M Others Specify Tax Declaration No TCTOCTCCT Form

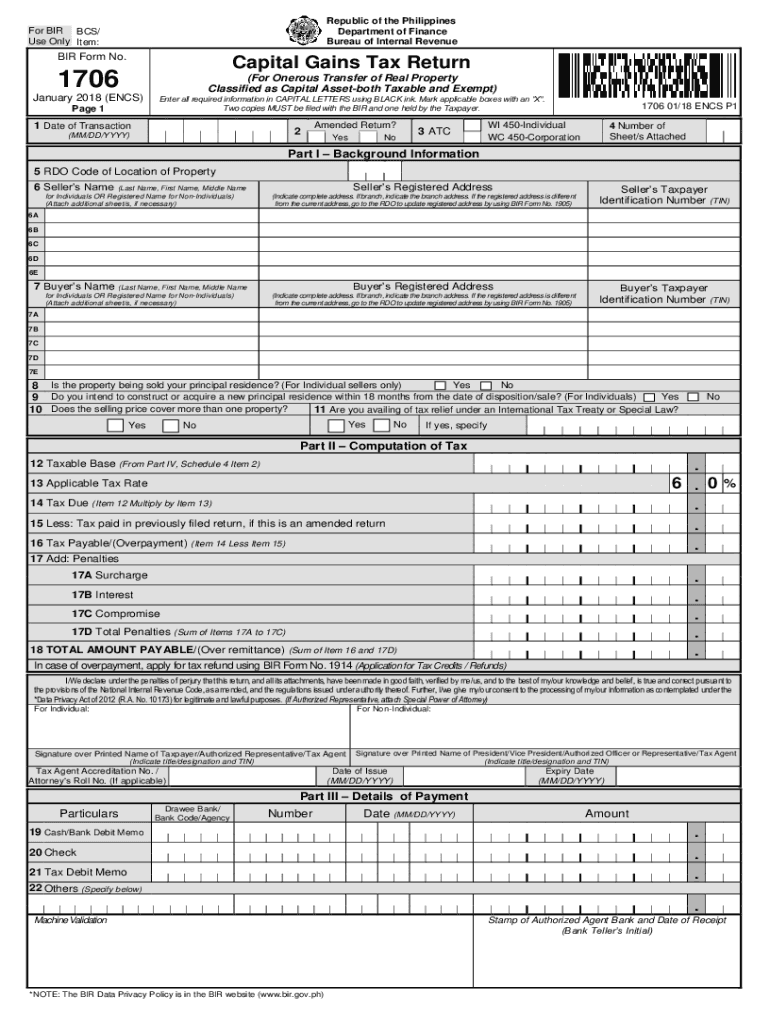

Understanding the bir form 1706

The bir form 1706 serves as a capital gains tax return form in the United States, specifically designed for individuals and entities reporting capital gains from the sale of assets. This form is crucial for ensuring compliance with tax regulations and accurately reporting income derived from capital transactions. Understanding its purpose and requirements is essential for taxpayers to fulfill their obligations and avoid potential penalties.

Steps to complete the bir form 1706

Filling out the bir form 1706 involves several key steps to ensure accuracy and compliance. Here’s a straightforward approach:

- Gather necessary documents, including details about the assets sold, purchase prices, and selling prices.

- Accurately report the capital gains or losses by entering the required information in the designated sections of the form.

- Double-check all calculations to ensure that the reported figures are correct.

- Sign and date the form to validate its authenticity before submission.

Legal use of the bir form 1706

The bir form 1706 is legally binding when completed correctly and submitted according to IRS guidelines. It is essential to ensure that all information is accurate and that the form is signed appropriately. Compliance with legal requirements not only protects taxpayers but also ensures that the form is accepted by the IRS without issues.

Filing deadlines for the bir form 1706

Timely submission of the bir form 1706 is critical to avoid penalties. The typical deadline for filing this form is aligned with the annual tax filing deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as they may vary slightly depending on weekends or holidays.

Who issues the bir form 1706

The bir form 1706 is issued by the Bureau of Internal Revenue (BIR) in the United States. This government agency is responsible for tax collection and enforcement of tax laws, making it essential for taxpayers to utilize the correct forms as mandated by the BIR.

Required documents for the bir form 1706

To complete the bir form 1706, several documents are typically required. These may include:

- Proof of purchase for the assets sold.

- Documentation of sale transactions, including contracts or agreements.

- Any prior tax returns that may relate to the assets in question.

Examples of using the bir form 1706

Taxpayers may encounter various scenarios requiring the use of the bir form 1706. For instance, an individual selling a property or stocks that have appreciated in value must report the capital gains using this form. Additionally, businesses that dispose of assets must also utilize the bir form 1706 to report their capital gains accurately.

Quick guide on how to complete m others specify tax declaration no tctoctcct

Complete M Others Specify Tax Declaration No TCTOCTCCT seamlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle M Others Specify Tax Declaration No TCTOCTCCT on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign M Others Specify Tax Declaration No TCTOCTCCT effortlessly

- Locate M Others Specify Tax Declaration No TCTOCTCCT and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries of lost or misplaced documents, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign M Others Specify Tax Declaration No TCTOCTCCT and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m others specify tax declaration no tctoctcct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is bir form 1706, and why is it important?

BIR Form 1706 is essential for businesses in the Philippines, as it pertains to the residential real property tax declaration. Downloading the bir form 1706 is crucial for accurate tax reporting and compliance with government regulations. airSlate SignNow makes it simple to fill out and sign this form electronically.

-

How can I obtain the bir form 1706 download from airSlate SignNow?

To access the bir form 1706 download, simply visit the airSlate SignNow platform and search for the form in our template library. Once located, you can easily download, fill out, and send the form for e-signature directly. Our user-friendly interface streamlines this process.

-

Are there any costs associated with downloading bir form 1706?

Yes, while downloading the bir form 1706 is free, using airSlate SignNow's e-signature features may have associated costs depending on your plan. We offer various pricing tiers to fit different business needs, ensuring you get an affordable solution for document management. Check our pricing page for more details.

-

Can I use airSlate SignNow to store my signed bir form 1706?

Absolutely! After completing your bir form 1706 download and e-signing, airSlate SignNow allows you to securely store your documents in the cloud. This feature ensures easy access and management of all your important documents in one place, enhancing your workflow.

-

What features does airSlate SignNow offer for managing forms like bir form 1706?

AirSlate SignNow offers numerous features for efficient document management, including customizable templates, automated workflows, and real-time tracking of document status. These capabilities streamline the process of handling forms such as the bir form 1706, making it easier for you to manage compliance.

-

Is airSlate SignNow mobile-friendly for downloading bir form 1706?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to download and manage the bir form 1706 on the go. Our mobile app enables you to edit, sign, and send documents from anywhere, ensuring you remain productive even outside the office.

-

Does airSlate SignNow integrate with other applications for managing bir form 1706?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. These integrations help manage the bir form 1706 download and streamline your document workflows, making collaboration more efficient across platforms.

Get more for M Others Specify Tax Declaration No TCTOCTCCT

Find out other M Others Specify Tax Declaration No TCTOCTCCT

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself