Form Apl 002 2017

What is the Form Apl 002

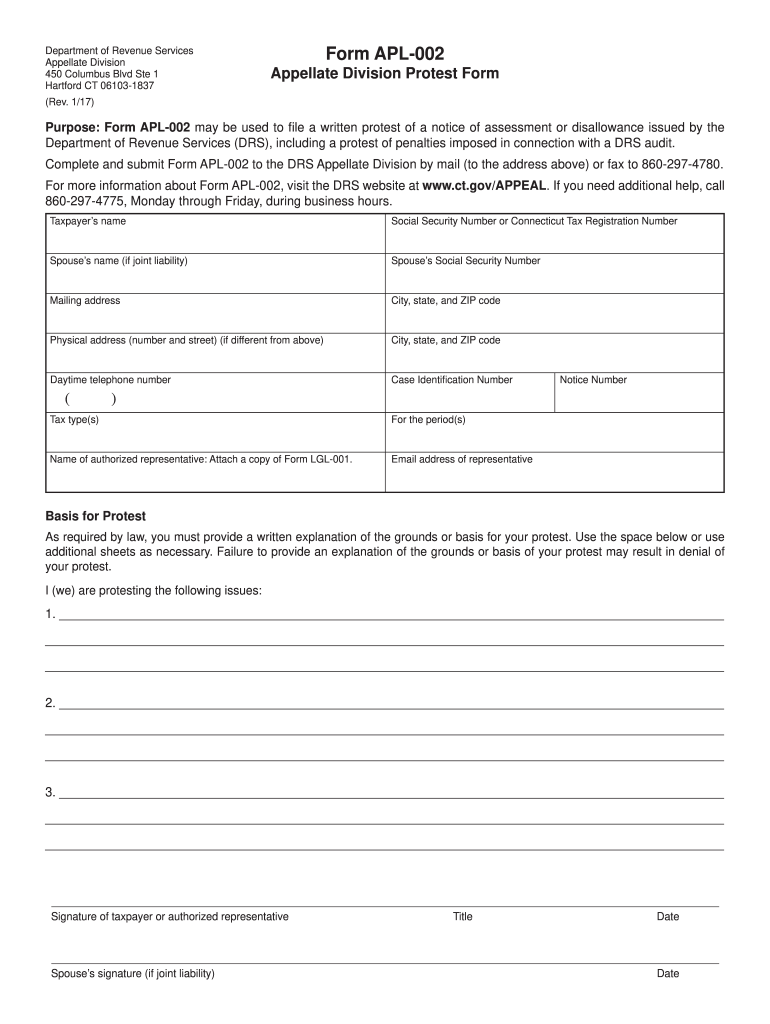

The Form Apl 002 is a specific document used for various administrative purposes, often related to tax reporting or applications. This form is designed to collect essential information from individuals or businesses to ensure compliance with relevant regulations. By providing a structured format, it facilitates the submission of necessary details to the appropriate authorities.

How to use the Form Apl 002

Using the Form Apl 002 involves several straightforward steps. First, ensure that you have the correct version of the form, as outdated versions may not be accepted. Next, fill in the required fields with accurate information. It is crucial to review the form for any errors before submission. Once completed, you can submit the form electronically or via traditional mail, depending on the specific requirements outlined for this document.

Steps to complete the Form Apl 002

Completing the Form Apl 002 requires careful attention to detail. Follow these steps:

- Download the latest version of the form from a trusted source.

- Read the instructions carefully to understand the information required.

- Fill in your personal or business information as needed.

- Double-check all entries for accuracy and completeness.

- Sign the form electronically or by hand, as required.

- Submit the form according to the specified submission methods.

Legal use of the Form Apl 002

The Form Apl 002 is legally binding when completed and submitted according to the guidelines provided by the issuing authority. It is important to ensure that the information provided is truthful and accurate, as any discrepancies could lead to penalties or legal issues. Understanding the legal implications of the form can help individuals and businesses avoid potential pitfalls.

Filing Deadlines / Important Dates

Filing deadlines for the Form Apl 002 can vary based on the specific purpose of the form. It is essential to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or delays in processing. Always check for the most current deadlines to stay compliant.

Form Submission Methods (Online / Mail / In-Person)

The Form Apl 002 can typically be submitted through various methods. These may include:

- Online submission via an official portal or eSignature platform.

- Mailing the completed form to the designated address.

- In-person submission at a local office, if applicable.

Choosing the right submission method can enhance the efficiency of the process and ensure that the form reaches the appropriate authority without delay.

Quick guide on how to complete form apl 002 2017

Your assistance manual on how to set up your Form Apl 002

If you’re seeking to understand how to generate and dispatch your Form Apl 002, below are a few concise instructions on how to simplify tax submission.

Firstly, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and revert to amend responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form Apl 002 in a matter of minutes:

- Establish your account and commence working on PDFs swiftly.

- Utilize our catalog to obtain any IRS tax form; browse various versions and schedules.

- Click Obtain form to open your Form Apl 002 in our editor.

- Fill in the mandatory fields with your details (text, numbers, checkmarks).

- Use the Signature Tool to add your legally-recognized eSignature (if necessary).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper can increase return errors and delay refunds. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form apl 002 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the form apl 002 2017

How to make an electronic signature for the Form Apl 002 2017 online

How to generate an eSignature for the Form Apl 002 2017 in Google Chrome

How to create an electronic signature for putting it on the Form Apl 002 2017 in Gmail

How to create an electronic signature for the Form Apl 002 2017 from your smartphone

How to generate an eSignature for the Form Apl 002 2017 on iOS devices

How to make an electronic signature for the Form Apl 002 2017 on Android

People also ask

-

What is Form Apl 002 in airSlate SignNow?

Form Apl 002 is a customizable document template available in airSlate SignNow that streamlines the process of collecting signatures and important information. This form helps businesses efficiently manage their document workflows while ensuring compliance and security.

-

How much does it cost to use Form Apl 002 with airSlate SignNow?

Using Form Apl 002 with airSlate SignNow is part of our subscription plans, which are designed to be cost-effective for businesses of any size. We offer various pricing tiers, so you can choose the one that best fits your needs while utilizing the powerful features of Form Apl 002.

-

What features does Form Apl 002 offer?

Form Apl 002 comes with features such as easy document customization, electronic signature capabilities, and automated workflows. These functionalities ensure that your document management is not only efficient but also user-friendly, making it ideal for any business.

-

How can Form Apl 002 benefit my business?

By using Form Apl 002 in airSlate SignNow, your business can signNowly reduce the time spent on paperwork and enhance the speed of signature collection. This leads to faster transactions, improved client satisfaction, and a more streamlined workflow overall.

-

Can I integrate Form Apl 002 with other software?

Yes, Form Apl 002 seamlessly integrates with various software applications, including CRM systems and cloud storage solutions. This flexibility allows you to incorporate it into your existing tech stack, enhancing overall productivity.

-

Is Form Apl 002 secure for sensitive documents?

Absolutely, airSlate SignNow takes security seriously. Form Apl 002 is designed to comply with industry standards, ensuring that your sensitive documents are protected with encryption and secure access controls.

-

What types of businesses can benefit from using Form Apl 002?

Form Apl 002 is versatile and can benefit a wide range of businesses, from small startups to large enterprises. Any organization that requires efficient document management and electronic signatures will find value in this powerful tool.

Get more for Form Apl 002

Find out other Form Apl 002

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF