Personal Income Tax Preparation Guide's Form

What is the Personal Income Tax Preparation Guide

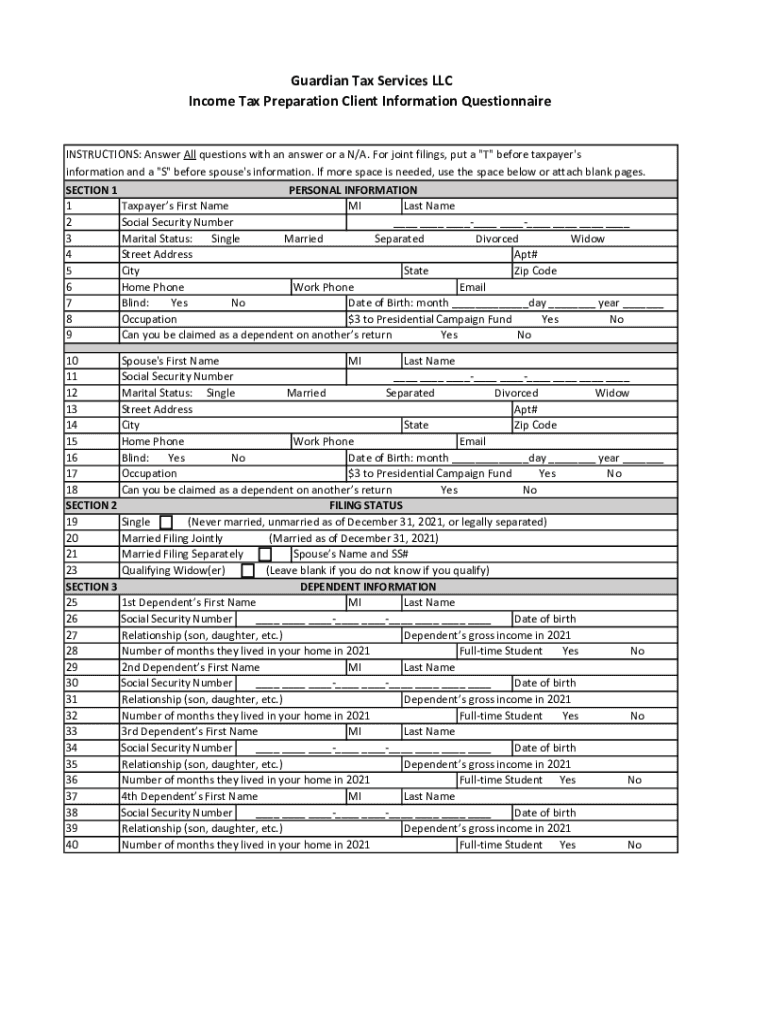

The Personal Income Tax Preparation Guide is a comprehensive resource designed to assist individuals in navigating the complexities of filing their income tax returns. This guide outlines the necessary steps, forms, and documentation required to ensure compliance with federal and state tax regulations. It serves as a valuable tool for taxpayers, providing insights into deductions, credits, and filing statuses that may apply to their unique financial situations.

Steps to Complete the Personal Income Tax Preparation Guide

Completing the Personal Income Tax Preparation Guide involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any receipts for deductible expenses. Next, review the guide to understand the specific forms required based on your filing status and income level. Fill out the forms carefully, ensuring all information is accurate. Finally, review your completed forms for any errors before submitting them electronically or via mail.

Legal Use of the Personal Income Tax Preparation Guide

The Personal Income Tax Preparation Guide is legally recognized as a valid resource for preparing tax returns. It adheres to the guidelines set forth by the Internal Revenue Service (IRS) and complies with federal regulations regarding tax filings. Utilizing this guide ensures that taxpayers can confidently complete their returns while meeting all legal requirements. It is essential to follow the instructions closely to avoid potential penalties or issues with the IRS.

Required Documents for the Personal Income Tax Preparation Guide

To effectively use the Personal Income Tax Preparation Guide, certain documents are essential. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income, such as interest or dividends

- Receipts for deductible expenses, including medical costs, charitable donations, and education expenses

- Previous year’s tax return for reference

Having these documents on hand will streamline the preparation process and help ensure that all income and deductions are accurately reported.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for successfully completing the Personal Income Tax Preparation Guide. Typically, the deadline for filing federal income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of state-specific deadlines, which can vary. It is advisable to mark these dates on your calendar to avoid late penalties and ensure timely submission.

IRS Guidelines

The IRS provides specific guidelines that must be followed when using the Personal Income Tax Preparation Guide. These guidelines cover various aspects of tax preparation, including eligibility for deductions and credits, acceptable forms of income documentation, and rules regarding electronic filing. Familiarizing yourself with these guidelines is essential to ensure compliance and to maximize potential tax benefits.

Examples of Using the Personal Income Tax Preparation Guide

Utilizing the Personal Income Tax Preparation Guide can vary based on individual circumstances. For instance, a self-employed individual may use the guide to identify deductible business expenses, while a retiree might focus on income from pensions and Social Security. Each example illustrates how the guide can cater to different taxpayer scenarios, ensuring that all relevant information is accurately captured and reported.

Quick guide on how to complete personal income tax preparation guides

Complete Personal Income Tax Preparation Guide's effortlessly on any device

Online document administration has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without holdups. Manage Personal Income Tax Preparation Guide's on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and electronically sign Personal Income Tax Preparation Guide's with ease

- Locate Personal Income Tax Preparation Guide's and then click Get Form to commence.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to missing or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Personal Income Tax Preparation Guide's and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal income tax preparation guides

Create this form in 5 minutes!

How to create an eSignature for the personal income tax preparation guides

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of a Personal Income Tax Preparation Guide?

A Personal Income Tax Preparation Guide helps individuals organize their tax information effectively to ensure accurate filing. This guide simplifies the tax preparation process, highlighting critical documents and deadlines. Using this guide can minimize mistakes and maximize potential refunds.

-

How can airSlate SignNow assist with my Personal Income Tax Preparation Guide?

airSlate SignNow offers a streamlined solution for signing and managing documents, making the process of gathering necessary forms for your Personal Income Tax Preparation Guide more efficient. You can eSign tax documents quickly, reducing delays. Additionally, the platform provides a secure storage solution for your sensitive tax information.

-

What features does the Personal Income Tax Preparation Guide include?

The Personal Income Tax Preparation Guide includes a checklist of necessary documents, timelines for filing, and tips for maximizing deductions. It also identifies common pitfalls to avoid during tax season. With airSlate SignNow, users can integrate their digital documents seamlessly for easy access.

-

Is there a cost associated with using the Personal Income Tax Preparation Guide?

Access to the Personal Income Tax Preparation Guide is included in airSlate SignNow's affordable pricing plans. Pricing varies based on the features and number of users. Users can evaluate the options to choose a plan that best fits their tax preparation needs without breaking the bank.

-

Can I integrate the Personal Income Tax Preparation Guide with other software?

Yes, airSlate SignNow allows seamless integration with several popular accounting and tax software to enhance your Personal Income Tax Preparation Guide's functionality. This integration can help streamline workflows and ensure that all necessary documents are in one place. Users can enhance their financial management by syncing information across platforms.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents enhances efficiency and security. The platform provides an easy-to-use interface for eSigning, which saves time during the Personal Income Tax Preparation Guide process. Additionally, secure storage ensures your documents are protected from unauthorized access.

-

How does airSlate SignNow ensure the security of my Personal Income Tax Preparation Guide's information?

airSlate SignNow prioritizes your security by employing top-notch encryption protocols to protect your documents and personal information. The platform complies with industry standards to ensure your tax data's confidentiality and integrity. You can eSign documents with peace of mind knowing your information is secure.

Get more for Personal Income Tax Preparation Guide's

Find out other Personal Income Tax Preparation Guide's

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word