Direct Deposit Agreement Account Form

What is the Direct Deposit Agreement Account

The direct deposit agreement account is a financial arrangement that allows employers to deposit employees' wages directly into their bank accounts. This method streamlines payroll processes and enhances security by reducing the need for paper checks. Employees typically provide their bank account details to their employers, who then initiate deposits on scheduled paydays. This account type is particularly beneficial for both parties, as it minimizes the risk of lost or stolen checks and ensures timely access to funds.

How to use the Direct Deposit Agreement Account

Using a direct deposit agreement account involves several straightforward steps. Employees must first complete a direct deposit form, providing necessary information such as bank account numbers and routing numbers. Once submitted to the employer, the employer processes this information to set up the direct deposit. Employees should monitor their bank accounts to confirm that deposits are made as expected. It is also advisable for employees to keep their banking information updated, especially if they change banks or accounts.

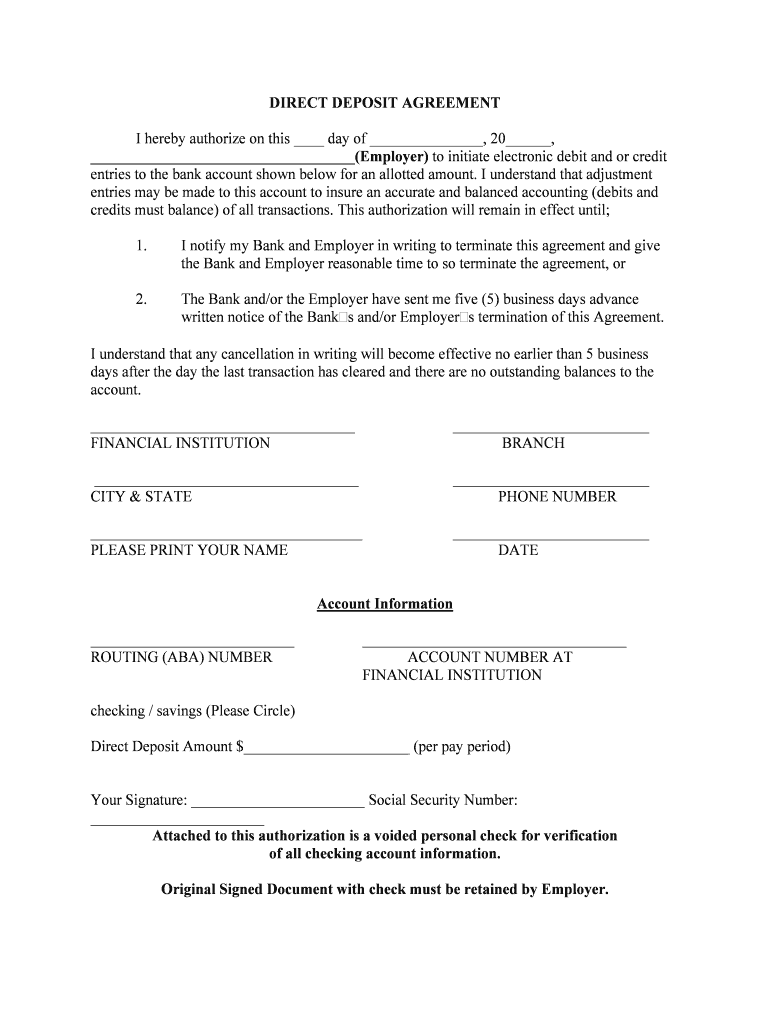

Steps to complete the Direct Deposit Agreement Account

Completing a direct deposit agreement account requires careful attention to detail. Follow these steps:

- Obtain the direct deposit form from your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide your bank account details, including the account number and routing number.

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer's payroll department.

After submission, it may take one or two pay cycles for the direct deposit to begin, so employees should remain patient during this transition period.

Legal use of the Direct Deposit Agreement Account

The legal framework governing the use of direct deposit agreement accounts is primarily defined by federal and state laws. Employers must comply with the Electronic Fund Transfer Act (EFTA), which protects consumers in electronic transactions. Additionally, employers should ensure that employees have voluntarily consented to the direct deposit arrangement. This consent is typically documented through the signed direct deposit form. Maintaining compliance with these regulations is essential to avoid potential legal issues.

Required Documents

To set up a direct deposit agreement account, employees typically need to provide specific documents. These may include:

- A completed direct deposit form.

- Proof of identity, such as a driver's license or Social Security card.

- Bank account information, which may require a voided check or bank statement.

Having these documents ready can expedite the setup process and ensure that payroll deposits are initiated without delay.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for employers regarding direct deposit practices. Employers must ensure that the direct deposit process complies with tax withholding requirements. Additionally, employees should be aware that direct deposits will be reported on their W-2 forms, reflecting the total wages paid and taxes withheld. It is essential for both employers and employees to maintain accurate records to facilitate smooth tax filing and compliance.

Quick guide on how to complete direct deposit agreement account

Effortlessly Prepare Direct Deposit Agreement Account on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Handle Direct Deposit Agreement Account on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The Easiest Way to Edit and Electronically Sign Direct Deposit Agreement Account with Ease

- Obtain Direct Deposit Agreement Account and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for these purposes.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Direct Deposit Agreement Account and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the direct deposit agreement account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is worker direct deposit?

Worker direct deposit is a convenient electronic payment method that allows employers to deposit employees' wages directly into their bank accounts. This service eliminates the need for physical checks and streamlines the payroll process. With airSlate SignNow, setting up worker direct deposit becomes seamless and efficient.

-

How does airSlate SignNow facilitate worker direct deposit?

airSlate SignNow integrates with various payroll systems to automate the worker direct deposit process. Once documents are signed electronically, the system securely processes payments, ensuring timely deposits for employees. This integration saves time and reduces errors in payroll management.

-

What are the benefits of using worker direct deposit?

Utilizing worker direct deposit offers numerous benefits, including faster access to funds for employees and reduced administrative costs for employers. It also enhances security by minimizing the risk of lost or stolen checks. Moreover, worker direct deposit allows for easy tracking of payments and payroll records.

-

Is there a fee for using worker direct deposit with airSlate SignNow?

While airSlate SignNow provides a cost-effective solution, the fees associated with worker direct deposit can vary based on the payroll integration chosen. Typically, employers benefit from reduced expenses related to printing and distributing checks. It's best to review the pricing details based on your specific needs.

-

Can airSlate SignNow handle large volumes of worker direct deposit transactions?

Yes, airSlate SignNow is designed to efficiently manage large volumes of worker direct deposit transactions. The platform scales easily, accommodating businesses of all sizes and ensuring that payroll processes remain smooth even during peak periods. This capability helps maintain employee satisfaction and trust.

-

How secure is the worker direct deposit process with airSlate SignNow?

Security is a top priority at airSlate SignNow, which employs state-of-the-art encryption and compliance protocols to protect worker direct deposit information. All transactions are monitored for fraud prevention, ensuring that both employer and employee data remains confidential. This commitment to security makes the service reliable for all users.

-

Does airSlate SignNow integrate with popular accounting software for worker direct deposit?

Yes, airSlate SignNow integrates seamlessly with various popular accounting software systems, enhancing the worker direct deposit experience. This allows businesses to streamline their payroll processes, automate documentation, and ensure accurate financial reporting. Check the list of integrations to confirm compatibility with your accounting software.

Get more for Direct Deposit Agreement Account

Find out other Direct Deposit Agreement Account

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document