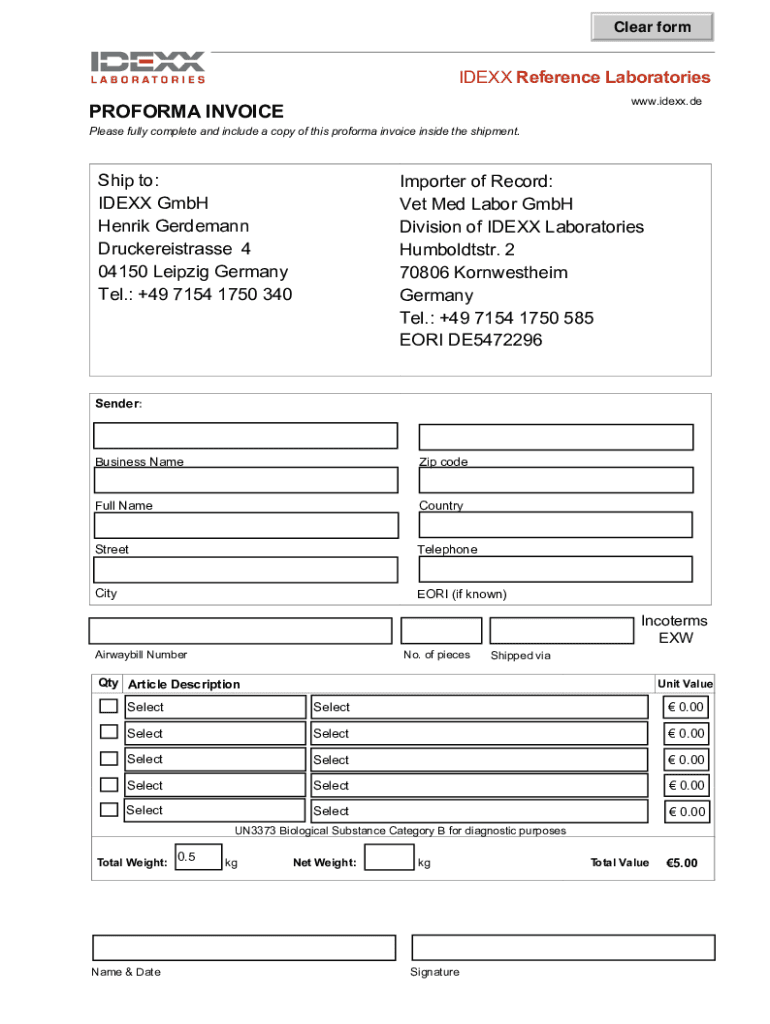

Www Idexx Fifilesidexx Reference LaboratoriesIDEXX Reference Laboratories Supply Request Form 2013-2026

Steps to prepare payroll in Excel

Preparing payroll in Excel involves several systematic steps to ensure accuracy and compliance. Start by gathering all necessary employee information, including names, Social Security numbers, and pay rates. Next, set up your Excel spreadsheet with appropriate columns for each data point, such as hours worked, overtime, and deductions.

Once your spreadsheet is structured, input the employee data. Calculate gross pay by multiplying the hours worked by the pay rate. For employees eligible for overtime, ensure that you apply the correct overtime rate for hours exceeding forty in a week. After calculating gross pay, subtract any deductions such as taxes, health insurance, and retirement contributions to determine net pay.

Regularly update your payroll template to reflect any changes in employee status or tax regulations. This will help maintain compliance and accuracy in future payroll cycles.

Key elements of payroll ledger template in Excel

A payroll ledger template in Excel should include essential elements to facilitate accurate payroll processing. Key components typically consist of:

- Employee Information: Names, Social Security numbers, and job titles.

- Pay Period: Start and end dates for each payroll cycle.

- Hours Worked: Regular and overtime hours for each employee.

- Gross Pay: Total earnings before deductions.

- Deductions: Taxes, benefits, and other withholdings.

- Net Pay: Final amount received by the employee after deductions.

Including these elements will streamline the payroll process and help ensure that all calculations are accurate and compliant with regulations.

IRS guidelines for payroll preparation

Understanding IRS guidelines is crucial for preparing payroll correctly. Employers must comply with federal tax withholding requirements, including Social Security, Medicare, and federal income tax. It is important to use the correct tax tables and forms to calculate the appropriate amounts to withhold from employee paychecks.

Additionally, employers must file payroll tax returns, such as Form 941, quarterly, and ensure that year-end forms like W-2s are accurately completed and distributed to employees. Keeping up with these guidelines will help avoid penalties and ensure compliance with federal regulations.

Required documents for payroll processing

To prepare payroll effectively, certain documents are essential. These include:

- Employee W-4 Forms: To determine federal tax withholding.

- Time Sheets: To track hours worked by employees.

- Payroll Ledger: To record all payroll transactions.

- State Tax Forms: Depending on state requirements, additional forms may be necessary.

Having these documents organized will facilitate a smoother payroll process and ensure that all necessary information is readily available.

Form submission methods for payroll records

When it comes to submitting payroll records, there are several methods available. Payroll information can be submitted via:

- Online Payroll Services: Many businesses opt for cloud-based payroll solutions that automate calculations and filings.

- Manual Submission: Payroll records can also be maintained and submitted manually using Excel spreadsheets.

- Mail: Employers may choose to send payroll tax forms and documents via postal service.

Each method has its advantages, and the choice will depend on the size of the business and the complexity of payroll requirements.

Quick guide on how to complete www idexx fifilesidexx reference laboratoriesidexx reference laboratories supply request form

Finish Www idexx fifilesidexx reference laboratoriesIDEXX Reference Laboratories Supply Request Form effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Www idexx fifilesidexx reference laboratoriesIDEXX Reference Laboratories Supply Request Form across any platform using airSlate SignNow's Android or iOS applications and simplify your document-driven workflow today.

The simplest way to modify and electronically sign Www idexx fifilesidexx reference laboratoriesIDEXX Reference Laboratories Supply Request Form with ease

- Locate Www idexx fifilesidexx reference laboratoriesIDEXX Reference Laboratories Supply Request Form and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you want to share your form, via email, SMS, or a sharing link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Www idexx fifilesidexx reference laboratoriesIDEXX Reference Laboratories Supply Request Form while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the www idexx fifilesidexx reference laboratoriesidexx reference laboratories supply request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for preparing payroll in Excel?

airSlate SignNow includes features that simplify the process of preparing payroll in Excel. You can easily eSign documents, automate workflows, and manage your payroll records efficiently. Its user-friendly interface ensures that even those unfamiliar with Excel can create accurate payroll while maximizing productivity.

-

How can airSlate SignNow help streamline the payroll preparation process?

With airSlate SignNow, businesses can streamline how to prepare payroll in Excel by automating repetitive tasks. This tool offers integration with Excel to streamline data entry, electronic signatures for approvals, and the ability to store payroll documents securely. The outcome is a more efficient payroll process, reducing errors and saving time.

-

Is there any training provided for using airSlate SignNow for payroll in Excel?

Yes, airSlate SignNow offers comprehensive training and support to help you learn how to prepare payroll in Excel effectively. Users can access tutorials, webinars, and customer support to ensure they can maximize the software's benefits. This resource availability makes it easier for any team member to get up and running quickly.

-

What are the pricing options for airSlate SignNow's payroll preparation features?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Depending on the features you choose, you can find a plan that suits your budget while still allowing you to learn how to prepare payroll in Excel effectively. Contact their sales team for a customized quote based on your requirements.

-

Can I integrate airSlate SignNow with other payroll software?

Absolutely! airSlate SignNow integrates seamlessly with various payroll software, enhancing your ability to know how to prepare payroll in Excel. This integration allows for easy data transfer, tracking, and management, ensuring your payroll process is efficient and accurate with every paycheck.

-

What benefits does eSigning provide for payroll documents?

eSigning payroll documents with airSlate SignNow offers several benefits. It ensures that all necessary approvals are obtained electronically, making how to prepare payroll in Excel more efficient. Additionally, it enhances security, reduces paper usage, and speeds up the payroll workflow for your business.

-

Is airSlate SignNow suitable for businesses of all sizes?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, making it ideal for anyone learning how to prepare payroll in Excel. Whether you are a small startup or a large enterprise, its scalable solutions can meet your payroll preparation needs effectively.

Get more for Www idexx fifilesidexx reference laboratoriesIDEXX Reference Laboratories Supply Request Form

- Torontosom form

- Texas womens health application pdf form

- Catholic profession of faith printable form

- Philmont participant information worksheet

- Worked examples to eurocode 2 volume 2 form

- Form approved o m b 2060 0095 united states environmental protection agency declaration form importation of motor vehicles and

- Hawaii form n 301

- Gad 7 scale general anxiety disorder 7 item form

Find out other Www idexx fifilesidexx reference laboratoriesIDEXX Reference Laboratories Supply Request Form

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT