Deductions and CreditsDepartment of Revenue 2024

IRS Guidelines

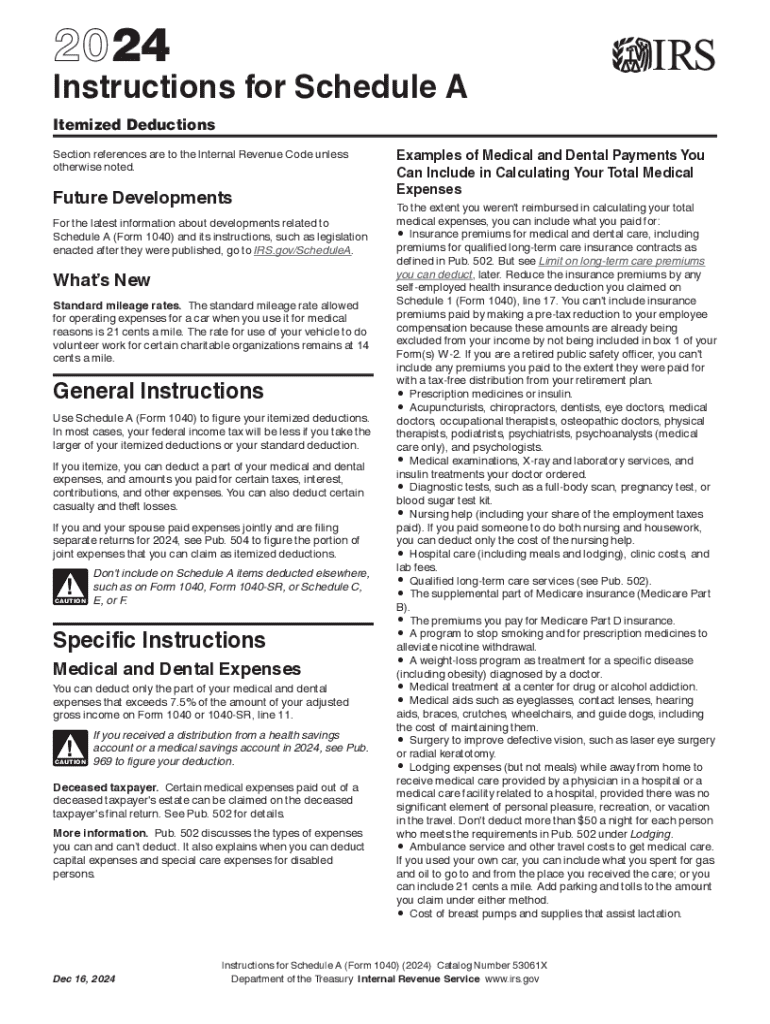

The IRS provides specific guidelines for itemized deductions, which are detailed in the 2024 Instructions for Form 1040. Taxpayers can choose to itemize deductions on Schedule A if their total deductions exceed the standard deduction. This includes various categories such as medical expenses, state and local taxes, mortgage interest, and charitable contributions. It is essential to follow the IRS guidelines closely to ensure compliance and maximize potential tax benefits.

Key Elements of Itemized Deductions

Itemized deductions consist of several key components that taxpayers must understand. These include:

- Medical and Dental Expenses: Only expenses that exceed a certain percentage of adjusted gross income (AGI) are deductible.

- State and Local Taxes: Taxpayers can deduct either state income or sales taxes, along with property taxes, subject to a cap.

- Mortgage Interest: Interest paid on qualified residence loans can be deducted, which is beneficial for homeowners.

- Charitable Contributions: Donations to qualified organizations can be deducted, provided proper documentation is maintained.

Steps to Complete Itemized Deductions

Completing itemized deductions involves several steps:

- Gather all relevant documentation, including receipts and statements for eligible expenses.

- Complete Schedule A of Form 1040, ensuring each deduction is accurately reported.

- Calculate the total of all itemized deductions and compare it to the standard deduction.

- File the completed form with your tax return by the designated deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines to avoid penalties. For the 2024 tax year, the standard deadline for filing Form 1040, including itemized deductions on Schedule A, is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider the deadlines for any extensions if they require additional time to file.

Required Documents

When preparing to itemize deductions, certain documents are necessary to substantiate claims. Essential documents include:

- Medical expense receipts and insurance statements.

- Property tax statements and proof of state income or sales taxes paid.

- Mortgage interest statements (Form 1098).

- Receipts for charitable contributions, including acknowledgment letters from organizations.

Eligibility Criteria

To qualify for itemized deductions, taxpayers must meet specific eligibility criteria. These include:

- Filing status: Certain statuses may affect the ability to itemize.

- Income level: High-income earners may face limitations on specific deductions.

- Type of expenses: Only qualifying expenses can be deducted, and they must exceed the standard deduction.

Create this form in 5 minutes or less

Find and fill out the correct deductions and creditsdepartment of revenue

Create this form in 5 minutes!

How to create an eSignature for the deductions and creditsdepartment of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are itemized deductions and how can airSlate SignNow help?

Itemized deductions are specific expenses that taxpayers can deduct from their taxable income to reduce their tax liability. airSlate SignNow provides a streamlined process for signing and managing documents related to itemized deductions, ensuring that you can easily submit your tax forms with all necessary documentation.

-

How do I get started with airSlate SignNow for itemized deductions?

To get started with airSlate SignNow for instructions a itemized deductions, simply sign up for an account on our website. Once registered, you can upload your documents, create templates, and send them for eSignature, making the process of managing your deductions efficient and straightforward.

-

What features does airSlate SignNow offer for managing itemized deductions?

airSlate SignNow offers features such as document templates, customizable workflows, and secure eSignature capabilities. These tools help you efficiently manage the paperwork associated with instructions a itemized deductions, ensuring that you stay organized and compliant with tax regulations.

-

Is airSlate SignNow cost-effective for small businesses handling itemized deductions?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With flexible pricing plans, you can choose the option that best fits your needs while ensuring that you have the necessary tools to manage instructions a itemized deductions without breaking the bank.

-

Can I integrate airSlate SignNow with other software for itemized deductions?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your itemized deductions. This seamless integration allows you to streamline your workflow and ensure that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for itemized deductions?

Using airSlate SignNow for instructions a itemized deductions provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing your document management process, you can save time and focus on maximizing your deductions.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your sensitive tax documents related to instructions a itemized deductions, ensuring that your information remains confidential and safe from unauthorized access.

Get more for Deductions And CreditsDepartment Of Revenue

Find out other Deductions And CreditsDepartment Of Revenue

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document