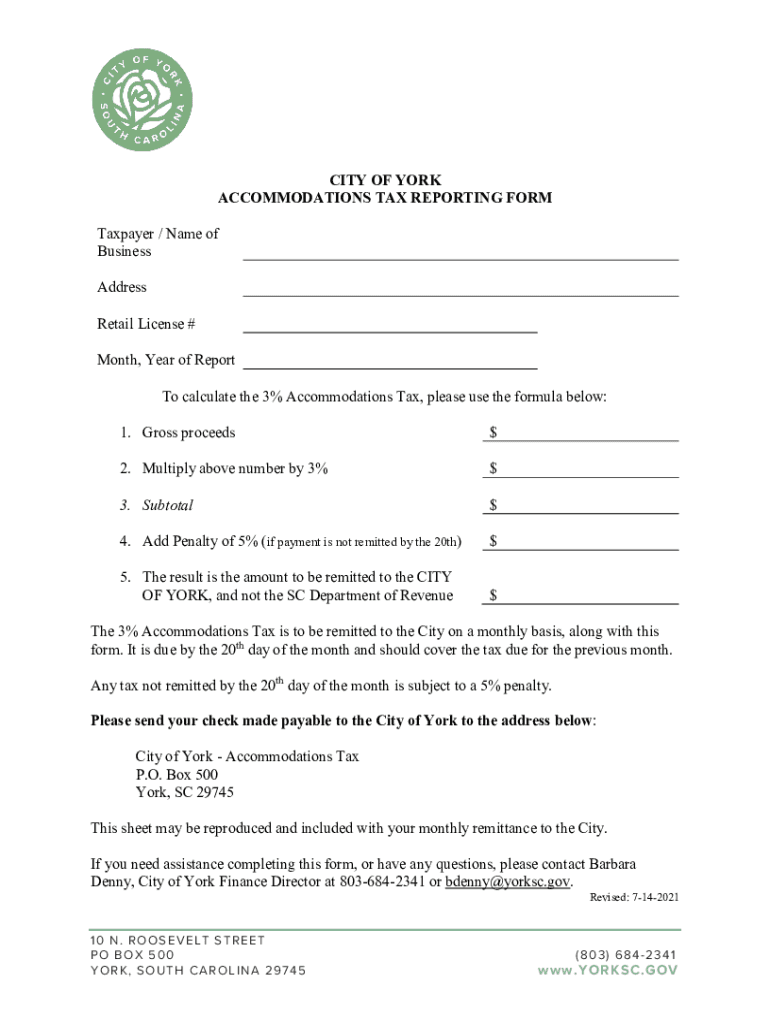

The CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax is a specific document required for reporting accommodations tax obligations within the City of York. This form is typically utilized by businesses and individuals who provide lodging services, such as hotels, motels, and short-term rental properties. The accommodations tax is a charge imposed on guests who stay in these establishments, and the collected funds are often used to support local tourism and infrastructure.

How to use the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

Using the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax involves several straightforward steps. First, ensure you have the most current version of the form, which can usually be obtained from the city’s official website or local tax office. Next, gather all necessary financial records related to your accommodations business, including total rental income and the amount of tax collected from guests. Fill out the form accurately, providing all required information, and ensure that you sign and date it before submission.

Steps to complete the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

Completing the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax can be done by following these steps:

- Obtain the form from the appropriate source.

- Gather necessary documentation, including income statements and tax collection records.

- Fill in your business details, including name, address, and tax identification number.

- Report the total accommodations income and the total tax collected.

- Review the completed form for accuracy.

- Sign and date the form to validate your submission.

Key elements of the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

The key elements of the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax include the following:

- Business Information: Name, address, and tax identification number of the lodging provider.

- Income Reporting: Total income generated from accommodations over the reporting period.

- Tax Calculation: Total accommodations tax collected from guests.

- Signature Section: Required signature and date to confirm the accuracy of the information provided.

Form Submission Methods

The CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax can be submitted through various methods to ensure compliance. Options typically include:

- Online Submission: Many jurisdictions allow for electronic filing through their official website.

- Mail: Completed forms can often be sent via postal service to the designated tax office.

- In-Person: Submitting the form directly at the local tax office may also be an option.

Penalties for Non-Compliance

Failure to comply with the requirements of the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax may result in penalties. These can include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes that accrue over time.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete city of york accommodations tax reporting form tax

Effortlessly Prepare CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the required forms and securely save them online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents quickly and without hassle. Manage CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax with Ease

- Obtain CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method of sending the form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, lengthy form searches, or errors that require reprinting. airSlate SignNow efficiently manages all your document needs with just a few clicks from any device you choose. Edit and eSign CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax while ensuring clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of york accommodations tax reporting form tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax?

The CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax is a specific form required for reporting accommodations tax in York. This form simplifies the process for businesses that offer lodging services, ensuring compliance with local regulations. Utilizing airSlate SignNow can streamline this reporting, making submissions easy and efficient.

-

How can airSlate SignNow help with the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax?

airSlate SignNow provides businesses with a user-friendly platform to complete and eSign the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax. By eliminating paper-based solutions, businesses can save time and reduce errors in their submissions. This ensures timely compliance with local tax regulations.

-

What features does SignNow offer for the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax?

SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage that are essential for managing the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax. These features help businesses streamline their workflow, ensuring quick access and efficient processing of tax documents.

-

Is there a cost associated with using airSlate SignNow for tax reporting?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for managing the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax. The cost can vary based on features and user requirements, but users find it to be a cost-effective solution for document management and eSigning.

-

How secure is airSlate SignNow when handling the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax?

Security is a top priority for airSlate SignNow, which employs advanced encryption and secure cloud protocols to protect sensitive documents like the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax. Businesses can feel confident that their data is safe while utilizing the platform for compliance purposes.

-

Can I integrate airSlate SignNow with other software for tax reporting?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software that can assist in managing the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax. These integrations facilitate better data flow and reduce the chances of errors, helping businesses maintain compliance.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for the CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax streamlines the entire document management process. Benefits include enhanced efficiency, reduced paperwork, and the ability to access documents from anywhere. This means businesses can complete their tax reporting with less hassle.

Get more for CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

Find out other CITY OF YORK ACCOMMODATIONS TAX REPORTING FORM Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors