Gp5479us Form Hancock 2016-2026

What is the GP5479US Form Hancock

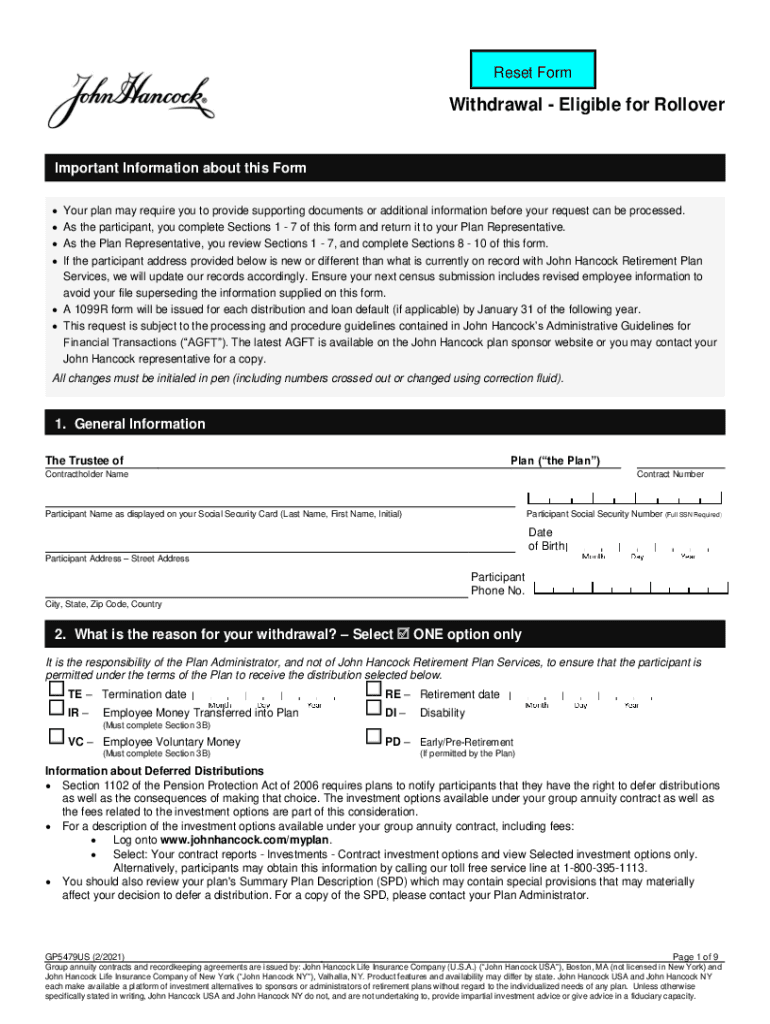

The GP5479US Form Hancock is a specific type of tax form used primarily for managing retirement account distributions, particularly in relation to 401k plans. This form is essential for individuals who wish to withdraw funds from their 401k accounts, providing necessary information about the withdrawal amount and the reason for the distribution. Understanding the purpose of this form is crucial for ensuring compliance with tax regulations and for making informed financial decisions regarding retirement savings.

Steps to Complete the GP5479US Form Hancock

Completing the GP5479US Form Hancock involves several important steps to ensure accuracy and compliance:

- Gather necessary information, including your personal identification details, account number, and the amount you wish to withdraw.

- Clearly state the reason for the withdrawal, as this can affect tax implications and penalties.

- Fill out the form completely, ensuring that all required fields are addressed.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form to validate your request.

How to Obtain the GP5479US Form Hancock

The GP5479US Form Hancock can typically be obtained through various channels. Most commonly, it is available directly from your 401k plan provider's website or customer service. You may also request a physical copy by contacting the provider's support team. Additionally, financial institutions that manage retirement accounts often have access to this form, making it easy to acquire when needed.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the GP5479US Form Hancock. It is important to adhere to these guidelines to avoid potential penalties. The IRS outlines the conditions under which withdrawals can be made, including age restrictions and qualifying hardships. Familiarizing yourself with these guidelines ensures that you are compliant with federal tax laws and can help minimize any tax liabilities associated with your withdrawal.

Legal Use of the GP5479US Form Hancock

The legal use of the GP5479US Form Hancock is crucial for ensuring that your withdrawal request is valid and recognized by financial institutions and the IRS. This form must be completed accurately and submitted in accordance with the specific regulations governing retirement account distributions. Proper use of this form protects your rights as a plan participant and helps maintain compliance with tax laws, ensuring that your withdrawal is processed without issues.

Required Documents

When completing the GP5479US Form Hancock, certain documents may be required to support your withdrawal request. Commonly required documents include:

- Proof of identity, such as a government-issued ID.

- Documentation supporting the reason for withdrawal, such as medical bills or proof of financial hardship.

- Any previous tax forms related to your 401k account, if applicable.

Having these documents ready can facilitate a smoother processing of your request.

Quick guide on how to complete gp5479us form hancock

Prepare Gp5479us Form Hancock effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Gp5479us Form Hancock on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Gp5479us Form Hancock without hassle

- Locate Gp5479us Form Hancock and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Gp5479us Form Hancock and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gp5479us form hancock

Create this form in 5 minutes!

How to create an eSignature for the gp5479us form hancock

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 401k tax form and why is it important?

The 401k tax form is essential for reporting contributions and distributions to your 401k plan. It ensures that you fulfill your tax obligations and maintain compliance with IRS regulations. Completing this form accurately helps avoid penalties and ensures that your retirement savings grow tax-deferred.

-

How can airSlate SignNow assist with the 401k tax form process?

airSlate SignNow simplifies the signing and management of your 401k tax forms by allowing you to eSign documents securely online. Our platform eliminates the hassle of printing and mailing, saving you time and ensuring a smooth process. With templates available, you can easily handle multiple requests without stress.

-

What are the pricing options for using airSlate SignNow for 401k tax forms?

airSlate SignNow offers various pricing plans designed to meet the needs of businesses of all sizes. With affordable options, you can choose a plan that aligns with your budget while benefiting from features that enhance the handling of your 401k tax forms. Check our website for the latest pricing details and special offers.

-

Is it safe to send my 401k tax form using airSlate SignNow?

Yes, airSlate SignNow prioritizes security by using advanced encryption technologies to protect your sensitive information, including your 401k tax form. Our compliance with regulations ensures that your data is handled with care. You can confidently manage your forms knowing that your information is secure.

-

Are there features in airSlate SignNow specifically for 401k tax form management?

Absolutely! airSlate SignNow offers features such as customizable templates, automated reminders, and a secure audit trail, all tailored to enhance the management of your 401k tax forms. These tools help you streamline the process, improve efficiency, and maintain organized records for future reference.

-

Can airSlate SignNow integrate with other software when managing 401k tax forms?

Yes, airSlate SignNow seamlessly integrates with a variety of software solutions, enhancing your experience when managing 401k tax forms. This includes compatibility with CRM systems, email platforms, and cloud storage services, allowing you to efficiently exchange and store documents without interruptions.

-

How can I track the status of my 401k tax form with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your 401k tax form through our user-friendly dashboard. You’ll receive notifications when your forms are eSigned and can monitor who has viewed or completed them. This transparency helps you stay informed and organized throughout the process.

Get more for Gp5479us Form Hancock

- Medical eligibility form

- Eanes isd physical form

- Virginia 502w form

- Employment attestation form

- Fastapp xcel form

- Dpor address change form

- Odometer and damage disclosure statement for use by a dealer or private owner where the title or dealers certificate of sale form

- Mva cs 053 formfill out and use this pdf

Find out other Gp5479us Form Hancock

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free