Same Day Taxpayer Worksheet Form

What is the Same Day Taxpayer Worksheet

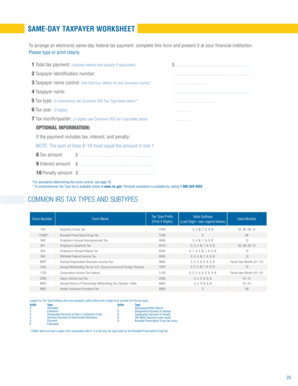

The Same Day Taxpayer Worksheet is a specific form used by taxpayers in the United States to facilitate the completion of their tax obligations on the same day. This worksheet simplifies the process by providing a structured format for gathering necessary information, ensuring that all relevant details are collected efficiently. It is particularly useful for individuals who need to file their taxes promptly, allowing them to organize their financial data and calculations in one place.

How to use the Same Day Taxpayer Worksheet

Using the Same Day Taxpayer Worksheet involves several straightforward steps. First, gather all relevant financial documents, such as W-2s, 1099s, and any other income statements. Next, fill in the worksheet with your personal information, including your name, address, and Social Security number. Then, input your income details and any deductions or credits you may qualify for. Once completed, review the worksheet for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Same Day Taxpayer Worksheet

Completing the Same Day Taxpayer Worksheet can be broken down into a series of clear steps:

- Collect all necessary financial documents.

- Enter your personal information accurately.

- Detail your income sources and amounts.

- List any deductions or credits applicable to your situation.

- Double-check all entries for errors or omissions.

- Submit the completed worksheet to the relevant tax agency.

Legal use of the Same Day Taxpayer Worksheet

The Same Day Taxpayer Worksheet is legally recognized as a valid document for tax filing purposes in the United States. When completed accurately and submitted on time, it serves as an official record of your tax information. It is essential to ensure that all details are correct and that the worksheet complies with IRS regulations to avoid any legal issues or penalties.

Filing Deadlines / Important Dates

Timely submission of the Same Day Taxpayer Worksheet is crucial. Generally, tax returns are due on April fifteenth each year, but specific deadlines may vary based on individual circumstances. It is advisable to check for any updates or changes in filing deadlines each tax year to ensure compliance and avoid late fees.

Required Documents

To complete the Same Day Taxpayer Worksheet effectively, you will need several key documents, including:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as receipts or tax statements.

- Previous year’s tax return for reference.

Examples of using the Same Day Taxpayer Worksheet

The Same Day Taxpayer Worksheet can be utilized in various scenarios. For instance, a self-employed individual may use it to compile income from multiple clients, while a student may use it to report part-time job earnings. Additionally, families can benefit from the worksheet to organize their tax credits, such as the Child Tax Credit, ensuring they maximize their potential refunds.

Quick guide on how to complete same day taxpayer worksheet 100515003

Prepare Same Day Taxpayer Worksheet effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Same Day Taxpayer Worksheet on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Same Day Taxpayer Worksheet effortlessly

- Find Same Day Taxpayer Worksheet and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Same Day Taxpayer Worksheet to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the same day taxpayer worksheet 100515003

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the same day taxpayer worksheet?

The same day taxpayer worksheet is a streamlined tool designed to help individuals and businesses quickly gather their financial information for tax preparation. By organizing necessary data in one place, it simplifies the process, making it easier to complete your taxes efficiently.

-

How does the same day taxpayer worksheet integrate with airSlate SignNow?

The same day taxpayer worksheet seamlessly integrates with airSlate SignNow, allowing you to easily eSign and send your completed tax documents. This integration ensures that your data remains secure while providing a convenient way for users to handle their tax submissions.

-

What are the benefits of using the same day taxpayer worksheet?

Using the same day taxpayer worksheet offers numerous benefits, including time savings and reduced stress during tax season. It helps you stay organized and ensures that you have all necessary documents ready for a smooth filing process.

-

Is there a cost associated with the same day taxpayer worksheet?

The same day taxpayer worksheet is part of the affordable offerings from airSlate SignNow, ensuring that you get cost-effective solutions for your document needs. Pricing details can be found on the airSlate SignNow website, where various plans cater to individual and business users.

-

Can I access the same day taxpayer worksheet on mobile devices?

Yes, the same day taxpayer worksheet is mobile-friendly, allowing users to access and complete their worksheets on smartphones or tablets. This flexibility ensures you can work on your taxes anytime and anywhere, making the process even easier.

-

What features does the same day taxpayer worksheet offer?

The same day taxpayer worksheet includes features like auto-saving, easy collaboration with tax professionals, and secure eSigning through airSlate SignNow. These functionalities streamline the tax preparation process, helping to ensure a hassle-free experience.

-

How can I get started with the same day taxpayer worksheet?

Getting started with the same day taxpayer worksheet is simple. You can sign up for an airSlate SignNow account and access the worksheet from your dashboard, where you can fill it out at your convenience and securely manage your tax documents.

Get more for Same Day Taxpayer Worksheet

Find out other Same Day Taxpayer Worksheet

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online