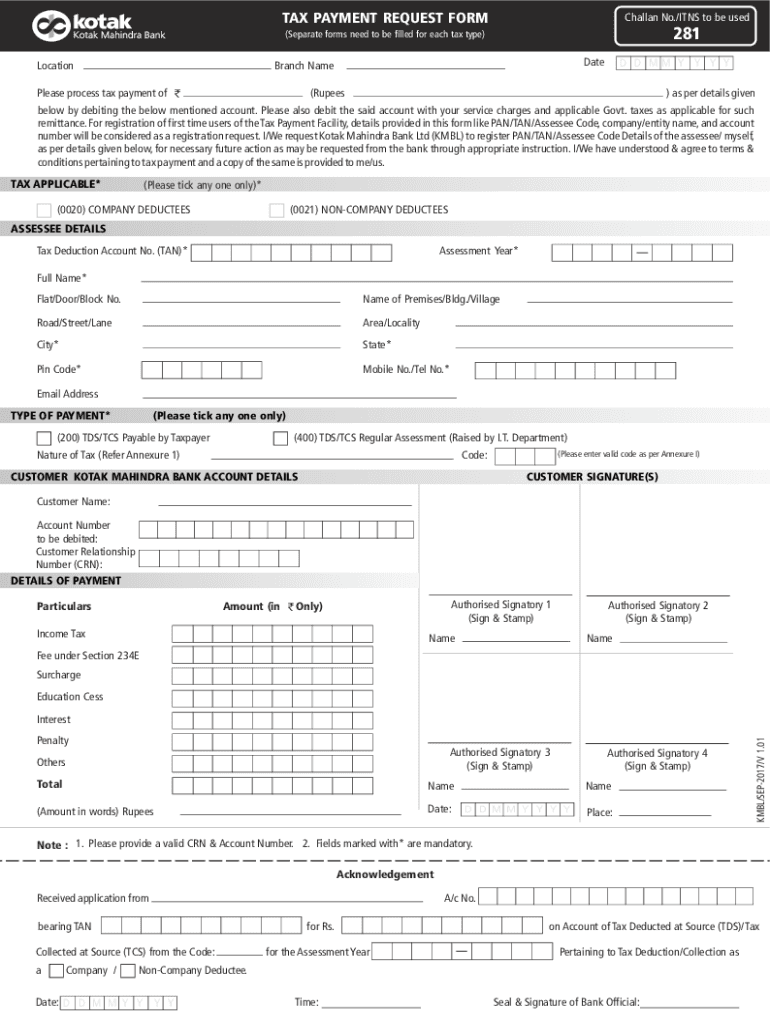

Kotak Mahindra Bank Challan No ITNS to Be UsedTax 2017-2026

What is the Canara Bank Challan?

The Canara Bank challan is a payment form used for various banking transactions, including tax payments and utility bill payments. This form serves as a receipt for the transaction and is essential for maintaining financial records. It is commonly used by individuals and businesses to facilitate payments to the government or other entities. Understanding the structure and purpose of the Canara Bank challan is crucial for its effective use.

Steps to Complete the Canara Bank Challan

Completing the Canara Bank challan involves several key steps:

- Gather necessary information, including your account details and the payment amount.

- Obtain the correct challan form from the Canara Bank website or a physical branch.

- Fill in the required fields accurately, ensuring all details are correct to avoid processing delays.

- Submit the completed challan at the bank counter or through an online banking platform, depending on your preference.

- Retain a copy of the challan for your records as proof of payment.

Legal Use of the Canara Bank Challan

The Canara Bank challan is legally binding when filled out correctly and submitted as per the guidelines. It serves as a formal record of payment, which can be referenced in case of disputes or audits. Compliance with relevant laws and regulations is essential to ensure the validity of the challan. Users should familiarize themselves with the legal implications of using this form to avoid any potential issues.

Required Documents for Using the Canara Bank Challan

To successfully complete a transaction using the Canara Bank challan, certain documents may be required. These typically include:

- Identification proof, such as a driver's license or passport.

- Tax identification number or relevant account numbers.

- Any additional documentation specific to the payment being made, such as invoices or tax returns.

Form Submission Methods

The Canara Bank challan can be submitted through various methods, providing flexibility for users. These methods include:

- In-person submission at any Canara Bank branch.

- Online submission through the Canara Bank internet banking portal.

- Mobile banking applications that support challan payments.

Examples of Using the Canara Bank Challan

Common scenarios for using the Canara Bank challan include:

- Paying income tax or other government taxes.

- Settling utility bills such as electricity or water charges.

- Making payments for various services offered by government departments.

Quick guide on how to complete kotak mahindra bank challan no itns to be usedtax

Effortlessly Create Kotak Mahindra Bank Challan No ITNS To Be UsedTax on Any Device

Web-based document management has become increasingly favored by both businesses and individuals. It offers a great eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents promptly without delays. Manage Kotak Mahindra Bank Challan No ITNS To Be UsedTax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Alter and eSign Kotak Mahindra Bank Challan No ITNS To Be UsedTax with Ease

- Locate Kotak Mahindra Bank Challan No ITNS To Be UsedTax and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools designed by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Kotak Mahindra Bank Challan No ITNS To Be UsedTax and guarantee exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kotak mahindra bank challan no itns to be usedtax

Create this form in 5 minutes!

How to create an eSignature for the kotak mahindra bank challan no itns to be usedtax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Canara Bank challan?

A Canara Bank challan is a payment receipt used to make payments for various services such as taxes, fees, or other governmental dues. By using the Canara Bank challan, customers can ensure that their payments are processed efficiently and securely.

-

How can I generate a Canara Bank challan?

You can easily generate a Canara Bank challan online through the official Canara Bank website or related portals. Simply select the payment type, fill in the required details, and the system will create the challan for you.

-

What payment methods can be used with a Canara Bank challan?

A Canara Bank challan typically supports multiple payment methods, including cash, cheque, and online payment options. This flexibility allows users to choose the most convenient method for completing their transactions.

-

Is there a fee associated with using a Canara Bank challan?

Generally, there are no additional fees for creating a Canara Bank challan; however, applicable service charges may depend on the payment method or service being utilized. Always check the specific terms associated with the service for detailed information.

-

Can I track my payment status after using a Canara Bank challan?

Yes, once you make a payment using a Canara Bank challan, you can track the status of your payment through the bank's online portal. This feature helps ensure that you stay updated on your payment confirmations and any processing stages.

-

What are the benefits of using an eChallan for Canara Bank payments?

Using an eChallan for Canara Bank payments is highly beneficial because it saves time and offers convenience. Customers can make payments from anywhere, eliminating the need for physical visits to the bank, thus enhancing overall efficiency.

-

Can airSlate SignNow integrate with Canara Bank for seamless document signing?

Yes, airSlate SignNow can integrate with Canara Bank to streamline the document signing process associated with payments. This integration allows users to eSign important documents related to their Canara Bank challan transactions effortlessly.

Get more for Kotak Mahindra Bank Challan No ITNS To Be UsedTax

- Patient interview form

- Route card template word form

- Cf6r form

- Form lir 27 example

- To place an order please call your scholastic book fairs sales consultant or fax this form to 888 288 7323

- Military transfer form

- Note taking worksheet weathering and soil answers form

- Form w 3c pr rev december transmittal of corrected wage and tax statements puerto rican version

Find out other Kotak Mahindra Bank Challan No ITNS To Be UsedTax

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy