Village of Evendale OH 2021-2026

Understanding Ohio Resident Income Tax

The Ohio resident income tax is a state tax imposed on the income of individuals who reside in Ohio. This tax is calculated based on the taxpayer's total income, which includes wages, salaries, and other forms of compensation. The tax rates are progressive, meaning that higher income levels are taxed at higher rates. Understanding how this tax works is essential for residents to ensure compliance and optimize their tax obligations.

Filing Deadlines and Important Dates

For Ohio residents, the deadline to file state income tax returns typically aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to stay informed about any changes to deadlines or extensions that may apply, particularly for specific situations such as natural disasters or other state declarations.

Required Documents for Filing

When preparing to file Ohio resident income tax, several documents are necessary to ensure accurate reporting. Key documents include:

- W-2 forms from employers, detailing wages and tax withheld

- 1099 forms for other income sources, such as freelance work or interest

- Documentation of any deductions or credits claimed, such as receipts for charitable contributions

- Previous year’s tax return for reference

Having these documents ready can streamline the filing process and help avoid errors.

Form Submission Methods

Ohio residents have several options for submitting their income tax returns. These methods include:

- Online filing through the Ohio Department of Taxation’s website or approved tax software

- Mailing a paper return to the appropriate state address

- In-person submission at designated tax offices, although this method may require an appointment

Each method has its advantages, and residents should choose the one that best fits their needs and preferences.

Penalties for Non-Compliance

Failure to comply with Ohio resident income tax regulations can result in significant penalties. Common penalties include:

- Late filing penalties, which can accrue if returns are not submitted by the deadline

- Failure to pay penalties for any outstanding tax owed

- Interest charges on unpaid taxes, which can accumulate over time

Understanding these penalties can motivate timely and accurate filing, helping residents avoid unnecessary financial burdens.

Taxpayer Scenarios

Different taxpayer scenarios can affect how Ohio resident income tax is filed. For example:

- Self-employed individuals may need to report additional income and pay estimated taxes quarterly

- Retired residents might have different considerations regarding pension income and social security

- Students may qualify for specific deductions or credits based on their income and education expenses

Each scenario presents unique challenges and opportunities, making it essential for taxpayers to understand their specific circumstances.

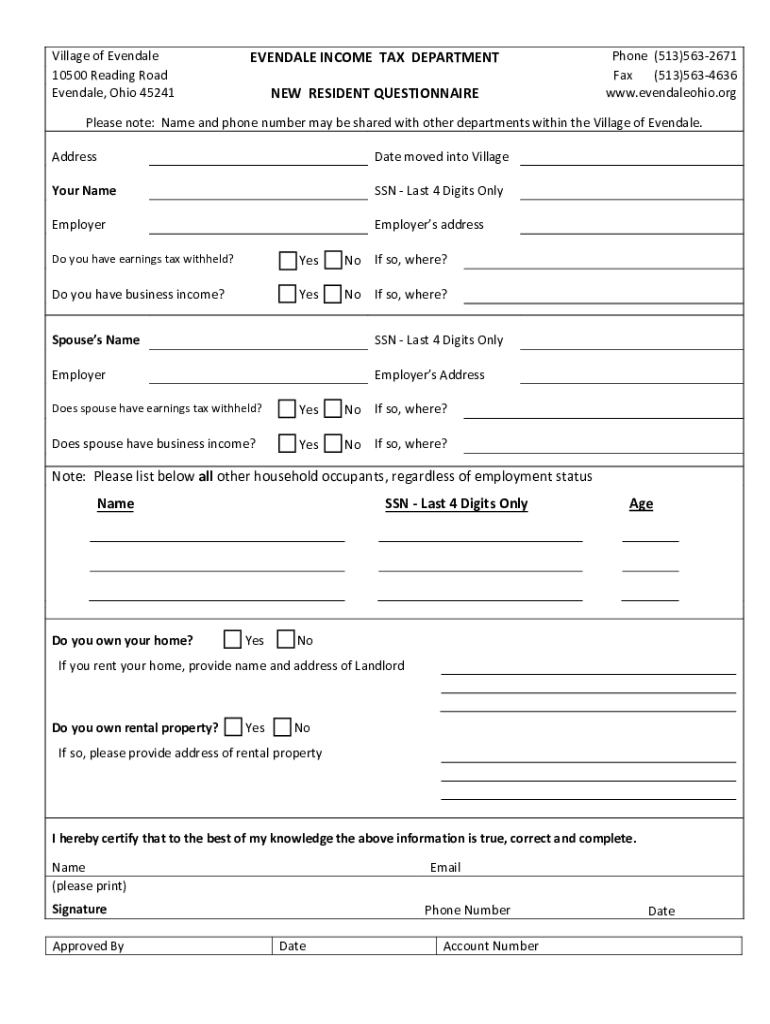

Quick guide on how to complete village of evendale oh

Complete Village Of Evendale OH seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Village Of Evendale OH on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Village Of Evendale OH effortlessly

- Find Village Of Evendale OH and then select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and eSign Village Of Evendale OH while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct village of evendale oh

Create this form in 5 minutes!

How to create an eSignature for the village of evendale oh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of understanding Ohio resident income tax when using airSlate SignNow?

Understanding Ohio resident income tax is crucial for ensuring that any signed documents and transactions comply with state tax laws. airSlate SignNow allows you to manage all your documents efficiently, but being aware of your tax obligations can help you avoid potential legal issues related to misunderstanding your income tax responsibilities.

-

How does airSlate SignNow simplify the process for Ohio residents dealing with income tax forms?

airSlate SignNow streamlines the signing and sending of income tax forms for Ohio residents, making it easier to manage your tax documents. By providing electronic signatures and secure sharing options, you can ensure that your Ohio resident income tax forms are submitted accurately and on time, reducing the stress of tax season.

-

Can airSlate SignNow help me track deadlines related to Ohio resident income tax?

Yes, airSlate SignNow can assist in tracking deadlines for Ohio resident income tax documents. With its reminders and notifications features, you'll stay informed about important dates, ensuring you never miss a filing deadline, which is crucial for staying compliant with Ohio tax regulations.

-

What pricing options are available for airSlate SignNow for Ohio residents dealing with income tax?

airSlate SignNow offers various pricing plans that are cost-effective for Ohio residents managing their income tax documents. These plans are designed to fit different business sizes and needs, ensuring that you can select a package that best suits your budget while providing essential features for effective document management.

-

Are there any features in airSlate SignNow specifically designed for Ohio resident income tax documentation?

Absolutely! airSlate SignNow includes features tailored for Ohio resident income tax documentation, including template creation for common tax forms and secure eSigning options. These tools help users efficiently manage their tax paperwork while maintaining compliance with Ohio's legal requirements.

-

How does airSlate SignNow integrate with accounting software for managing Ohio resident income tax?

airSlate SignNow seamlessly integrates with various accounting software platforms that are essential for managing Ohio resident income tax obligations. This integration allows for a smooth workflow, making it easier to import and export tax-related documents directly from your accounting system.

-

What are the benefits of using airSlate SignNow for Ohio resident income tax compliance?

Using airSlate SignNow for Ohio resident income tax compliance allows for increased efficiency, reduced errors, and better document tracking. With its user-friendly interface and comprehensive features, you can ensure your tax documents are handled efficiently, helping you maintain compliance with state regulations.

Get more for Village Of Evendale OH

- Criminal history disclosure form

- 180 essential vocabulary words for 5th grade pdf form

- Illinois financial affidavit form

- Pythagorean theorem guided notes pdf form

- Illinois lottery retailer application form

- Team opponent date circle attempted shots use slash form

- Mosque boq xls form

- Lake county indiana court forms

Find out other Village Of Evendale OH

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document