Kotak Tds Challan 2014

What is the Kotak TDS Challan?

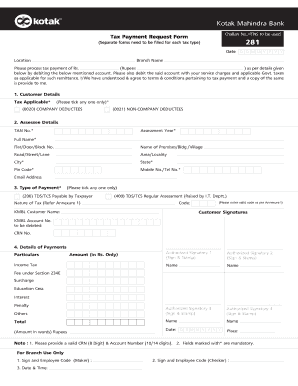

The Kotak TDS Challan, commonly referred to as Challan 281, is a specific form used for the payment of Tax Deducted at Source (TDS) in India. This form is essential for individuals and businesses that need to remit TDS to the government. It is particularly relevant for payments made to contractors, professionals, and other service providers. The challan serves as proof of payment and is a crucial document for tax compliance.

How to Use the Kotak TDS Challan

Using the Kotak TDS Challan involves several straightforward steps. First, ensure you have the necessary details, such as the PAN of the deductor and the amount of TDS to be paid. You can access the challan online through the Kotak Mahindra Bank website or other authorized platforms. After filling in the required information, submit the form electronically or print it for physical submission. Always retain a copy for your records, as it will be needed for future tax filings.

Steps to Complete the Kotak TDS Challan

Completing the Kotak TDS Challan requires careful attention to detail. Follow these steps:

- Gather necessary information, including PAN details and TDS amount.

- Access the Kotak TDS Challan online or obtain a physical form.

- Fill in the required fields accurately, ensuring all information is correct.

- Choose the payment method, which can be online or via bank branches.

- Submit the form and retain the acknowledgment receipt for your records.

Legal Use of the Kotak TDS Challan

The Kotak TDS Challan is legally recognized as a valid document for TDS payments. It must be filled out correctly to ensure compliance with tax laws. The information provided in the challan is used by the Income Tax Department to track payments and ensure that taxpayers meet their obligations. Failure to use the form correctly can result in penalties and complications during tax assessments.

Key Elements of the Kotak TDS Challan

Understanding the key elements of the Kotak TDS Challan is vital for accurate completion. Important components include:

- Challan Number: A unique identifier for each payment.

- PAN of the Deductor: Required for identification purposes.

- Type of Payment: Indicates the nature of the transaction, such as salary or professional fees.

- Amount of TDS: The total TDS being remitted to the government.

Filing Deadlines / Important Dates

Filing deadlines for the Kotak TDS Challan are critical to avoid penalties. Generally, TDS payments must be made by the seventh of the month following the deduction. It is essential to stay informed about specific deadlines, especially during tax season, to ensure timely compliance. Missing these deadlines can lead to interest charges and penalties, complicating your tax situation.

Quick guide on how to complete kotak tds challan

Prepare Kotak Tds Challan effortlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents quickly and efficiently. Manage Kotak Tds Challan on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Kotak Tds Challan with ease

- Obtain Kotak Tds Challan and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Kotak Tds Challan and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kotak tds challan

Create this form in 5 minutes!

How to create an eSignature for the kotak tds challan

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 281 challan PDF and how can it be used?

The 281 challan PDF is an essential document for tax payments in India, used for depositing certain taxes to the government. With airSlate SignNow, you can easily fill out and eSign the 281 challan PDF, making the process quick and efficient.

-

How can I access the 281 challan PDF using airSlate SignNow?

You can access the 281 challan PDF directly from your airSlate SignNow dashboard. Simply upload the document, fill in the necessary fields, and eSign it to ensure a seamless submission process for your tax payments.

-

Is there a cost associated with using airSlate SignNow for the 281 challan PDF?

airSlate SignNow offers a variety of pricing plans to suit your needs, including options for individuals and businesses. Generally, you can use the platform to eSign documents, including the 281 challan PDF, at an affordable rate, ensuring signNow savings on time and resources.

-

What features does airSlate SignNow offer for the 281 challan PDF?

airSlate SignNow provides a user-friendly interface to upload, fill, and eSign the 281 challan PDF. Additional features include document tracking, secure storage, and integration with other applications to enhance your workflow and efficiency.

-

How can airSlate SignNow improve the efficiency of handling the 281 challan PDF?

Using airSlate SignNow for your 281 challan PDF streamlines the entire process, allowing you to complete and sign documents electronically. This eliminates the need for physical paperwork, reduces errors, and speeds up your tax payment process.

-

Can I integrate airSlate SignNow with other software for managing the 281 challan PDF?

Yes, airSlate SignNow offers integrations with numerous applications, such as Google Drive and Dropbox, making it easy to manage your 281 challan PDF alongside other documents. This interoperability enhances your overall document management strategy.

-

What are the benefits of eSigning the 281 challan PDF with airSlate SignNow?

eSigning the 281 challan PDF with airSlate SignNow improves security and compliance, providing an audit trail for each document. Additionally, the ease of use ensures that you can quickly complete and submit your tax documents without hassle.

Get more for Kotak Tds Challan

- Karvy 15g form online submission

- Usda existing dwelling certification form

- Nca login renewal form

- Cacfp menu template form

- Phs inclusion enrollment report fillable form

- Highly structured parenting plan florida form

- Dh1096 housing statement housing statement made by applicant or tenant housing pathways form

- S44 model daval per a la concessi de fraccionaments form

Find out other Kotak Tds Challan

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF