Local Business Tax Receipt Lee Form

What is the Local Business Tax Receipt Lee?

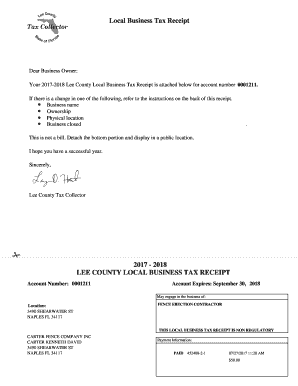

The Local Business Tax Receipt Lee is a legal document issued by Lee County that allows businesses to operate within the jurisdiction. This receipt is essential for compliance with local regulations and signifies that a business has met the necessary requirements to conduct its operations legally. It is commonly required for various business types, including retail, service, and food establishments. Obtaining this receipt is a crucial step for entrepreneurs and business owners to ensure they are adhering to local laws and regulations.

How to Obtain the Local Business Tax Receipt Lee

To obtain the Local Business Tax Receipt Lee, businesses must follow a specific process. First, applicants need to gather necessary documentation, which may include proof of identity, business registration, and any relevant licenses. Next, they should visit the Lee County Tax Collector's office or its official website to access the application form. After completing the form, applicants can submit it along with the required documents and payment. It's important to check for any specific local requirements that may apply to different types of businesses.

Steps to Complete the Local Business Tax Receipt Lee

Completing the Local Business Tax Receipt Lee involves several key steps:

- Gather necessary documentation, including identification and business registration.

- Access the application form from the Lee County Tax Collector's office or website.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application along with required documents and payment, either online or in person.

- Await confirmation of receipt and any further instructions from the county office.

Legal Use of the Local Business Tax Receipt Lee

The Local Business Tax Receipt Lee serves as a legal authorization for businesses to operate within Lee County. It is important for business owners to understand that this receipt must be renewed periodically, as specified by local regulations. Failure to maintain a valid receipt can result in penalties, including fines or the suspension of business operations. Therefore, it is crucial to keep track of renewal dates and ensure compliance with all local laws.

Key Elements of the Local Business Tax Receipt Lee

The Local Business Tax Receipt Lee contains several key elements that are essential for its validity:

- Business Name: The official name under which the business operates.

- Business Address: The physical location of the business.

- Owner Information: Details about the business owner or responsible party.

- Issue Date: The date the receipt was issued, indicating the start of legal operation.

- Expiration Date: The date by which the receipt must be renewed.

Form Submission Methods

Businesses can submit their Local Business Tax Receipt Lee application through various methods:

- Online: Many counties offer online submission through their official websites, allowing for a convenient application process.

- Mail: Applications can often be mailed to the appropriate county office, ensuring all documents are included.

- In-Person: Applicants may also visit the local Tax Collector's office to submit their application directly and receive immediate assistance.

Quick guide on how to complete local business tax receipt lee

Complete Local Business Tax Receipt Lee effortlessly on any device

Web-based document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Local Business Tax Receipt Lee on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to amend and eSign Local Business Tax Receipt Lee with ease

- Obtain Local Business Tax Receipt Lee and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, be it via email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns over missing or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and eSign Local Business Tax Receipt Lee to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the local business tax receipt lee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Lee County business tax receipt?

A Lee County business tax receipt is a document issued by the local government that permits individuals or entities to operate a business within Lee County. It typically includes important details like the business name, address, and nature of business activities, ensuring compliance with local regulations.

-

How do I obtain a Lee County business tax receipt?

To obtain a Lee County business tax receipt, you must complete the necessary application process through the Lee County tax collector's office. This process often includes providing relevant business information and, in some cases, paying a fee. Utilizing airSlate SignNow can streamline this application process by allowing you to fill out and eSign the required documents easily.

-

What are the benefits of having a Lee County business tax receipt?

Having a Lee County business tax receipt is essential for legal compliance and helps to establish your business's legitimacy in the local community. It can also enhance your credibility when seeking partnerships or customer trust. Additionally, it may be necessary for applying for loans or securing permits.

-

Is there a fee for a Lee County business tax receipt?

Yes, there is usually a fee associated with obtaining a Lee County business tax receipt, and the amount may vary based on the type of business and its location. It's advisable to check with the Lee County tax collector’s office for specific fees. Additionally, using airSlate SignNow can help you manage your budget effectively by streamlining the application process.

-

How often do I need to renew my Lee County business tax receipt?

A Lee County business tax receipt typically requires annual renewal to ensure that your business continues to operate legally within the county. It's important to keep track of renewal dates to avoid potential penalties or disruptions. With airSlate SignNow, you can set reminders and manage your business documents effortlessly.

-

Can I apply for a Lee County business tax receipt online?

Yes, many services now allow you to apply for a Lee County business tax receipt online, simplifying the process. By using airSlate SignNow, you can easily fill out the necessary forms and eSign them from the comfort of your own home, making the application process quicker and more efficient.

-

What if I have questions about my Lee County business tax receipt application?

If you have questions about your Lee County business tax receipt application, it's best to contact the Lee County tax collector’s office directly. They can provide guidance and clarification on any issues you may be encountering. Additionally, airSlate SignNow’s customer support can assist you in navigating through document-related queries.

Get more for Local Business Tax Receipt Lee

Find out other Local Business Tax Receipt Lee

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed