Schedule D 1 Form 1041 Irs 2012-2026

What is the Schedule D-1 Form 1041?

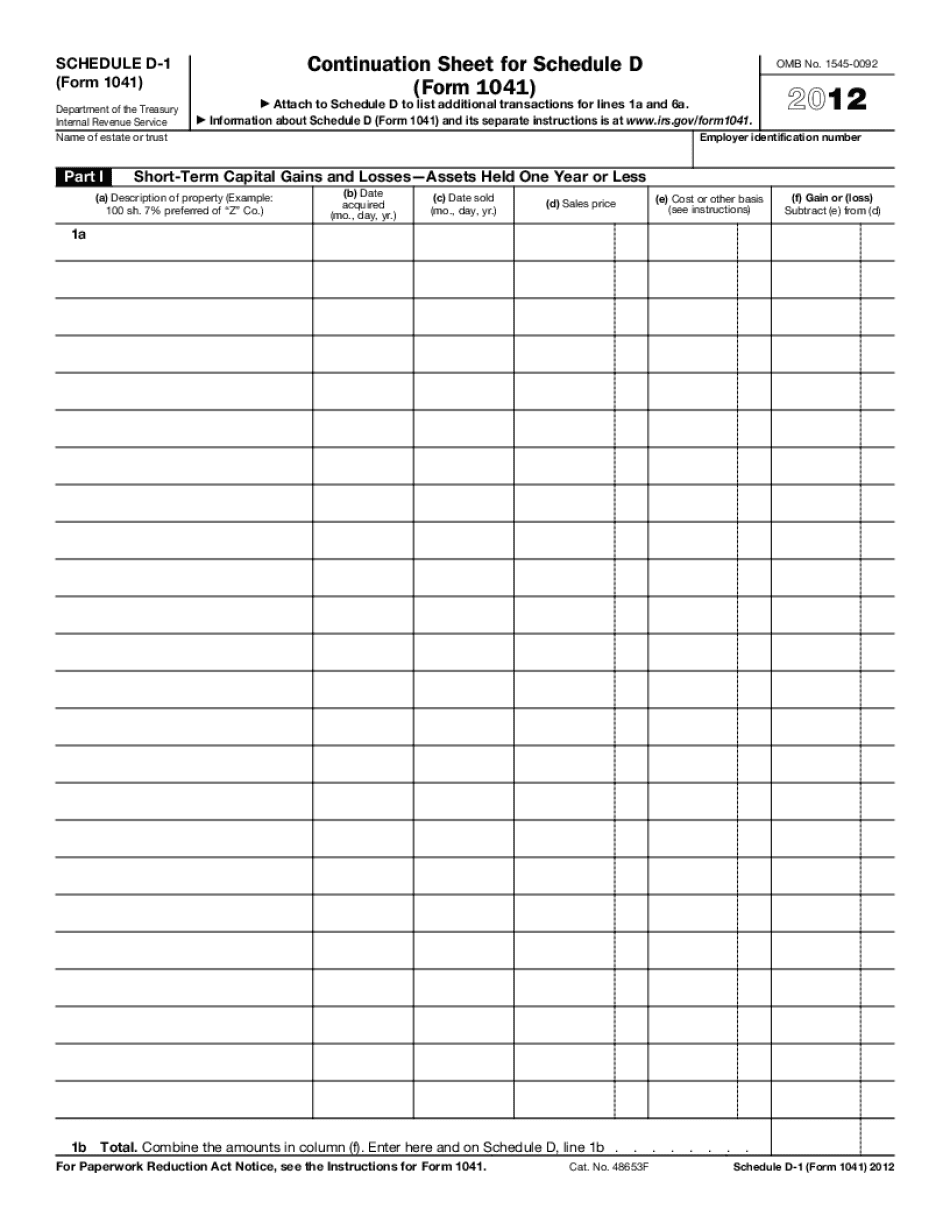

The Schedule D-1 Form 1041 is a tax form used by estates and trusts to report capital gains and losses. It is part of the U.S. Internal Revenue Service (IRS) Form 1041, which is the income tax return for estates and trusts. The Schedule D-1 specifically details transactions involving capital assets, allowing fiduciaries to report the sale or exchange of these assets. Understanding this form is crucial for ensuring accurate tax reporting and compliance with IRS regulations.

How to use the Schedule D-1 Form 1041

Using the Schedule D-1 Form 1041 involves several steps. First, gather all necessary documentation regarding capital asset transactions, including purchase and sale records. Next, fill out the form by detailing each transaction, including the date acquired, date sold, proceeds, and cost basis. After completing the form, it should be attached to Form 1041 when filing your estate or trust tax return. Accurate completion of this form ensures that any capital gains or losses are correctly reported to the IRS.

Steps to complete the Schedule D-1 Form 1041

Completing the Schedule D-1 Form 1041 requires careful attention to detail. Follow these steps:

- Gather all relevant records of capital asset transactions.

- Begin filling out the form by entering the name of the estate or trust and the tax year.

- List each capital asset transaction, including the date acquired, date sold, proceeds from the sale, and cost basis.

- Calculate the total capital gains and losses for the year.

- Attach the completed Schedule D-1 to Form 1041 before submission.

Key elements of the Schedule D-1 Form 1041

The Schedule D-1 Form 1041 includes several key elements that must be accurately reported. These elements include:

- Transaction Details: Each transaction must include specific information such as the date of acquisition, date of sale, proceeds, and cost basis.

- Capital Gains and Losses: The form requires a summary of total capital gains and losses, which impacts the overall tax liability.

- Signature and Date: The fiduciary must sign and date the form, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D-1 Form 1041 align with the overall deadlines for Form 1041. Typically, the form must be filed by the fifteenth day of the fourth month following the close of the estate or trust's tax year. For estates and trusts operating on a calendar year, this means the deadline is April fifteenth. It is essential to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Schedule D-1 Form 1041. These guidelines include instructions on what constitutes a capital asset, how to calculate gains and losses, and the importance of maintaining accurate records. Adhering to these guidelines is vital for ensuring that all reported information is correct and compliant with federal tax laws.

Create this form in 5 minutes or less

Find and fill out the correct schedule d 1 form 1041 irs

Create this form in 5 minutes!

How to create an eSignature for the schedule d 1 form 1041 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule D 1 Form 1041 Irs used for?

The Schedule D 1 Form 1041 Irs is used to report capital gains and losses for estates and trusts. It helps in calculating the tax liability on the sale of assets. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow assist with the Schedule D 1 Form 1041 Irs?

airSlate SignNow provides a seamless platform for eSigning and sending the Schedule D 1 Form 1041 Irs. With its user-friendly interface, you can easily prepare and share this important tax document with stakeholders. This ensures timely submissions and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Schedule D 1 Form 1041 Irs?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the process of managing the Schedule D 1 Form 1041 Irs. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Schedule D 1 Form 1041 Irs?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage for the Schedule D 1 Form 1041 Irs. These tools streamline the document management process, making it easier to handle tax-related paperwork efficiently.

-

Can I integrate airSlate SignNow with other software for the Schedule D 1 Form 1041 Irs?

Absolutely! airSlate SignNow integrates with various applications, enhancing your workflow for the Schedule D 1 Form 1041 Irs. This allows you to connect with accounting software and other tools, ensuring a smooth process from document creation to submission.

-

What are the benefits of using airSlate SignNow for the Schedule D 1 Form 1041 Irs?

Using airSlate SignNow for the Schedule D 1 Form 1041 Irs offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform simplifies the eSigning process, ensuring that your tax documents are handled efficiently and securely.

-

How does airSlate SignNow ensure the security of the Schedule D 1 Form 1041 Irs?

airSlate SignNow employs advanced security measures to protect your Schedule D 1 Form 1041 Irs and other documents. With encryption and secure access controls, you can trust that your sensitive tax information is safe from unauthorized access.

Get more for Schedule D 1 Form 1041 Irs

- Sagu transcripts form

- Life estate deed example 3300525 form

- Pdf glaze class form

- Prizm segments pdf form

- Transient occupancy tax registration application form

- Commercial property license agreement template form

- Commercial property management agreement template form

- Commercial property purchase agreement template form

Find out other Schedule D 1 Form 1041 Irs

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy