Form 8938 Continuation Sheet

What is the Form 8938 Continuation Sheet

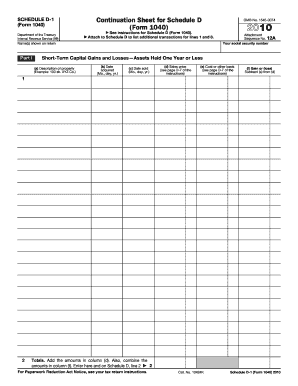

The Form 8938 continuation sheet is a crucial document for U.S. taxpayers who hold specified foreign financial assets. This form is part of the IRS requirements under the Foreign Account Tax Compliance Act (FATCA). It allows taxpayers to report their foreign assets accurately when the primary Form 8938 does not provide sufficient space. The continuation sheet ensures that all relevant financial information is disclosed to the IRS, helping to maintain compliance with tax regulations.

How to Use the Form 8938 Continuation Sheet

To use the Form 8938 continuation sheet effectively, taxpayers should first complete the primary Form 8938. If the space provided is inadequate for listing all foreign financial assets, the continuation sheet can be attached. Each asset must be detailed, including information such as the name of the financial institution, account number, and the maximum value of the asset during the tax year. This ensures that all necessary information is reported in accordance with IRS guidelines.

Steps to Complete the Form 8938 Continuation Sheet

Completing the Form 8938 continuation sheet involves several key steps:

- Begin by filling out the primary Form 8938, ensuring all required fields are completed.

- If additional space is needed, download the continuation sheet in PDF format.

- On the continuation sheet, accurately list each foreign financial asset, providing all necessary details.

- Double-check the information for accuracy and completeness.

- Attach the continuation sheet to your primary Form 8938 when submitting to the IRS.

IRS Guidelines for the Form 8938 Continuation Sheet

The IRS provides specific guidelines regarding the use of the Form 8938 continuation sheet. Taxpayers must ensure that the information reported is accurate and complete to avoid penalties. The IRS requires that all specified foreign financial assets be reported if the total value exceeds certain thresholds. It is essential to stay updated on any changes to IRS guidelines regarding FATCA reporting to ensure compliance.

Filing Deadlines for the Form 8938 Continuation Sheet

The filing deadline for the Form 8938 continuation sheet aligns with the due date for the primary Form 8938. Typically, this is the same as the due date for the individual income tax return, which is April 15 for most taxpayers. However, if an extension is filed, the continuation sheet must also be submitted by the extended deadline. It is important to adhere to these deadlines to avoid potential penalties for late filing.

Penalties for Non-Compliance with the Form 8938

Failing to file the Form 8938 continuation sheet or providing inaccurate information can result in significant penalties. The IRS imposes a penalty for failing to report foreign financial assets, which can be substantial. Additionally, continued non-compliance may lead to further legal consequences. Taxpayers are encouraged to maintain accurate records and ensure timely submission to avoid these penalties.

Quick guide on how to complete form 8938 continuation sheet 1651565

Effortlessly Prepare Form 8938 Continuation Sheet on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to procure the appropriate form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Form 8938 Continuation Sheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Form 8938 Continuation Sheet with Ease

- Locate Form 8938 Continuation Sheet and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all details and click the Done button to save your changes.

- Choose your preferred method to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Modify and eSign Form 8938 Continuation Sheet to ensure seamless communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8938 continuation sheet 1651565

Create this form in 5 minutes!

How to create an eSignature for the form 8938 continuation sheet 1651565

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 8938 continuation statement 2021?

The form 8938 continuation statement 2021 is used to report specified foreign financial assets and is required for certain U.S. taxpayers. This continuation statement enables taxpayers to provide additional details beyond the initial form if needed. Filing this form correctly is crucial to avoid potential penalties.

-

How can airSlate SignNow help with the form 8938 continuation statement 2021?

airSlate SignNow simplifies the process of preparing and signing the form 8938 continuation statement 2021 by providing a user-friendly digital platform. Our solution allows you to easily fill out, eSign, and securely send your documents. This streamlines compliance and makes it easier for you to manage your reporting requirements.

-

Is there a cost associated with using airSlate SignNow for the form 8938 continuation statement 2021?

Yes, airSlate SignNow offers a variety of pricing plans, making it a cost-effective option for completing the form 8938 continuation statement 2021. Depending on your needs, you can choose a plan that fits your budget while providing essential features for efficient document handling. You can also take advantage of a free trial to explore the service.

-

What features does airSlate SignNow offer for the form 8938 continuation statement 2021?

airSlate SignNow includes several powerful features to assist with the form 8938 continuation statement 2021, such as customizable templates, secure eSignature capabilities, and automated workflows. These features ensure that your documents are not only compliant but also processed efficiently. Additionally, you can track the status of your submissions easily through our dashboard.

-

Are there integrations available with airSlate SignNow for the form 8938 continuation statement 2021?

Yes, airSlate SignNow offers integrations with popular applications and services to enhance the processing of the form 8938 continuation statement 2021. This includes compatibility with cloud storage solutions and document management systems. Such integrations streamline your workflow and improve the overall efficiency of your tax reporting process.

-

What are the benefits of using airSlate SignNow for the form 8938 continuation statement 2021?

Using airSlate SignNow for the form 8938 continuation statement 2021 provides numerous benefits, including enhanced compliance, improved speed, and greater security. The platform allows for quick collaboration with tax professionals, ensuring that your statements are accurate and submitted on time. Additionally, our document storage feature keeps your important tax documents organized and accessible.

-

Is the airSlate SignNow platform easy to use for the form 8938 continuation statement 2021?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to complete the form 8938 continuation statement 2021. Whether you're tech-savvy or not, our intuitive interface guides you through every step of the signing process. Plus, customer support is available to assist you whenever needed.

Get more for Form 8938 Continuation Sheet

- Ncel 408466425 form

- Population ecology graph worksheet form

- Af form 88

- Sf 1190 addendum 100078769 form

- Bullfrogs and bumblebees daycare form

- Letterhead msgme multi site mc9000 21 letterhead msgme multi site 200 street sw rochester minnesota 55905 507 284 2220 school form

- Va form 10 10d

- Conveyanc contract template form

Find out other Form 8938 Continuation Sheet

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now