Metropolitan Life Insurance Company GUL BENEFICIARY Form

What is the Metropolitan Life Insurance Company GUL Beneficiary?

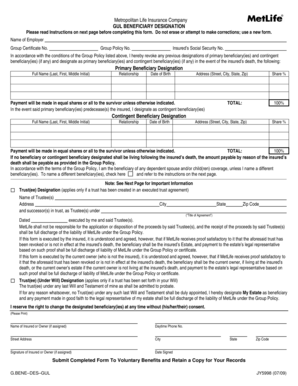

The Metropolitan Life Insurance Company GUL Beneficiary form is a crucial document used to designate individuals or entities that will receive benefits from a Guaranteed Universal Life (GUL) insurance policy upon the policyholder's passing. This form ensures that the policyholder's wishes are clearly outlined and legally recognized, providing peace of mind regarding the distribution of life insurance benefits. It is essential for policyholders to understand the implications of their choices and to keep this information updated as life circumstances change.

Steps to Complete the Metropolitan Life Insurance Company GUL Beneficiary

Completing the Metropolitan Life Insurance Company GUL Beneficiary form involves several important steps:

- Begin by gathering necessary personal information, including your full name, policy number, and the details of your beneficiaries.

- Clearly identify each beneficiary by providing their full name, relationship to you, and contact information.

- Decide on the percentage of benefits each beneficiary will receive, ensuring the total equals one hundred percent.

- Sign and date the form in the designated areas to validate your choices.

- Review the completed form for accuracy before submission.

Legal Use of the Metropolitan Life Insurance Company GUL Beneficiary

The legal use of the Metropolitan Life Insurance Company GUL Beneficiary form requires adherence to specific regulations that govern life insurance policies. To be considered valid, the form must be signed by the policyholder and may require notarization, depending on state laws. It is important to ensure that the form complies with both federal and state regulations, which can vary significantly. This legal framework protects the rights of the beneficiaries and ensures that the policyholder's intentions are honored.

How to Obtain the Metropolitan Life Insurance Company GUL Beneficiary

To obtain the Metropolitan Life Insurance Company GUL Beneficiary form, policyholders can follow these steps:

- Visit the official Metropolitan Life Insurance Company website or contact their customer service for assistance.

- Request the form directly through your insurance agent or representative, who can provide guidance on completing it correctly.

- Access your online account if available, as many insurance companies offer downloadable forms for convenience.

Key Elements of the Metropolitan Life Insurance Company GUL Beneficiary

The key elements of the Metropolitan Life Insurance Company GUL Beneficiary form include:

- Policyholder Information: Essential details about the individual holding the insurance policy.

- Beneficiary Designation: Names and contact information of individuals or entities designated to receive benefits.

- Percentage Allocation: Clear specification of how benefits are divided among beneficiaries.

- Signature and Date: Required validation from the policyholder to ensure the form is legally binding.

Form Submission Methods

The Metropolitan Life Insurance Company GUL Beneficiary form can be submitted through various methods, ensuring flexibility for policyholders:

- Online Submission: Some policyholders may have the option to submit the form electronically through the insurance provider's secure portal.

- Mail: The completed form can be mailed to the designated address provided by the insurance company.

- In-Person: Policyholders may also choose to submit the form in person at their local Metropolitan Life Insurance Company office for immediate processing.

Quick guide on how to complete metropolitan life insurance company gul beneficiary

Easily Prepare Metropolitan Life Insurance Company GUL BENEFICIARY on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Metropolitan Life Insurance Company GUL BENEFICIARY on any platform using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to Modify and Electronically Sign Metropolitan Life Insurance Company GUL BENEFICIARY Effortlessly

- Obtain Metropolitan Life Insurance Company GUL BENEFICIARY and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your method of sending the form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Metropolitan Life Insurance Company GUL BENEFICIARY to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the metropolitan life insurance company gul beneficiary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Metropolitan Life Insurance Company GUL BENEFICIARY policy?

The Metropolitan Life Insurance Company GUL BENEFICIARY policy is a guaranteed universal life insurance product that provides coverage for your entire lifetime. This policy ensures that your beneficiaries receive the death benefit when you pass away, offering peace of mind for you and your loved ones.

-

How does the pricing work for the Metropolitan Life Insurance Company GUL BENEFICIARY?

Pricing for the Metropolitan Life Insurance Company GUL BENEFICIARY policy varies based on factors like age, health, and desired coverage amount. It's advisable to get a personalized quote to understand the specific cost tailored to your needs, ensuring it fits within your budget.

-

What are the key features of the Metropolitan Life Insurance Company GUL BENEFICIARY?

The key features of the Metropolitan Life Insurance Company GUL BENEFICIARY include flexible premium payments, lifelong coverage, and a guaranteed death benefit. Additionally, it may offer options for cash value accumulation depending on your policy terms.

-

What benefits does the Metropolitan Life Insurance Company GUL BENEFICIARY provide?

The primary benefit of the Metropolitan Life Insurance Company GUL BENEFICIARY is the financial security it offers your beneficiaries after your death. This policy also allows you to lock in rates at younger ages and provides choices for increasing coverage in the future.

-

Is the Metropolitan Life Insurance Company GUL BENEFICIARY policy customizable?

Yes, the Metropolitan Life Insurance Company GUL BENEFICIARY policy is customizable to fit your specific needs. You can choose different coverage amounts and premium payment options, ensuring that the policy aligns with your personal financial plan.

-

What integrations are available with Metropolitan Life Insurance Company GUL BENEFICIARY?

The Metropolitan Life Insurance Company GUL BENEFICIARY can be easily integrated with various financial planning tools and personal finance management software. This allows policyholders to seamlessly manage their insurance alongside other financial assets.

-

How do I make claims on my Metropolitan Life Insurance Company GUL BENEFICIARY?

To make a claim on your Metropolitan Life Insurance Company GUL BENEFICIARY, you will need to contact their claims department. Be prepared to provide necessary documentation, including the death certificate, to facilitate a smooth and timely claims process.

Get more for Metropolitan Life Insurance Company GUL BENEFICIARY

- Aircraft squawk sheet form

- Application for consumer exemption form

- The monkeys paw vocabulary pdf form

- Authorized signatory list template 423026331 form

- 4 point inspection checklist form

- Angle angle similarity worksheet pdf form

- Udyog aadhar form pdf

- Discipline and guidance policy for not just another daycare form

Find out other Metropolitan Life Insurance Company GUL BENEFICIARY

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe