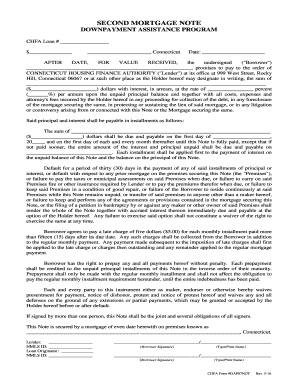

SECOND MORTGAGE NOTE Loan Chfa Org Form

What is the SECOND MORTGAGE NOTE Loan Chfa org

The SECOND MORTGAGE NOTE Loan Chfa org is a financial instrument that allows homeowners to borrow against the equity in their property. This type of loan is secured by a second mortgage on the home, meaning that if the borrower defaults, the lender can claim the property after the first mortgage is paid off. It is often used for various purposes, such as home improvements, debt consolidation, or covering unexpected expenses. The loan is typically issued by the Colorado Housing and Finance Authority (CHFA), which aims to provide affordable housing solutions.

How to obtain the SECOND MORTGAGE NOTE Loan Chfa org

To obtain the SECOND MORTGAGE NOTE Loan Chfa org, borrowers must first check their eligibility. This usually involves verifying income, credit score, and the amount of equity available in the home. Interested applicants can then complete the application process through CHFA-approved lenders. It is essential to gather necessary documentation, such as proof of income, tax returns, and information about existing mortgages. After submitting the application, the lender will review it and provide a decision based on the borrower’s financial situation.

Steps to complete the SECOND MORTGAGE NOTE Loan Chfa org

Completing the SECOND MORTGAGE NOTE Loan Chfa org involves several key steps:

- Determine eligibility by assessing income, credit score, and home equity.

- Gather required documents, including proof of income and existing mortgage details.

- Choose a CHFA-approved lender and complete the application form.

- Submit the application along with the necessary documentation.

- Await the lender's decision and respond to any requests for additional information.

- If approved, review the loan terms and sign the SECOND MORTGAGE NOTE.

Legal use of the SECOND MORTGAGE NOTE Loan Chfa org

The SECOND MORTGAGE NOTE Loan Chfa org is legally binding once signed by both the borrower and the lender. It is important to ensure that all legal requirements are met during the signing process, including compliance with federal and state laws governing mortgage loans. This includes adherence to the Electronic Signatures in Global and National Commerce (ESIGN) Act, which validates electronic signatures. Proper documentation and record-keeping are essential to uphold the legal standing of the loan.

Key elements of the SECOND MORTGAGE NOTE Loan Chfa org

Several key elements define the SECOND MORTGAGE NOTE Loan Chfa org:

- Loan Amount: The total funds borrowed against the home equity.

- Interest Rate: The cost of borrowing, typically fixed or variable.

- Repayment Terms: The schedule and duration for loan repayment.

- Collateral: The home itself serves as security for the loan.

- Borrower Obligations: Responsibilities of the borrower, including timely payments.

Eligibility Criteria

Eligibility for the SECOND MORTGAGE NOTE Loan Chfa org generally includes several factors:

- Homeownership status, requiring the applicant to own the property outright or have sufficient equity.

- Credit score, with a minimum requirement typically set by the lender.

- Income verification to ensure the borrower can meet repayment obligations.

- Debt-to-income ratio, which assesses the borrower’s ability to manage additional debt.

Quick guide on how to complete second mortgage note loan chfa org

Effortlessly Prepare SECOND MORTGAGE NOTE Loan Chfa org on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage SECOND MORTGAGE NOTE Loan Chfa org on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The Easiest Way to Edit and eSign SECOND MORTGAGE NOTE Loan Chfa org Without Difficulty

- Obtain SECOND MORTGAGE NOTE Loan Chfa org and then click Get Form to initiate.

- Make use of the tools we provide to finish your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, tiresome form searches, or errors that require new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you prefer. Modify and eSign SECOND MORTGAGE NOTE Loan Chfa org to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the second mortgage note loan chfa org

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SECOND MORTGAGE NOTE Loan from Chfa org?

A SECOND MORTGAGE NOTE Loan from Chfa org is a type of financing that allows homeowners to borrow against the equity in their home. By utilizing this loan, borrowers can access funds for various needs such as home improvements or debt consolidation, while also maintaining their primary mortgage. Understanding this type of loan can help you make informed financial decisions.

-

How does the application process for a SECOND MORTGAGE NOTE Loan with Chfa org work?

The application process for a SECOND MORTGAGE NOTE Loan from Chfa org typically involves filling out the necessary paperwork and providing financial documentation. You will need to demonstrate your creditworthiness and the property's value. After submission, your application will be reviewed, and you may receive a decision within a few days.

-

What are the eligibility requirements for a SECOND MORTGAGE NOTE Loan at Chfa org?

To qualify for a SECOND MORTGAGE NOTE Loan from Chfa org, borrowers must meet specific criteria including income limits, credit score requirements, and property types. Specific eligibility criteria can vary, so it's best to check directly with Chfa org for the most current guidelines. Meeting these requirements ensures a smoother loan approval process.

-

What are the advantages of a SECOND MORTGAGE NOTE Loan with Chfa org?

One major advantage of a SECOND MORTGAGE NOTE Loan from Chfa org is the ability to access funds at a lower interest rate compared to unsecured loans. Additionally, the interest paid on the loan may be tax-deductible. This loan can provide a great financial tool for managing expenses and investing in home-related projects.

-

Can I use a SECOND MORTGAGE NOTE Loan from Chfa org for home improvements?

Yes, a SECOND MORTGAGE NOTE Loan from Chfa org can be effectively used for home improvements. These improvements can not only enhance your living space but also potentially increase your home's market value. Using your home equity this way can be a smart investment.

-

What should I know about the interest rates on SECOND MORTGAGE NOTE Loans from Chfa org?

Interest rates on SECOND MORTGAGE NOTE Loans from Chfa org can vary based on factors like credit score and market conditions. Generally, these rates tend to be lower than those of personal loans or credit cards. It's advisable to compare rates from different lenders to ensure you're getting the best deal.

-

Are there any fees associated with obtaining a SECOND MORTGAGE NOTE Loan from Chfa org?

Yes, there may be fees associated with obtaining a SECOND MORTGAGE NOTE Loan from Chfa org, including application fees, closing costs, and appraisal fees. It's essential to review the fee structure disclosed during the application process to avoid any surprises. Understanding these costs can help with budget planning.

Get more for SECOND MORTGAGE NOTE Loan Chfa org

Find out other SECOND MORTGAGE NOTE Loan Chfa org

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple