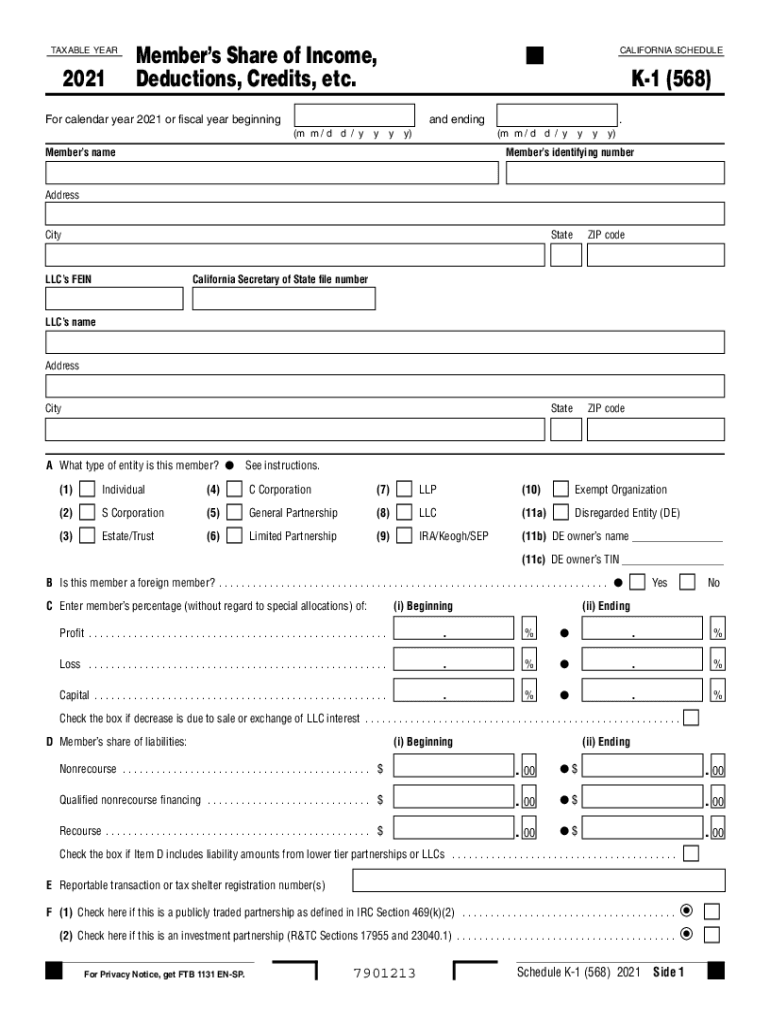

Ca Schedule K 1 568 2021

What is the California Schedule K-1 (568)

The California Schedule K-1 (568) is a tax form used by partnerships and limited liability companies (LLCs) to report income, deductions, and credits to their partners or members. This form is essential for ensuring that each partner or member accurately reports their share of income on their individual tax returns. The information provided on the K-1 helps to determine each partner's tax liability and is critical for compliance with state tax regulations.

Steps to Complete the California Schedule K-1 (568)

Completing the California Schedule K-1 (568) involves several key steps:

- Gather necessary financial information from the partnership or LLC, including income, deductions, and credits.

- Fill out the form accurately, ensuring all sections are completed, including the partner's name, address, and tax identification number.

- Report each partner's share of income, deductions, and credits based on the partnership agreement.

- Review the completed form for accuracy before distribution.

- Distribute the completed K-1 forms to all partners or members in a timely manner.

Legal Use of the California Schedule K-1 (568)

The California Schedule K-1 (568) serves a legal purpose in tax reporting. It is a formal document that must be completed and provided to each partner or member to ensure compliance with California tax laws. The form must be filled out correctly to avoid penalties and ensure that all partners report their income accurately. Using a reliable eSignature platform can enhance the legal standing of the document, ensuring that it meets the necessary requirements for electronic submissions.

Filing Deadlines / Important Dates

Filing deadlines for the California Schedule K-1 (568) are critical for compliance. Typically, the form must be filed by the due date of the partnership or LLC's tax return, which is usually the 15th day of the third month following the close of the tax year. For partnerships operating on a calendar year, this means the form is due by March 15. Partners should also be aware of the deadlines for their individual tax returns, as the information from the K-1 is needed for accurate reporting.

Who Issues the California Schedule K-1 (568)

The California Schedule K-1 (568) is issued by partnerships and limited liability companies (LLCs) that are registered in California. These entities are responsible for preparing the form and distributing it to their partners or members. Each partner or member receives their own K-1, which details their share of the entity's income, deductions, and credits for the tax year.

Examples of Using the California Schedule K-1 (568)

Using the California Schedule K-1 (568) can vary depending on the structure of the partnership or LLC. For example:

- A multi-member LLC might use the K-1 to report each member's share of profits and losses, which they will then include on their personal tax returns.

- A partnership may use the K-1 to allocate specific deductions, such as business expenses, to each partner based on their ownership percentage.

These examples illustrate the importance of accurate reporting and the role of the K-1 in ensuring compliance with California tax laws.

Quick guide on how to complete ca schedule k 1 568

Complete Ca Schedule K 1 568 effortlessly on any device

Web-based document management has become prevalent among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Ca Schedule K 1 568 on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Ca Schedule K 1 568 effortlessly

- Find Ca Schedule K 1 568 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, either via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or mismanaged files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Ca Schedule K 1 568 and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca schedule k 1 568

Create this form in 5 minutes!

How to create an eSignature for the ca schedule k 1 568

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a California Schedule K-1 568?

The California Schedule K-1 568 is a tax form used by partnerships and LLCs in California to report the income, deductions, and credits of each partner or member. It is essential for accurately filing California state taxes as it provides detailed information about each individual's share of the entity's earnings.

-

How can airSlate SignNow help with California Schedule K-1 568 forms?

airSlate SignNow simplifies the process of completing California Schedule K-1 568 forms by allowing users to electronically sign and send documents securely. This streamlines the workflow, making it easier for partnerships and LLCs to manage their tax documentation efficiently.

-

What features does airSlate SignNow offer for managing California Schedule K-1 568 documents?

airSlate SignNow includes features such as document templates, customizable workflows, and secure eSigning, which can enhance the management of California Schedule K-1 568 documents. These tools help users save time and reduce errors during tax preparation.

-

Is airSlate SignNow cost-effective for handling California Schedule K-1 568 forms?

Yes, airSlate SignNow provides a cost-effective solution for handling California Schedule K-1 568 forms, as it eliminates the need for paper documents and reduces administrative costs associated with traditional signing methods. Subscribing to airSlate SignNow can help businesses save money while ensuring compliance.

-

Can I integrate airSlate SignNow with other tools for California Schedule K-1 568 processing?

Absolutely, airSlate SignNow offers integrations with popular business tools like Google Drive, Dropbox, and CRMs, facilitating seamless management of California Schedule K-1 568 forms. This interoperability ensures that your workflow remains efficient and organized.

-

How secure is my data when using airSlate SignNow for California Schedule K-1 568?

airSlate SignNow prioritizes security with encryption and compliance with industry standards, ensuring that your data related to California Schedule K-1 568 is protected. This approach provides peace of mind while managing sensitive tax documents.

-

What are the benefits of using airSlate SignNow for California Schedule K-1 568?

Using airSlate SignNow for California Schedule K-1 568 offers multiple benefits, including enhanced efficiency, reduced processing times, and improved accuracy in document management. It also enables easy collaboration among partners, streamlining the tax preparation process.

Get more for Ca Schedule K 1 568

Find out other Ca Schedule K 1 568

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer