About Form 8829, Expenses for Business Use of Your Home 2024-2026

Understanding Form 8829: Expenses for Business Use of Your Home

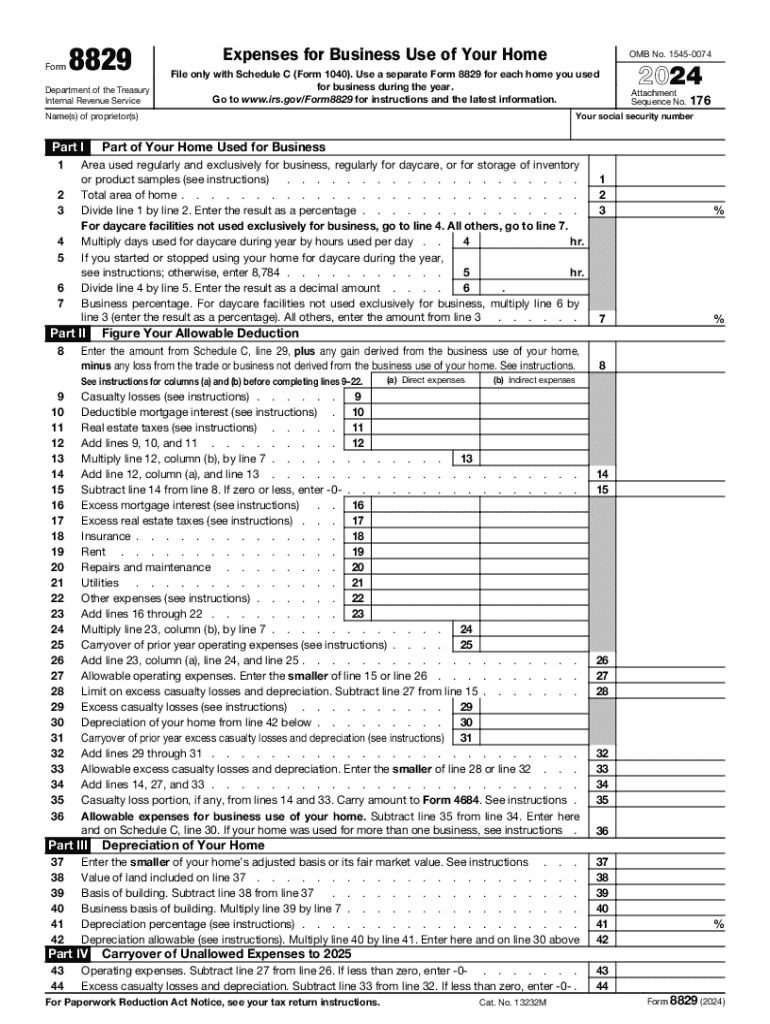

The IRS Form 8829 is designed for individuals who wish to claim expenses related to the business use of their home. This form allows self-employed taxpayers to calculate their home office deduction, which can significantly reduce their taxable income. The form requires detailed information about the home, including the total area of the home, the area used exclusively for business, and various expenses related to the home, such as mortgage interest, utilities, and repairs. Understanding the nuances of this form is essential for maximizing deductions legally and effectively.

Steps to Complete Form 8829

Completing Form 8829 involves several key steps:

- Determine eligibility: Ensure that your home office meets IRS requirements, including exclusive and regular use for business.

- Gather necessary documents: Collect records of all relevant expenses, such as mortgage statements, utility bills, and repair invoices.

- Calculate the area: Measure the total square footage of your home and the portion used for business to determine the percentage of expenses you can claim.

- Fill out the form: Enter your calculated expenses and the relevant details into Form 8829, ensuring accuracy to avoid issues with the IRS.

- Review and submit: Double-check all entries for accuracy before submitting the form with your tax return.

Key Elements of Form 8829

Form 8829 contains several critical sections that taxpayers must complete:

- Part I: This section requires basic information about the taxpayer's home and the area used for business.

- Part II: Here, taxpayers report their total expenses, including direct and indirect expenses related to the business use of the home.

- Part III: This part calculates the allowable deduction based on the information provided in the previous sections.

Understanding these elements helps ensure that all necessary information is accurately reported, facilitating a smoother filing process.

IRS Guidelines for Using Form 8829

The IRS provides specific guidelines for completing Form 8829, which include:

- Home offices must be used exclusively for business purposes to qualify for deductions.

- Taxpayers should maintain accurate records of all expenses related to the home office.

- Indirect expenses must be prorated based on the percentage of the home used for business.

Adhering to these guidelines is crucial to ensure compliance with IRS regulations and to avoid potential penalties.

Eligibility Criteria for Form 8829

To qualify for deductions using Form 8829, taxpayers must meet certain eligibility criteria:

- The home office must be used regularly and exclusively for business activities.

- The taxpayer must be self-employed or a partner in a business.

- Expenses must be ordinary and necessary for the operation of the business.

Meeting these criteria ensures that taxpayers can legitimately claim deductions and benefit from the home office tax deduction.

Common Scenarios for Using Form 8829

Form 8829 is particularly useful for various taxpayer scenarios, including:

- Self-employed individuals who operate their business from home.

- Freelancers who use a portion of their home exclusively for client meetings or work.

- Business owners who run their operations from a designated area in their residence.

Understanding these scenarios can help taxpayers identify if they qualify for home office deductions and how to maximize their claims.

Handy tips for filling out About Form 8829, Expenses For Business Use Of Your Home online

Quick steps to complete and e-sign About Form 8829, Expenses For Business Use Of Your Home online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant service for maximum simplicity. Use signNow to e-sign and send About Form 8829, Expenses For Business Use Of Your Home for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct about form 8829 expenses for business use of your home

Create this form in 5 minutes!

How to create an eSignature for the about form 8829 expenses for business use of your home

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a simplified method worksheet?

A simplified method worksheet is a tool designed to streamline the process of document management and eSigning. It allows users to easily create, send, and sign documents without the complexities often associated with traditional methods.

-

How does airSlate SignNow utilize the simplified method worksheet?

airSlate SignNow incorporates the simplified method worksheet to enhance user experience by providing a straightforward interface for document handling. This method reduces the time spent on paperwork, allowing businesses to focus on their core operations.

-

What are the pricing options for using the simplified method worksheet with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Each plan includes access to the simplified method worksheet, ensuring that users can efficiently manage their documents at a cost-effective rate.

-

What features are included in the simplified method worksheet?

The simplified method worksheet includes features such as document templates, eSignature capabilities, and real-time tracking. These features work together to provide a seamless experience for users looking to manage their documents efficiently.

-

What are the benefits of using the simplified method worksheet?

Using the simplified method worksheet can signNowly reduce the time and effort required for document management. It enhances productivity by allowing users to quickly create and send documents for eSigning, ultimately leading to faster business transactions.

-

Can the simplified method worksheet integrate with other tools?

Yes, the simplified method worksheet can integrate with various third-party applications, enhancing its functionality. This allows users to connect their existing workflows and tools, making document management even more efficient.

-

Is the simplified method worksheet suitable for all business sizes?

Absolutely! The simplified method worksheet is designed to cater to businesses of all sizes, from startups to large enterprises. Its user-friendly interface and scalable features make it an ideal solution for any organization looking to streamline their document processes.

Get more for About Form 8829, Expenses For Business Use Of Your Home

Find out other About Form 8829, Expenses For Business Use Of Your Home

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free