Omb No 1660 0008 Form

What is the OMB No ?

The OMB No is a form issued by the Federal Emergency Management Agency (FEMA) that collects information necessary for disaster assistance programs. This form is part of the federal government's effort to streamline the process of providing aid to individuals and communities affected by disasters. It is essential for applicants seeking assistance to understand the purpose and requirements of this form to ensure compliance and successful submission.

How to use the OMB No

Using the OMB No involves filling out the required sections accurately to provide necessary information regarding your disaster assistance needs. Applicants should carefully read the instructions provided with the form to understand what information is needed. This may include personal identification details, information about the disaster, and specifics about the assistance being requested. Utilizing a digital platform like signNow can simplify this process, allowing users to fill out and eSign the form securely.

Steps to complete the OMB No

Completing the OMB No involves several key steps:

- Gather all necessary documentation, including identification and any relevant disaster-related information.

- Access the form online or obtain a physical copy.

- Carefully fill out each section of the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mail, following the guidelines provided.

Legal use of the OMB No

The OMB No must be used in accordance with federal regulations governing disaster assistance. This includes ensuring that all information provided is truthful and accurate. Misrepresentation or failure to comply with the requirements can result in penalties or denial of assistance. Understanding the legal implications of this form is crucial for applicants to avoid potential issues during the application process.

Key elements of the OMB No

Key elements of the OMB No include:

- Personal identification information, such as name, address, and contact details.

- Details regarding the disaster event, including dates and types of assistance needed.

- Signature section to confirm the authenticity of the information provided.

- Instructions for submission and any required supporting documentation.

Form Submission Methods

Applicants can submit the OMB No through various methods, including:

- Online submission through FEMA's designated portal.

- Mailing a physical copy to the appropriate FEMA address.

- In-person submission at designated FEMA offices, if applicable.

Examples of using the OMB No

Examples of using the OMB No include individuals applying for assistance after natural disasters such as hurricanes, floods, or wildfires. In these scenarios, the form serves as a critical tool for documenting the need for federal aid, allowing applicants to detail their circumstances and request specific types of assistance, such as housing support or financial aid for repairs.

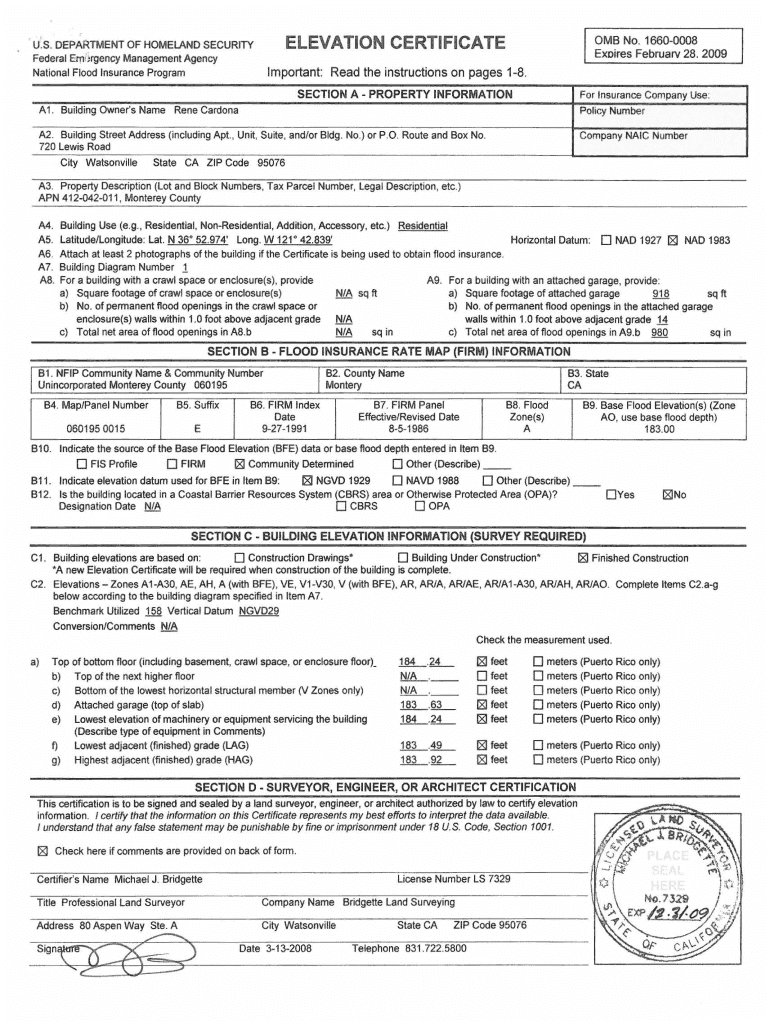

Quick guide on how to complete us elevation certificate omb no 1660 0008

Complete Omb No 1660 0008 seamlessly on any gadget

Digital document management has gained traction with organizations and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and eSign your documents swiftly without delays. Manage Omb No 1660 0008 on any gadget using airSlate SignNow Android or iOS applications and simplify any document-based procedure today.

How to alter and eSign Omb No 1660 0008 effortlessly

- Locate Omb No 1660 0008 and then click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Omb No 1660 0008 and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I take my child (16yrs) to the U.S if my immigrant visa is approved? My husband, a US citizen, filled out form I 130 for me and mentioned this child as migrating in future.

Just petition using a I-130 yourself. Read the instructions very carefully. I am not sure but it’s possible that the affidavit of support will need to be filled by your husband since he is the citizen and he filled one for you - again, check the instructions very carefully. It should be a pretty clear, straightforward process.Your child is still well below the age limit and should be fine. If there are any problems, do the same thing you did with your own process - use the numbers you are given to check on the process and if you see it stuck call to make sure they have everything they need early.It is my understanding that the age limit of the child is based on the petition date, so go ahead and do it.You still have plenty of time at 16, just don’t delay.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the us elevation certificate omb no 1660 0008

How to generate an eSignature for the Us Elevation Certificate Omb No 1660 0008 in the online mode

How to make an eSignature for the Us Elevation Certificate Omb No 1660 0008 in Google Chrome

How to create an eSignature for putting it on the Us Elevation Certificate Omb No 1660 0008 in Gmail

How to create an eSignature for the Us Elevation Certificate Omb No 1660 0008 from your smart phone

How to generate an electronic signature for the Us Elevation Certificate Omb No 1660 0008 on iOS

How to generate an eSignature for the Us Elevation Certificate Omb No 1660 0008 on Android

People also ask

-

What is the significance of Omb No 1660 0008 in e-signatures?

Omb No 1660 0008 refers to the Office of Management and Budget's control number that is associated with electronic signatures in federal paperwork. Understanding Omb No 1660 0008 is crucial for businesses to ensure compliance with federal regulations when using e-signature solutions like airSlate SignNow.

-

How does airSlate SignNow comply with Omb No 1660 0008?

airSlate SignNow complies with Omb No 1660 0008 by providing a secure and legally binding e-signature platform that meets the required federal standards. Our solution ensures that all signed documents are encrypted and stored securely, making it a reliable choice for organizations that need to adhere to these regulations.

-

What are the pricing options for airSlate SignNow with respect to Omb No 1660 0008 compliance?

airSlate SignNow offers various pricing plans that cater to different business needs while ensuring compliance with Omb No 1660 0008. Each plan includes full access to features that support electronic signatures, making it a cost-effective choice for businesses of all sizes.

-

What features does airSlate SignNow offer that align with Omb No 1660 0008?

airSlate SignNow includes features such as secure document storage, user authentication, and audit trails, all of which align with Omb No 1660 0008 requirements. These features not only enhance security but also provide users with the tools they need to manage their e-signature processes effectively.

-

How can airSlate SignNow benefit my business while adhering to Omb No 1660 0008?

By using airSlate SignNow, businesses can streamline their document signing processes while remaining compliant with Omb No 1660 0008. This results in faster turnaround times and improved efficiency, allowing companies to focus on growth while ensuring legal compliance in their operations.

-

Can airSlate SignNow integrate with other systems while staying compliant with Omb No 1660 0008?

Yes, airSlate SignNow offers seamless integrations with various third-party applications while ensuring adherence to Omb No 1660 0008. This flexibility allows businesses to enhance their workflows without sacrificing compliance or functionality.

-

Is airSlate SignNow suitable for federal agencies considering Omb No 1660 0008?

Absolutely! airSlate SignNow is designed to cater to the needs of federal agencies, ensuring compliance with Omb No 1660 0008. Our platform provides the necessary tools and security features that federal organizations require for effective electronic signature management.

Get more for Omb No 1660 0008

Find out other Omb No 1660 0008

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple