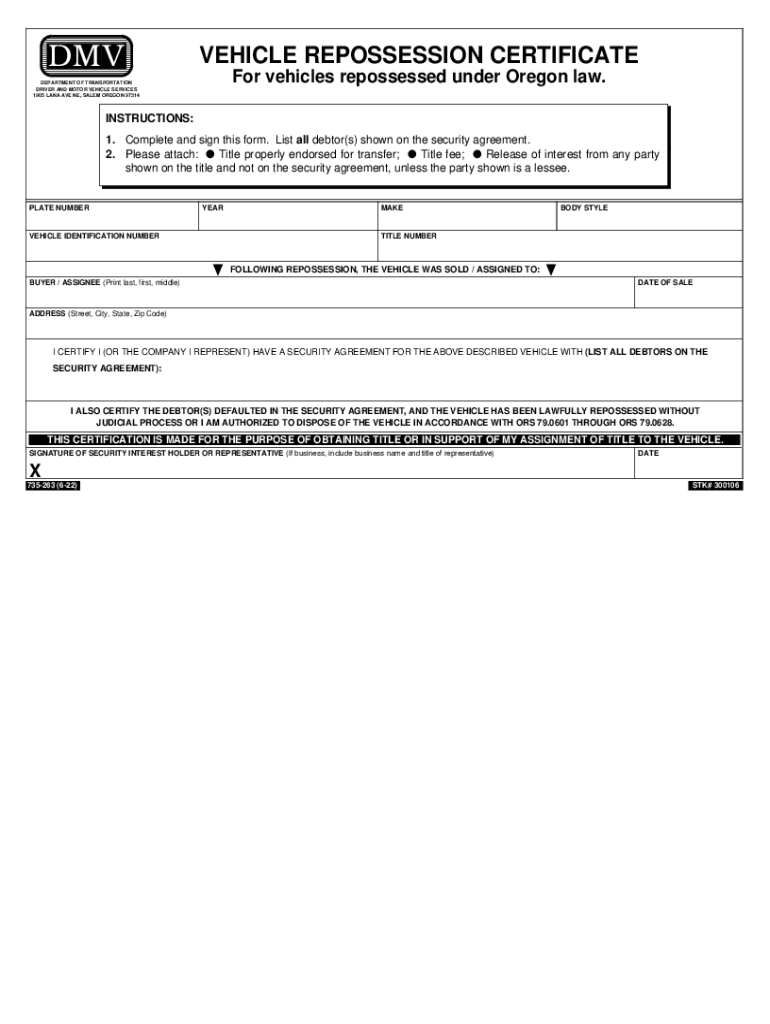

VEHICLE REPOSSESSION CERTIFICATE Form

What is the vehicle repossession certificate?

The vehicle repossession certificate is a legal document that serves as proof of the repossession of a vehicle. This certificate is essential for lenders and repossession agents to confirm that the vehicle has been legally taken back due to non-payment or breach of contract. In Oregon, the repossession certificate must include specific details such as the vehicle identification number (VIN), the name of the borrower, and the date of repossession. This document is crucial for both the lender and the borrower, as it outlines the terms under which the vehicle was repossessed and can be used in any subsequent legal proceedings.

Steps to complete the vehicle repossession certificate

Completing the vehicle repossession certificate involves several important steps to ensure that the document is accurate and legally binding. First, gather all necessary information, including the borrower’s details, vehicle information, and the reason for repossession. Next, fill out the certificate form, ensuring that all sections are completed accurately. It is important to double-check the details, as errors can lead to complications later on. Once the form is filled out, both the repossession agent and the borrower should sign the document to validate it. Finally, make copies of the completed certificate for your records and for the borrower, as this will serve as proof of the transaction.

Legal use of the vehicle repossession certificate

The vehicle repossession certificate has specific legal uses that are vital for both lenders and borrowers. It acts as a formal record of the repossession process, which can be important in case of disputes. In Oregon, the repossession certificate must comply with state laws to be considered valid. This includes adhering to the requirements set forth by the Uniform Commercial Code (UCC) and other relevant regulations. The certificate can also be used in court if the borrower contests the repossession or if there are claims regarding the condition of the vehicle at the time of repossession. Understanding the legal implications of this document is crucial for all parties involved.

Key elements of the vehicle repossession certificate

Several key elements must be included in the vehicle repossession certificate to ensure its validity. These elements typically include:

- Borrower Information: Full name and address of the borrower.

- Vehicle Details: Make, model, year, and VIN of the vehicle being repossessed.

- Date of Repossession: The exact date when the vehicle was taken back.

- Reason for Repossession: A clear explanation of why the vehicle was repossessed, such as non-payment.

- Signatures: Signatures of both the repossession agent and the borrower, confirming the transaction.

Including these elements ensures that the certificate meets legal standards and can be used effectively in any necessary legal proceedings.

How to obtain the vehicle repossession certificate

Obtaining the vehicle repossession certificate in Oregon involves a straightforward process. Typically, the lender or repossession agency will provide the certificate upon repossession of the vehicle. It is advisable to request this certificate immediately after the repossession occurs to ensure that all parties have the necessary documentation. If the lender does not provide the certificate, the borrower may need to contact them directly to obtain it. In some cases, repossession agencies may also have their own forms that can be used to create the certificate, which should be filled out according to state regulations.

State-specific rules for the vehicle repossession certificate

In Oregon, specific rules govern the use and completion of the vehicle repossession certificate. These rules are designed to protect the rights of both lenders and borrowers. For instance, the repossession must be conducted in compliance with state laws, which include providing proper notice to the borrower before repossession. Additionally, the repossession certificate must be filed with the appropriate state agency if required. Understanding these state-specific regulations is essential for ensuring that the repossession process is legally sound and that the certificate holds up in any potential legal disputes.

Quick guide on how to complete vehicle repossession certificate

Accomplish VEHICLE REPOSSESSION CERTIFICATE effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with everything required to create, modify, and eSign your documents swiftly without interruptions. Manage VEHICLE REPOSSESSION CERTIFICATE on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign VEHICLE REPOSSESSION CERTIFICATE with ease

- Locate VEHICLE REPOSSESSION CERTIFICATE and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Revise and eSign VEHICLE REPOSSESSION CERTIFICATE to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vehicle repossession certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for repossessing a car in Oregon?

The process for repossessing a car in Oregon involves the lender providing notice to the borrower, after which they can reclaim the vehicle. It is essential to follow state laws to avoid potential legal issues when repossessing a car in Oregon. Lenders should carefully document each step to protect their interests.

-

How can airSlate SignNow help with repossessing a car in Oregon?

airSlate SignNow can streamline the documentation process involved in repossessing a car in Oregon. By allowing for quick and secure electronic signatures on necessary documents, airSlate SignNow saves time and ensures compliance with legal requirements. This can greatly enhance the efficiency of your repossession operations.

-

Are there any costs associated with repossessing a car in Oregon?

Yes, costs associated with repossessing a car in Oregon can include towing fees, storage costs, and legal fees if applicable. Additionally, using services like airSlate SignNow may have associated subscription or per-document fees. It’s important to budget for these expenses when planning the repossession process.

-

What features does airSlate SignNow offer for repossession documentation?

airSlate SignNow offers features such as template creation, secure document storage, and tracking of document status, which are vital for repossessing a car in Oregon. Additionally, users can set reminders for follow-ups and ensure all parties stay informed throughout the process. These features help keep everything organized and efficient.

-

Is airSlate SignNow compliant with Oregon laws for repossession?

Yes, airSlate SignNow is designed to comply with various state laws, including those governing repossessing a car in Oregon. The platform prioritizes legal compliance by allowing users to create and store signed documents securely. Always consult legal counsel to ensure full compliance with local regulations.

-

Can multiple team members access airSlate SignNow for car repossessions?

Absolutely! airSlate SignNow allows multiple team members to collaborate on documents related to repossessing a car in Oregon. This collaborative feature enables real-time updates and sharing of important information, ensuring everyone involved is on the same page throughout the repossession process.

-

What are the benefits of using airSlate SignNow for repossession?

Using airSlate SignNow for repossessing a car in Oregon offers signNow benefits, including faster processing times and reduced paper usage. The platform's ease of use and electronic signature capabilities simplify the document handling process, allowing lenders to focus on their core operations. This not only saves time but also enhances customer satisfaction.

Get more for VEHICLE REPOSSESSION CERTIFICATE

Find out other VEHICLE REPOSSESSION CERTIFICATE

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free