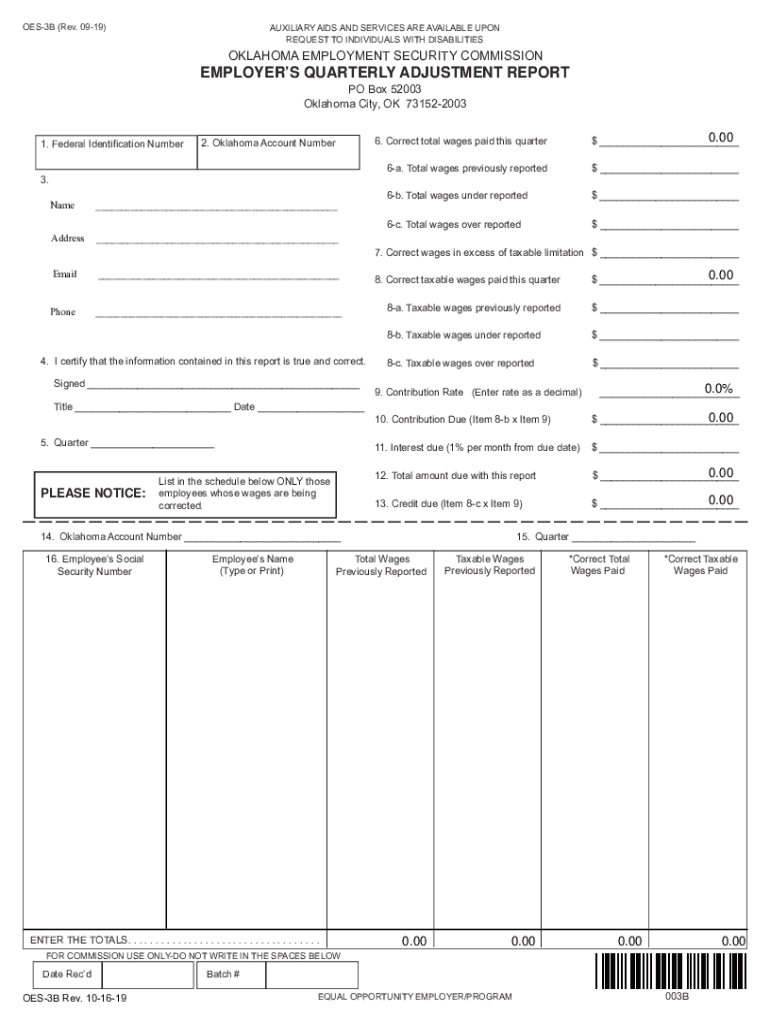

Employer's Quarterly Adjustment Report Form

What is the Employer's Quarterly Adjustment Report

The Employer's Quarterly Adjustment Report is a crucial document for businesses in the United States, primarily used to report adjustments to previously filed payroll taxes. This report ensures that employers accurately reflect any changes in their payroll tax liabilities, including corrections for overpayments or underpayments made in prior quarters. It is essential for maintaining compliance with federal and state tax regulations.

Steps to complete the Employer's Quarterly Adjustment Report

Completing the Employer's Quarterly Adjustment Report involves several key steps. First, gather all necessary payroll records and previous tax filings to ensure accurate reporting. Next, identify the adjustments needed, whether they pertain to employee wages, tax withholdings, or other relevant factors. Once the adjustments are determined, fill out the report accurately, ensuring all figures are correct. Finally, review the completed report for any discrepancies before submission.

How to obtain the Employer's Quarterly Adjustment Report

Employers can obtain the Employer's Quarterly Adjustment Report from the Internal Revenue Service (IRS) website or through state tax agencies. The form is typically available in a downloadable format, allowing for easy access. Additionally, businesses may also find the report through accounting software that integrates with payroll systems, streamlining the process of obtaining and completing the necessary documentation.

Legal use of the Employer's Quarterly Adjustment Report

The Employer's Quarterly Adjustment Report serves a legal purpose by ensuring that employers remain compliant with tax obligations. When completed accurately, this report can protect businesses from penalties associated with misreporting payroll taxes. It is essential to adhere to the legal requirements set forth by the IRS and state tax authorities, as failure to do so may result in audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Employer's Quarterly Adjustment Report typically align with quarterly payroll tax deadlines. Employers must submit the report by the last day of the month following the end of each quarter. For example, reports for the first quarter, ending March 31, are due by April 30. Staying informed about these deadlines is crucial for avoiding late fees and ensuring compliance with tax regulations.

Penalties for Non-Compliance

Failure to file the Employer's Quarterly Adjustment Report on time or inaccuracies in the report can lead to significant penalties. The IRS may impose fines based on the amount of tax owed or the duration of the delay. Additionally, states may have their own penalties for non-compliance, which can further impact a business's financial standing. Therefore, it is vital for employers to prioritize timely and accurate submissions.

Quick guide on how to complete employers quarterly adjustment report

Effortlessly Complete Employer's Quarterly Adjustment Report on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely archive it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Employer's Quarterly Adjustment Report on any platform with the airSlate SignNow applications for Android or iOS and enhance your document-based processes today.

How to Modify and Electronically Sign Employer's Quarterly Adjustment Report with Ease

- Obtain Employer's Quarterly Adjustment Report and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and is legally equivalent to a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Employer's Quarterly Adjustment Report to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employers quarterly adjustment report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employer's Quarterly Adjustment Report?

The Employer's Quarterly Adjustment Report is a crucial document that employers use to report changes in employee wage and withholding information on a quarterly basis. This report helps in ensuring compliance with tax regulations and enables accurate payroll processing. By using airSlate SignNow, you can easily create and manage this report digitally.

-

How does airSlate SignNow help with the Employer's Quarterly Adjustment Report?

airSlate SignNow streamlines the creation, signing, and storage of the Employer's Quarterly Adjustment Report. With its user-friendly interface, businesses can quickly input data, obtain necessary signatures, and securely send the report to the appropriate offices. This saves time and reduces the risk of errors compared to traditional paper methods.

-

What are the pricing options for using airSlate SignNow for the Employer's Quarterly Adjustment Report?

airSlate SignNow offers a variety of pricing plans tailored to businesses of all sizes. You can choose a plan that fits your needs for handling the Employer's Quarterly Adjustment Report and other document management tasks. Additionally, there are cost-effective solutions that make it budget-friendly for small businesses.

-

Can I integrate airSlate SignNow with other software for managing the Employer's Quarterly Adjustment Report?

Yes, airSlate SignNow is designed to integrate seamlessly with various accounting and payroll software. This allows you to easily import data for the Employer's Quarterly Adjustment Report, ensuring consistency and accuracy across your financial records. Integrations with tools like QuickBooks and Google Workspace enhance functionality and streamline processes.

-

What features does airSlate SignNow offer for the Employer's Quarterly Adjustment Report?

airSlate SignNow includes features like document templates, electronic signatures, and secure storage to simplify the management of the Employer's Quarterly Adjustment Report. You can customize templates to fit your specific needs and track the progress of the document in real-time. These features create an efficient workflow for document handling.

-

Is airSlate SignNow secure for handling the Employer's Quarterly Adjustment Report?

Absolutely, airSlate SignNow prioritizes security and compliance. It uses advanced encryption and follows strict security protocols to protect sensitive information related to the Employer's Quarterly Adjustment Report. With features like user authentication and access control, you can trust that your data is secure.

-

What are the benefits of using airSlate SignNow for the Employer's Quarterly Adjustment Report?

Using airSlate SignNow for the Employer's Quarterly Adjustment Report offers numerous benefits, including improved efficiency and reduced paper usage. The solution allows for faster turnaround times, easier collaboration among team members, and less risk of compliance issues. These advantages can lead to signNow time and cost savings for your business.

Get more for Employer's Quarterly Adjustment Report

- E filing pin number form

- Charlotte county utilities forms

- 859 455 8650 form

- Appointment of a designated representative cf es 2505 072013 pdf form

- Car declaration form

- Assignment of mortgage form

- Et 130 749337577 form

- Form rp 459 c application for partial tax exemption for real property of persons with disabilities and limited incomes tax year 769895235

Find out other Employer's Quarterly Adjustment Report

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document