Instructions for Form 1040 Tax Tables 2024-2026

Understanding the 1040 Schedule 3

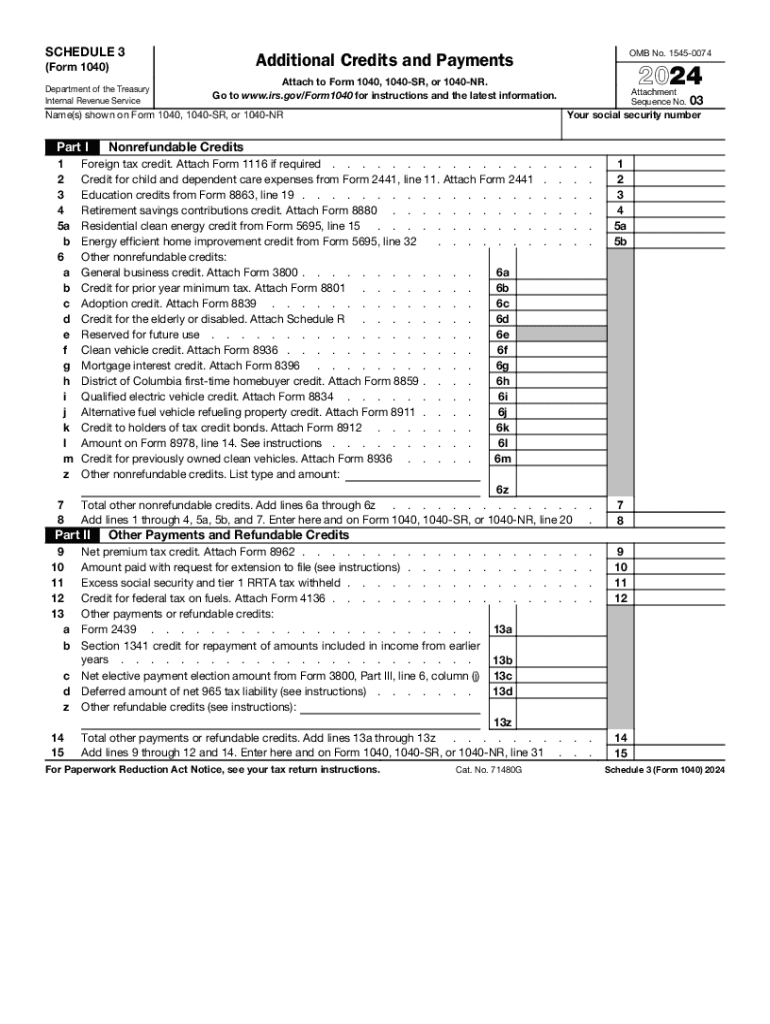

The 1040 Schedule 3 is a crucial tax form used by individuals to report additional credits and payments that may not be included directly on the main 1040 form. This schedule is essential for taxpayers seeking to claim various credits, such as the foreign tax credit, education credits, and other refundable credits. Understanding how to properly fill out this form can significantly impact your tax liability and potential refunds.

Key Elements of the 1040 Schedule 3

The 1040 Schedule 3 consists of several key sections that taxpayers must complete. These include:

- Part I: Nonrefundable Credits - This section allows you to report credits that can reduce your tax liability but cannot result in a refund.

- Part II: Refundable Credits - Here, you can claim credits that may lead to a refund, even if they exceed your tax liability.

- Part III: Other Payments - This part includes any other payments, such as the amount paid with a request for an extension.

Each section requires accurate information to ensure proper processing by the IRS.

Steps to Complete the 1040 Schedule 3

Completing the 1040 Schedule 3 involves several steps:

- Gather necessary documents, including your W-2s, 1099s, and any documentation for credits you plan to claim.

- Fill out Part I by entering any nonrefundable credits you qualify for, ensuring you have the correct amounts.

- Complete Part II with any refundable credits, double-checking your eligibility for each credit listed.

- In Part III, report any additional payments made, such as those made with an extension request.

- Review your entries for accuracy before submitting the form along with your main 1040 return.

IRS Guidelines for the 1040 Schedule 3

The IRS provides specific guidelines for completing the 1040 Schedule 3. It is important to refer to the latest IRS instructions for the form, as these guidelines can change annually. The instructions outline eligibility criteria for various credits and provide examples to assist taxpayers in accurately reporting their information. Following these guidelines closely can help avoid errors that may delay processing or result in penalties.

Filing Deadlines for the 1040 Schedule 3

The filing deadline for the 1040 Schedule 3 aligns with the main 1040 form, typically due on April fifteenth of each year. If you require additional time, you may file for an extension, but it is essential to ensure that any taxes owed are paid by the original deadline to avoid penalties. Staying aware of these deadlines helps ensure compliance with IRS requirements.

Eligibility Criteria for Credits on the 1040 Schedule 3

Eligibility for credits reported on the 1040 Schedule 3 varies based on the specific credit. For example, education credits often have income limits, while the foreign tax credit requires proof of taxes paid to a foreign government. It is crucial to review the eligibility criteria for each credit before claiming them on the schedule to ensure you meet all requirements and avoid potential issues with the IRS.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1040 tax tables

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1040 tax tables

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is schedule 3 in airSlate SignNow?

Schedule 3 in airSlate SignNow refers to a specific plan that offers enhanced features for document signing and management. This plan is designed for businesses that require advanced functionalities, making it easier to streamline workflows and improve efficiency.

-

How much does the schedule 3 plan cost?

The schedule 3 plan is competitively priced to provide excellent value for businesses looking to enhance their document management processes. For detailed pricing information, visit our pricing page or contact our sales team for a personalized quote.

-

What features are included in the schedule 3 plan?

The schedule 3 plan includes features such as advanced eSignature capabilities, customizable templates, and integration with various third-party applications. These features are designed to help businesses optimize their document workflows and improve collaboration.

-

How can schedule 3 benefit my business?

By choosing the schedule 3 plan, your business can benefit from increased efficiency in document handling and improved turnaround times for approvals. This plan also enhances security and compliance, ensuring that your documents are managed safely and effectively.

-

Can I integrate schedule 3 with other software?

Yes, the schedule 3 plan supports integrations with a variety of popular software applications, including CRM systems and project management tools. This allows you to create a seamless workflow that enhances productivity and reduces manual data entry.

-

Is there a free trial available for schedule 3?

Yes, airSlate SignNow offers a free trial for the schedule 3 plan, allowing you to explore its features and benefits without any commitment. This trial period is a great opportunity to see how schedule 3 can meet your business needs.

-

What kind of support is available for schedule 3 users?

Users of the schedule 3 plan have access to dedicated customer support, including live chat, email assistance, and a comprehensive knowledge base. Our support team is committed to helping you maximize the value of your airSlate SignNow experience.

Get more for Instructions For Form 1040 Tax Tables

Find out other Instructions For Form 1040 Tax Tables

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors