8888 Online 2022

What is the 8888 Online

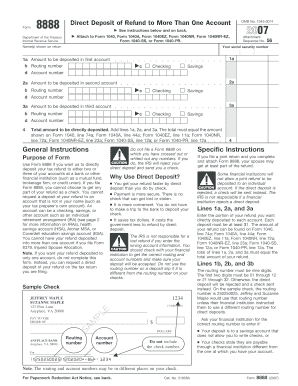

The 8888 Online refers to IRS Form 8888, which allows taxpayers to direct their tax refund into multiple accounts. This form is particularly useful for individuals who wish to allocate their refund among different savings or checking accounts. By using Form 8888, taxpayers can split their refund into up to three different accounts, making it easier to manage finances and save for specific goals.

How to complete the 8888 Online

Completing the 8888 Online is a straightforward process. First, ensure you have your tax return information ready. Then, access the form through the IRS website or a trusted tax software that supports e-filing. Fill out the required fields, including your personal information and the bank account details where you want your refund directed. Double-check all entries for accuracy to avoid delays. Once completed, you can e-file your tax return along with Form 8888, or print and mail it if you prefer a paper submission.

IRS Guidelines for Form 8888

The IRS provides specific guidelines for using Form 8888. It is essential to ensure that the accounts you designate for your refund are in your name or your spouse's name if filing jointly. The form cannot be used to direct deposits into accounts that are not owned by the taxpayer. Additionally, the IRS advises that if you are filing a joint return, both spouses must sign the return for the form to be valid. Familiarizing yourself with these guidelines can help prevent issues with your refund allocation.

Filing Deadlines / Important Dates

Understanding the filing deadlines for IRS Form 8888 is crucial for timely processing of your tax return. Generally, the deadline for filing your federal tax return is April fifteenth each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to file your return, including Form 8888, by this deadline to avoid penalties and ensure that your refund is processed promptly.

Form Submission Methods (Online / Mail / In-Person)

IRS Form 8888 can be submitted through various methods. The most efficient way is to e-file your tax return using tax software that supports the form. This method allows for quicker processing and direct deposit of your refund. Alternatively, you can print the completed form and mail it along with your tax return. If you prefer to file in person, you can visit a local IRS office, but appointments may be required. Each submission method has its advantages, so choose the one that best fits your needs.

Legal use of the 8888 Online

Using Form 8888 is legal and compliant with IRS regulations, provided you follow the guidelines set forth by the agency. The form is designed to facilitate the allocation of tax refunds and is recognized as a legitimate means of managing your finances. To ensure legal compliance, it is essential to complete the form accurately and submit it in conjunction with your tax return. Misuse of the form or providing incorrect information can lead to delays or issues with your refund.

Quick guide on how to complete 8888 online

Easily prepare 8888 Online on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right forms and securely store them online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 8888 Online on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to modify and electronically sign 8888 Online effortlessly

- Locate 8888 Online and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign 8888 Online to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8888 online

Create this form in 5 minutes!

How to create an eSignature for the 8888 online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS fax number for Form 8888?

The IRS fax number for Form 8888 is specifically designated for submitting requests for direct deposit of your tax refund. It's important to ensure that you have the correct fax number to avoid delays in processing. For the most current fax number, refer to the official IRS website or the specific form instructions.

-

How do I use SignNow to send IRS Form 8888?

Using SignNow to send IRS Form 8888 is straightforward. After completing the form, you can upload it to our platform and send it directly to the IRS's fax number for Form 8888. Our service ensures that your documents are securely transmitted and comply with IRS requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a range of features for managing tax documents, including eSigning, automated workflows, and document templates. You can easily prepare and send important tax documents like Form 8888 while ensuring legal compliance. Our platform helps streamline the entire process, making tax season less stressful.

-

Is there a cost associated with sending documents to the IRS fax number for Form 8888?

Yes, while using airSlate SignNow, there may be subscription fees for accessing premium features. However, sending documents like IRS Form 8888 to the designated fax number is included in your plan. Check our pricing page for detailed information on our various subscription tiers.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software tools, allowing you to manage documents related to IRS Form 8888 and other tax filings. This integration streamlines your workflow, ensuring that you can send and sign documents without switching platforms.

-

What security measures does SignNow implement for IRS tax documents?

airSlate SignNow prioritizes security, employing multiple layers of protection for your documents. When sending IRS Form 8888 to the fax number, your data remains encrypted, ensuring confidentiality and compliance with regulations. Our system also logs activities for added security and transparency.

-

How can I track the status of my submission after faxing Form 8888?

While you cannot track your submission directly through the IRS, airSlate SignNow provides confirmation notifications once your document is successfully sent. You will receive an email confirmation that verifies your submission of IRS Form 8888 to the correct fax number, ensuring peace of mind.

Get more for 8888 Online

- K 120 2019 kansas corporate income tax return rev 7 19 corporate tax form

- Abc forms kansas department of revenue

- High performance incentive program kansas department of

- Visio verification of deposit form

- Gross premiums report foreign casualty or foreign fire insurance companies rct 121c print only version form

- Filing taxes on artist commissions turbotax support get help form

- 2018 pa schedule fg multiple owner or lessor prorationsincome annualization pa 1000 fg formspublications

- 2019 m1w minnesota income tax withheld form

Find out other 8888 Online

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple