BDental Claim Formb Kfh Takaful Insurance

Understanding the KFH Takaful Medical Claim Form

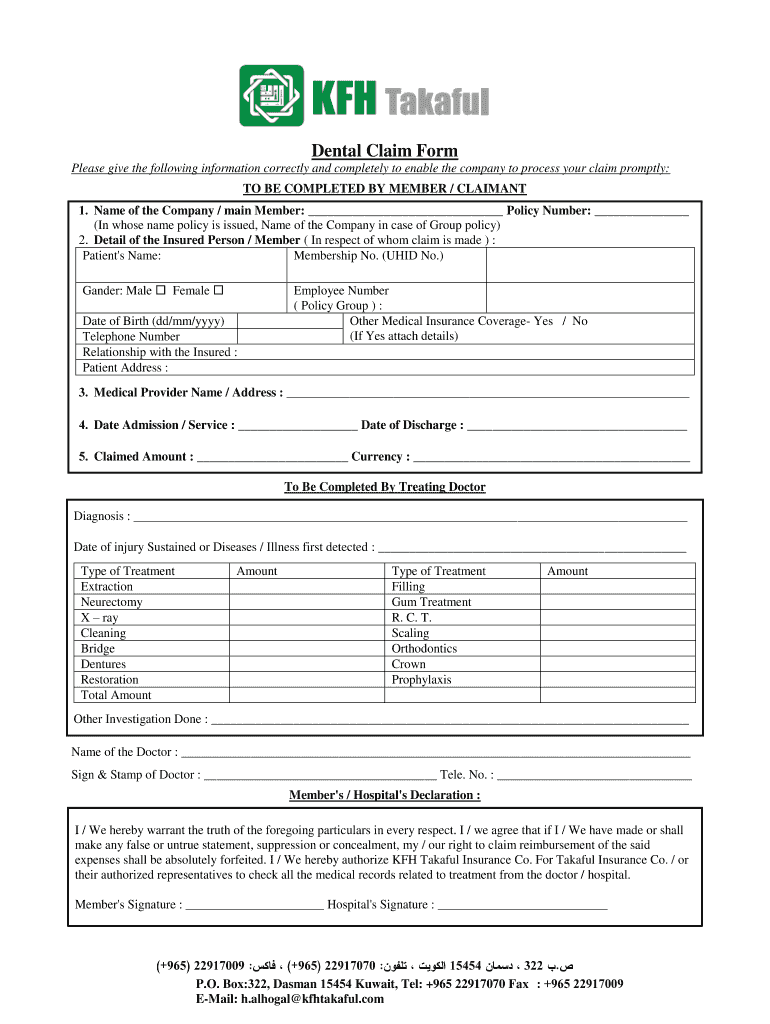

The KFH Takaful medical claim form is a crucial document for policyholders seeking reimbursement for medical expenses covered under their insurance plan. This form allows individuals to submit claims for various medical services, ensuring that they receive the financial support they need. It is essential to understand the specific requirements and details included in the form to facilitate a smooth claims process.

Steps to Complete the KFH Takaful Medical Claim Form

Filling out the KFH Takaful medical claim form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all necessary documents, including receipts and medical reports.

- Fill in your personal information accurately, including your policy number.

- Detail the medical services received, including dates and descriptions.

- Attach all supporting documents to the claim form.

- Review the completed form for any errors before submission.

Legal Use of the KFH Takaful Medical Claim Form

The KFH Takaful medical claim form serves as a legally binding document when submitted correctly. To ensure its legal standing, it must include accurate information and be accompanied by all required documentation. Compliance with relevant regulations, such as those governing electronic signatures, is also necessary for the form to be recognized by the insurance company and any legal entities.

Required Documents for the KFH Takaful Medical Claim

When submitting the KFH Takaful medical claim form, specific documents are required to support your claim. These typically include:

- Original invoices or receipts from medical providers.

- Medical reports detailing the treatment received.

- Any additional forms or documentation requested by KFH Takaful.

Form Submission Methods for KFH Takaful Medical Claims

Submitting the KFH Takaful medical claim form can be done through various methods to accommodate different preferences. Options typically include:

- Online submission through the KFH Takaful portal.

- Mailing the completed form and documents to the designated address.

- In-person submission at a local KFH Takaful office.

Key Elements of the KFH Takaful Medical Claim Form

Understanding the key elements of the KFH Takaful medical claim form is essential for successful completion. Important sections often include:

- Policyholder information, including name and contact details.

- Details of the medical services received, including provider information.

- Claim amount requested and breakdown of expenses.

Quick guide on how to complete bdental claim formb kfh takaful insurance

Complete BDental Claim Formb Kfh Takaful Insurance easily on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to locate the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle BDental Claim Formb Kfh Takaful Insurance on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest method to modify and eSign BDental Claim Formb Kfh Takaful Insurance effortlessly

- Locate BDental Claim Formb Kfh Takaful Insurance and then click Get Form to initiate.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of your documents or mask confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign BDental Claim Formb Kfh Takaful Insurance and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

-

Do the HIPAA laws prohibit Health Insurance companies from allowing members to fill out and submit medical claim forms on line?

No, nothing in HIPAA precludes collecting the claim information online.However, the information needs to be protected at rest as well as in-flight. This is typically done by encrypting the connection (HTTPS) as well the storage media

-

Can a pharmacist refuse to fill an Rx after the claim has already been paid by insurance, but also refuse to void out the fill request so Rx can't be transferred and filled elsewhere (Arizona)?

Ok, this weird. The pharmacy cannot collect from the insurance company unless the prescription has been filled. There is no pre paying.Did the pharmacist fill the prescription but you didn’t get it?You can always get your doctor to call your prescriptions in to another pharmacy.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

How do life insurance companies stay in business? Don’t they have to pay out claims to 100% of insureds?

That’s one way to look at it. However, keep in mind they have many people paying premiums every year. The amount they pay out on a policy will (hopefully for the insurance company) likely be less than the total of money they take in on premiums. This is similar to other insurances. They know they will have to pay out to policyholders for insured incidents (fire, hurricane, car accident) but hope that all the incoming premiums more than offset their loses. If someone signs up for a new auto policy with a new insurer and totals their brand new car a week later, the insurance company may be out a lot of money, despite not taking in much in the way of premiums from the newly insured client. That’s made up for by the person who has paid 200,000 dollars over a long driving career with zero claims. With life insurance, some will die relatively young, and some will die relatively old, but the basic principal is the same (and why if you are a smoker or obese your policy may cost more as they figure you’ll be paying in for a shorter period of time…) Same with pensions…Some will pay in for many years, retire, and die a year after they retire, never coming close to re-cooping all the money they put into the retirement system (or social security perhaps). Others will retire and live long enough to cost the pensions system more money than they contributed.

-

How can you find out which insurance companies are reliable when it comes to paying claims?

You must buy a separate health insurance for your family. It would be great if you go with a family floater health insurance plan.A family health insurance plan is basically a form of effective health insurance cover that provides coverage to you and your family against all medical emergencies in return for a single premium payment. With the same policy, you and your family will get assured coverage. A family health insurance plan generally provides coverage to the entire family under a single plan. While you have the freedom to insure your parents, there are some plans also which allows you to insure your parents- in laws. This plan allows you to protect your entire family and allow you to live stress-free.

-

Out of 100 $ paid in premiums how much do the insurance companies have to repay in claims on average?

Total premium revenue vs claim costs and expenses (which includes settlements, legal defenses, and the claims personnel, facilities, etc) is expressed as the Combined Operating Ratio. (COR).Most large carriers run a slightly negative COR, in the range of 104 to 106%. So to answer your question, on that $100 they lost around $5.(Progressive, when I was there, ran a COR in the mid 90’s, so they actually turned a small profit on underwriting alone.)Insurance companies make money by taking the cash it collects in premiums and investing it in the market. It’s the ROI on its massive portfolio that drives profit.

Create this form in 5 minutes!

How to create an eSignature for the bdental claim formb kfh takaful insurance

How to generate an electronic signature for your Bdental Claim Formb Kfh Takaful Insurance online

How to create an eSignature for your Bdental Claim Formb Kfh Takaful Insurance in Chrome

How to create an eSignature for signing the Bdental Claim Formb Kfh Takaful Insurance in Gmail

How to generate an eSignature for the Bdental Claim Formb Kfh Takaful Insurance right from your smart phone

How to create an electronic signature for the Bdental Claim Formb Kfh Takaful Insurance on iOS devices

How to create an electronic signature for the Bdental Claim Formb Kfh Takaful Insurance on Android

People also ask

-

What is KFH Takaful Insurance Company?

KFH Takaful Insurance Company is a well-established provider of Sharia-compliant insurance products. They offer a wide range of coverage options that cater to various needs, including life, health, and property insurance. This ensures that customers can find suitable products that align with their values and financial goals.

-

What types of insurance does KFH Takaful Insurance Company offer?

KFH Takaful Insurance Company offers several types of insurance, including life, health, motor, and property insurance. Each product is designed to provide comprehensive protection while adhering to Islamic principles. This allows customers to select policies that best meet their individual needs.

-

How does pricing work with KFH Takaful Insurance Company?

Pricing at KFH Takaful Insurance Company varies based on the type of coverage selected and the specific needs of the client. They provide a transparent pricing structure that includes all benefits and potential costs upfront. Prospective customers can easily request quotes to understand their options better.

-

What are the benefits of choosing KFH Takaful Insurance Company?

Choosing KFH Takaful Insurance Company comes with several benefits, including comprehensive coverage, adherence to Islamic principles, and excellent customer service. Additionally, they offer flexible payment plans to accommodate different budgets. Their commitment to ethical standards ensures peace of mind for policyholders.

-

Are there any integration options with KFH Takaful Insurance Company?

KFH Takaful Insurance Company offers integration options with various financial and insurance management software. These integrations simplify policy management and make it easier for customers to track their policies online. Streamlined operations ensure that clients have a hassle-free experience with their insurance.

-

How can I file a claim with KFH Takaful Insurance Company?

Filing a claim with KFH Takaful Insurance Company is a straightforward process. Customers can submit their claims online through their website or by contacting their customer service team. They provide detailed guidance on the required documentation to expedite the claims process for policyholders.

-

What makes KFH Takaful Insurance Company different from other insurers?

KFH Takaful Insurance Company stands out due to its commitment to Sharia compliance, ensuring that all insurance products reflect Islamic values. Their focus on community welfare and ethical insurance practices also differentiates them from conventional insurers. This approach fosters trust and reliability among customers seeking takaful solutions.

Get more for BDental Claim Formb Kfh Takaful Insurance

Find out other BDental Claim Formb Kfh Takaful Insurance

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online