Schedule R Form 941 Rev March 2024-2026

What is the Schedule R Form 941 Rev March

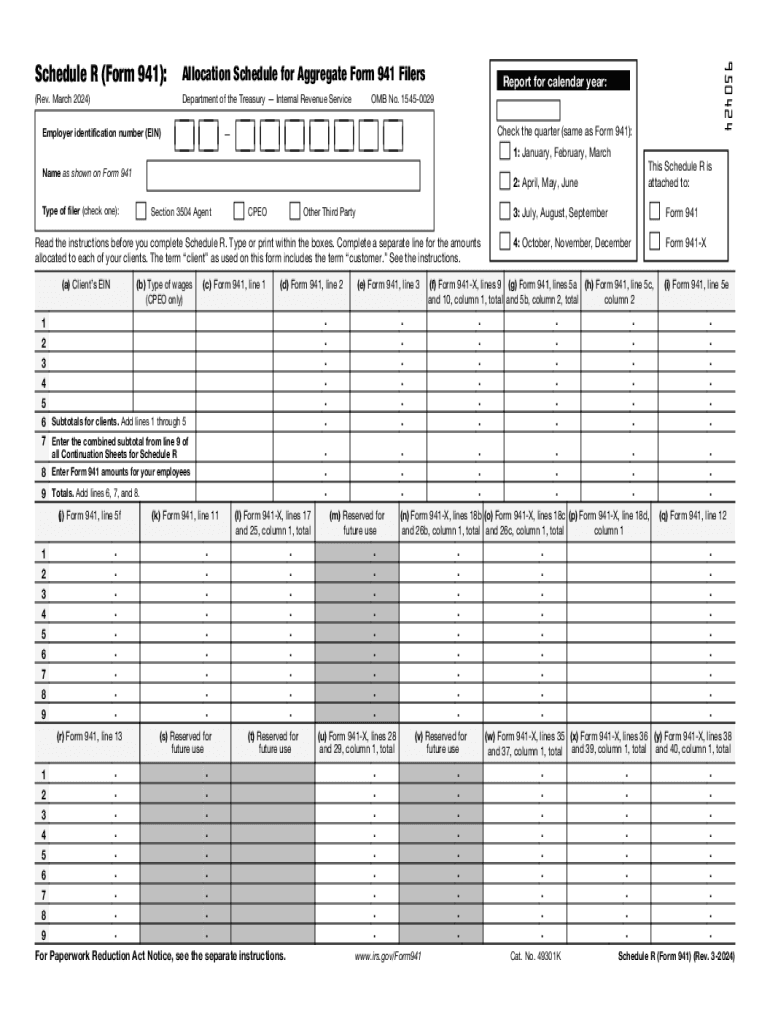

The Schedule R Form 941 Rev March is a supplementary form used by employers to report the allocation of tax credits for qualified sick and family leave wages under the Families First Coronavirus Response Act (FFCRA). This form is specifically designed to accompany the IRS Form 941, which is the Employer's Quarterly Federal Tax Return. The Schedule R allows employers to detail the amounts of qualified leave wages paid to employees and the corresponding tax credits they are claiming. This form is crucial for ensuring compliance with federal tax regulations and for accurately calculating the tax credits available to businesses.

How to use the Schedule R Form 941 Rev March

To effectively use the Schedule R Form 941 Rev March, employers must first complete the primary Form 941 for the relevant quarter. After filling out Form 941, employers will need to gather the necessary information regarding the qualified leave wages paid to employees. This includes the total amount of wages paid, the number of employees who took leave, and the specific periods during which the leave occurred. Once this information is collected, employers can accurately fill out Schedule R, ensuring that all relevant details are reported. The completed Schedule R should then be submitted alongside Form 941 to the IRS.

Steps to complete the Schedule R Form 941 Rev March

Completing the Schedule R Form 941 Rev March involves several key steps:

- Gather necessary information about qualified sick and family leave wages.

- Complete the IRS Form 941 for the applicable quarter.

- Fill in the Schedule R with details such as the total amount of qualified leave wages and the number of employees who took leave.

- Ensure all calculations are accurate, particularly the amounts for tax credits.

- Review the completed Schedule R for any errors or omissions.

- Submit the Schedule R along with Form 941 to the IRS by the required deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule R Form 941 Rev March align with the deadlines for Form 941. Generally, Form 941 must be filed quarterly, with the following deadlines:

- For the first quarter (January to March): April 30

- For the second quarter (April to June): July 31

- For the third quarter (July to September): October 31

- For the fourth quarter (October to December): January 31 of the following year

It is important for employers to file on time to avoid penalties and interest on any unpaid taxes.

Key elements of the Schedule R Form 941 Rev March

The Schedule R Form 941 Rev March includes several key elements that employers must complete:

- Employer Information: This section requires the employer's name, address, and Employer Identification Number (EIN).

- Qualified Leave Wages: Employers must report the total amount of qualified sick and family leave wages paid during the quarter.

- Tax Credit Calculation: This section details the calculation of the tax credits being claimed based on the wages reported.

- Employee Information: Employers may need to provide details about the employees who received qualified leave wages.

Legal use of the Schedule R Form 941 Rev March

The Schedule R Form 941 Rev March is legally mandated for employers who wish to claim tax credits under the FFCRA. Proper use of this form ensures compliance with IRS regulations and helps avoid potential legal issues related to tax reporting. Employers must accurately report all qualified leave wages and ensure that the information provided is truthful and complete. Failure to comply with these requirements may result in penalties, including fines and interest on unpaid taxes.

Quick guide on how to complete schedule r form 941 rev march

Complete Schedule R Form 941 Rev March effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Schedule R Form 941 Rev March on any device with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Schedule R Form 941 Rev March with ease

- Obtain Schedule R Form 941 Rev March and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Schedule R Form 941 Rev March and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule r form 941 rev march

Create this form in 5 minutes!

How to create an eSignature for the schedule r form 941 rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS R 941 form and why is it important?

The IRS R 941 form is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is crucial for compliance with federal tax regulations and helps businesses avoid penalties. Understanding how to properly fill out the IRS R 941 form is essential for maintaining accurate payroll records.

-

How can airSlate SignNow help with the IRS R 941 form?

airSlate SignNow provides a streamlined solution for electronically signing and sending the IRS R 941 form. With its user-friendly interface, businesses can easily manage their tax documents and ensure timely submissions. This not only saves time but also enhances accuracy in the filing process.

-

What are the pricing options for using airSlate SignNow for IRS R 941 form submissions?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic features or advanced functionalities for managing the IRS R 941 form, there is a plan that fits your budget. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need.

-

Are there any integrations available for managing the IRS R 941 form?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easier to manage the IRS R 941 form. These integrations allow for automatic data transfer, reducing the risk of errors and saving time. You can connect with popular platforms to streamline your tax filing process.

-

What features does airSlate SignNow offer for the IRS R 941 form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the IRS R 941 form. These tools enhance efficiency and ensure that your documents are signed and submitted on time. Additionally, you can access your documents from anywhere, making it convenient for busy professionals.

-

Can I store my IRS R 941 forms securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including the IRS R 941 form. This ensures that your sensitive information is protected and easily accessible whenever you need it. With robust security measures in place, you can have peace of mind knowing your documents are safe.

-

Is there customer support available for questions about the IRS R 941 form?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions regarding the IRS R 941 form. Whether you need help with the software or have specific inquiries about the form itself, our support team is ready to help. You can signNow out via chat, email, or phone for prompt assistance.

Get more for Schedule R Form 941 Rev March

Find out other Schedule R Form 941 Rev March

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors