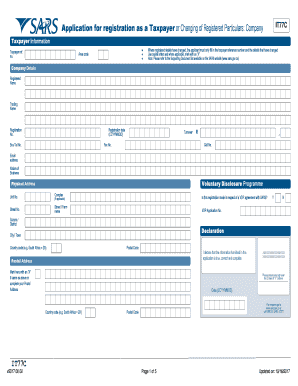

Application for Registration as a Taxpayer or Changing of Registered Particulars Company Form

What is the Application for Registration as a Taxpayer?

The it77c form, also known as the Application for Registration as a Taxpayer or Changing of Registered Particulars, is a crucial document for businesses and individuals in the United States who need to register for tax purposes. This form is essential for establishing a taxpayer identity with the Internal Revenue Service (IRS) and is used to report changes in registered particulars. Completing this form accurately ensures compliance with federal tax regulations and facilitates smooth interactions with tax authorities.

Steps to Complete the Application for Registration as a Taxpayer

Filling out the it77c form involves several important steps:

- Gather necessary information, including your legal name, business structure, and contact details.

- Provide your Social Security Number (SSN) or Employer Identification Number (EIN) as applicable.

- Indicate the reason for registering or changing particulars, ensuring clarity in your responses.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically or via mail, following the guidelines provided by the IRS.

Legal Use of the Application for Registration as a Taxpayer

The sars it77c form holds legal significance as it establishes your status as a registered taxpayer. Proper completion and submission of this form ensure that you fulfill your legal obligations under U.S. tax law. It is vital to adhere to the guidelines set forth by the IRS to avoid potential penalties or complications in your tax affairs.

Required Documents for the Application for Registration as a Taxpayer

When completing the sars it77c application, certain documents may be required to support your registration. These may include:

- Proof of identity, such as a government-issued photo ID.

- Business formation documents if registering as a business entity.

- Any prior tax documents that may be relevant to your application.

Having these documents ready can streamline the process and enhance the accuracy of your submission.

Form Submission Methods

The it77c form can be submitted through various methods, ensuring flexibility for users. The primary submission methods include:

- Online submission through the IRS website, which is the fastest and most efficient option.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, if necessary.

Choosing the right submission method can help expedite the processing of your application.

IRS Guidelines for Completing the Application

It is essential to follow the IRS guidelines when filling out the sars it77c form. These guidelines provide detailed instructions on:

- The information required for each section of the form.

- Common mistakes to avoid during the application process.

- Deadlines for submission to ensure timely processing.

Adhering to these guidelines can significantly reduce the likelihood of errors and delays in your application.

Quick guide on how to complete application for registration as a taxpayer or changing of registered particulars company

Complete Application For Registration As A Taxpayer Or Changing Of Registered Particulars Company effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents promptly without delays. Manage Application For Registration As A Taxpayer Or Changing Of Registered Particulars Company on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign Application For Registration As A Taxpayer Or Changing Of Registered Particulars Company without hassle

- Obtain Application For Registration As A Taxpayer Or Changing Of Registered Particulars Company and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to confirm your updates.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or save it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Application For Registration As A Taxpayer Or Changing Of Registered Particulars Company and maintain seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for registration as a taxpayer or changing of registered particulars company

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it77c form and how can airSlate SignNow assist with it?

The it77c form is used for reporting various types of income and tax information. Using airSlate SignNow, businesses can easily prepare, send, and eSign the it77c form, ensuring compliance and accuracy in documentation. Our platform simplifies the signing process, making it fast and efficient.

-

Is there a cost associated with using airSlate SignNow for the it77c form?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs. These plans provide access to eSigning features and the ability to manage documents like the it77c form efficiently. Our cost-effective solutions allow businesses to save time and resources.

-

What features does airSlate SignNow offer for managing the it77c form?

airSlate SignNow offers robust features such as templates specifically for the it77c form, customizable workflows, and real-time tracking of document status. These features enhance collaboration and ensure that all parties are informed and engaged throughout the signing process.

-

How can airSlate SignNow improve the process of sending the it77c form?

AirSlate SignNow simplifies sending the it77c form by allowing users to upload documents directly, add eSignature fields, and send them to recipients with just a few clicks. This streamlined process reduces the time spent on paperwork and helps maintain accuracy in submissions.

-

Does airSlate SignNow integrate with other software for handling the it77c form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing for efficient data transfer and document management related to the it77c form. This compatibility helps businesses maintain a cohesive workflow while minimizing manual data entry.

-

What are the benefits of using airSlate SignNow for the it77c form?

Using airSlate SignNow for the it77c form offers numerous benefits, including improved efficiency, enhanced security, and reduced turnaround times. Our platform ensures that your documents are secure and facilitates convenient access for signers, making compliance a breeze.

-

Can I track the status of the it77c form sent through airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of the it77c form. Our platform provides real-time notifications, allowing you to know when the document has been viewed, signed, or completed, ensuring you are always informed throughout the process.

Get more for Application For Registration As A Taxpayer Or Changing Of Registered Particulars Company

- Usa funds forbearance form

- Notice of family claim form f3 bc

- How to fill out third party financing addendum for conventional form

- Dir form a 1 131 instructions

- Flexible spending account fsa data collection worksheet benefits form

- Student registration form naui national association of

- Csd 1489 form

- Dog adoption printables form

Find out other Application For Registration As A Taxpayer Or Changing Of Registered Particulars Company

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed