Fax6099845210 2014-2026

Understanding the W-9 Form in New Jersey

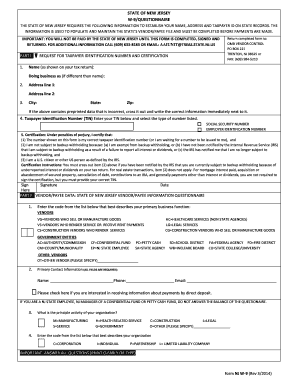

The W-9 form is a crucial document for individuals and businesses in New Jersey, primarily used to provide taxpayer identification information to entities that are required to file information returns with the IRS. This form is necessary for freelancers, contractors, and other self-employed individuals who receive payments for services rendered. By completing the W-9, you ensure that the correct tax information is reported, which helps avoid potential issues with the IRS.

Steps to Complete the W-9 Form in New Jersey

Filling out the W-9 form is straightforward. Here are the steps to ensure accurate completion:

- Provide your name: Enter your full legal name as it appears on your tax return.

- Business name (if applicable): If you operate under a different business name, include it here.

- Check the appropriate box: Indicate whether you are an individual, corporation, partnership, etc.

- Enter your address: Provide your mailing address, including city, state, and ZIP code.

- Taxpayer Identification Number (TIN): Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

- Signature and date: Sign and date the form to certify that the information provided is correct.

Legal Use of the W-9 Form in New Jersey

The W-9 form serves as a declaration of your taxpayer status and is legally binding once signed. It is essential for ensuring compliance with federal tax regulations. When you submit a W-9, you authorize the requester to use the information provided for tax reporting purposes. This form is often required by businesses or individuals who need to report payments made to you, such as for freelance work or contract services.

IRS Guidelines for the W-9 Form

The IRS provides specific guidelines on how to complete and submit the W-9 form. It is important to follow these instructions carefully to avoid delays or issues with tax reporting. The IRS recommends that you provide accurate information to ensure that the requester can complete their tax filings correctly. Additionally, the IRS may require you to update your W-9 form if your information changes, such as a change in your business name or tax identification number.

Form Submission Methods for the W-9 in New Jersey

Once you have completed the W-9 form, you can submit it in several ways, depending on the requester's preferences:

- Online submission: Many businesses allow you to submit the W-9 electronically through secure portals.

- Email: You may be able to send a scanned copy of the signed W-9 via email.

- Mail: Alternatively, you can print the form and mail it to the requester at their designated address.

Common Scenarios for Using the W-9 Form in New Jersey

The W-9 form is commonly used in various scenarios, including:

- Freelancers: Individuals providing services to clients need to submit a W-9 to ensure proper tax reporting.

- Contractors: Businesses hiring independent contractors require a W-9 for tax purposes.

- Real estate transactions: The W-9 may be requested during property sales or leases.

Quick guide on how to complete fax6099845210

Complete Fax6099845210 effortlessly on any gadget

Web-based document management has gained signNow traction with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without hold-ups. Manage Fax6099845210 on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to alter and eSign Fax6099845210 without difficulty

- Find Fax6099845210 and then click Get Form to commence.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to distribute your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Fax6099845210 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fax6099845210

Create this form in 5 minutes!

How to create an eSignature for the fax6099845210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the W9 form in New Jersey?

The W9 form in New Jersey is used by businesses to request the Taxpayer Identification Number (TIN) of vendors and contractors. This form is crucial for tax reporting purposes, ensuring accurate information is submitted to the IRS. By utilizing airSlate SignNow, businesses can easily manage and eSign W9 forms, streamlining their accounting processes.

-

How does airSlate SignNow help with W9 forms in New Jersey?

airSlate SignNow offers a simple and cost-effective solution for managing W9 forms in New Jersey. It allows users to send, sign, and store W9 documents securely online. This improves efficiency, reduces the risk of errors, and provides a seamless experience for both businesses and contractors.

-

Can I integrate airSlate SignNow with my accounting software for W9 management in New Jersey?

Yes, airSlate SignNow can be easily integrated with various accounting software programs popular in New Jersey. This integration allows businesses to automatically sync W9 data, simplifying recordkeeping and ensuring compliance. Utilizing these integrations can signNowly enhance your workflow efficiency.

-

What are the pricing options for using airSlate SignNow for W9 forms in New Jersey?

airSlate SignNow offers various pricing plans that cater to different business needs, whether you are a small business or a large enterprise in New Jersey. Each plan includes access to features that streamline the signing and management of W9 forms. You can choose a plan that best fits your budget and requirements.

-

Is airSlate SignNow compliant with New Jersey state regulations for W9 forms?

Yes, airSlate SignNow is designed to comply with applicable New Jersey state regulations regarding electronic signatures and W9 forms. The platform adheres to 21 CFR Part 11, ensuring that your signed W9 documents are legally binding. This compliance provides peace of mind for businesses operating in New Jersey.

-

What benefits does airSlate SignNow offer for employees submitting W9 forms in New Jersey?

Employees in New Jersey benefit greatly from using airSlate SignNow for submitting W9 forms. The platform allows for quick and secure submission of documents, reducing the turnaround time for obtaining necessary approvals. This ease of use promotes a smoother onboarding process for contractors and freelancers.

-

How secure is airSlate SignNow when handling W9 forms in New Jersey?

airSlate SignNow prioritizes security, using industry-standard encryption to protect W9 forms in New Jersey. Your documents are stored securely, and access is controlled to ensure that only authorized individuals can view or modify the information. This level of security gives businesses confidence in their document management practices.

Get more for Fax6099845210

- Soben claim form 51903479

- Transcript request form muskegon community college muskegoncc

- Altitude trampoline park waiver pdf form

- Pam 1 00 pa personnel management philippine army form

- Prolastin enrollment form

- Dhf horse boarding contract this agreement made and form

- Fillable online net minimum tax on exclusion items fax form

- Case study borough of dormont stormwater authority form

Find out other Fax6099845210

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer