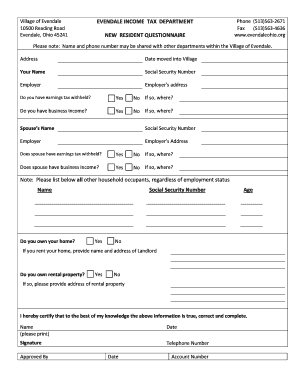

EVENDALE INCOME TAX DEPARTMENT 2016

Understanding the 2016 Ohio Income Tax

The 2016 Ohio income tax is a tax imposed on the income of individuals and businesses in Ohio. This tax is calculated based on the taxpayer's income level and is subject to various deductions and credits. Ohio's income tax system is progressive, meaning that higher income levels are taxed at higher rates. Taxpayers must be aware of the specific rates and brackets applicable for the 2016 tax year to ensure accurate filing.

Filing Deadlines for the 2016 Ohio Income Tax

For the 2016 tax year, the deadline to file the Ohio income tax return was April 18, 2017. Taxpayers who missed this deadline may face penalties and interest on any unpaid taxes. It is essential to stay informed about any extensions or changes to deadlines that may have occurred, especially for those who filed for an extension.

Required Documents for Filing

When preparing to file the 2016 Ohio income tax return, taxpayers need to gather several key documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents ready can streamline the filing process and help ensure that all income is accurately reported.

Steps to Complete the 2016 Ohio Income Tax Return

Completing the 2016 Ohio income tax return involves several important steps:

- Gather all necessary documents, including W-2s and 1099s.

- Determine your filing status and income level.

- Calculate your taxable income by applying any deductions or credits.

- Complete the appropriate Ohio income tax forms, such as the IT 1040.

- Review your completed return for accuracy.

- Submit your return electronically or via mail before the deadline.

Penalties for Non-Compliance

Failing to file the 2016 Ohio income tax return on time can result in significant penalties. Ohio imposes both late filing and late payment penalties, which can accumulate over time. Additionally, interest may accrue on any unpaid taxes. Taxpayers should be aware of these consequences and take steps to file their returns promptly.

Digital Submission Methods

Taxpayers have the option to submit their 2016 Ohio income tax return digitally. E-filing offers a convenient and efficient way to file taxes, reducing the risk of errors and ensuring faster processing times. Taxpayers can use various online platforms to complete their filings securely and receive confirmation of submission.

Quick guide on how to complete evendale income tax department

Prepare EVENDALE INCOME TAX DEPARTMENT effortlessly on any device

Digital document management has become increasingly popular with organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and efficiently. Handle EVENDALE INCOME TAX DEPARTMENT on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign EVENDALE INCOME TAX DEPARTMENT without any hassle

- Obtain EVENDALE INCOME TAX DEPARTMENT and click Get Form to begin.

- Utilize the provided tools to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Alter and electronically sign EVENDALE INCOME TAX DEPARTMENT and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct evendale income tax department

Create this form in 5 minutes!

How to create an eSignature for the evendale income tax department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of addressing 2016 Ohio income tax returns?

The 2016 Ohio income tax returns are crucial for staying compliant with state tax laws. Filing accurately can prevent penalties and ensure you receive any eligible refunds. Additionally, understanding these returns can help you plan for future tax obligations.

-

How can airSlate SignNow improve the efficiency of my 2016 Ohio income tax filing?

AirSlate SignNow allows users to easily send, sign, and manage all documents digitally, streamlining the process of filing 2016 Ohio income tax returns. This eliminates the hassle of paper-based workflows and speeds up document collection. By reducing the time spent on paperwork, you can focus on other financial priorities.

-

Are there any costs associated with using airSlate SignNow for 2016 Ohio income tax documents?

Yes, airSlate SignNow offers a range of pricing plans tailored to fit different business needs. Using our cost-effective solution to manage your 2016 Ohio income tax filings can help you save time and reduce operational costs. Check our pricing page for detailed information on different subscription options.

-

What features does airSlate SignNow offer for managing 2016 Ohio income tax documents?

AirSlate SignNow offers features such as document templates, in-app signing, and automated workflows. These tools make it easy to create and manage documents related to 2016 Ohio income tax effortlessly. Our platform ensures that you have everything you need to file accurately and on time.

-

Can I integrate airSlate SignNow with other software for my 2016 Ohio income tax preparation?

Absolutely! AirSlate SignNow supports integrations with popular accounting and tax preparation software. This compatibility allows for a seamless transition of information needed for your 2016 Ohio income tax filing, simplifying your overall workflow.

-

What benefits does using airSlate SignNow provide for 2016 Ohio income tax submissions?

Using airSlate SignNow streamlines the e-signature process and enhances document security for your 2016 Ohio income tax submissions. You'll enjoy increased efficiency, reduced turnaround times, and a clearer overview of the signing process. This leads to a smoother filing experience overall.

-

How does airSlate SignNow ensure the security of my 2016 Ohio income tax documents?

AirSlate SignNow prioritizes security, employing encryption protocols and secure cloud storage for your 2016 Ohio income tax documents. This safeguards sensitive information and ensures compliance with data protection regulations. You can confidently manage your tax documents without compromising security.

Get more for EVENDALE INCOME TAX DEPARTMENT

- Watersure application form homepage thames water

- Tc 96 16t form

- Oliver twist worksheets pdf form

- Wisconsin dmv seller notification form

- Vr 198 07 15 mva maryland gov mva maryland form

- Board uprestoration form

- Water supply emergency response plan form

- Ecmeaerie county music educators association form

Find out other EVENDALE INCOME TAX DEPARTMENT

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure