Paye A1 2015

What is the PAYE A1?

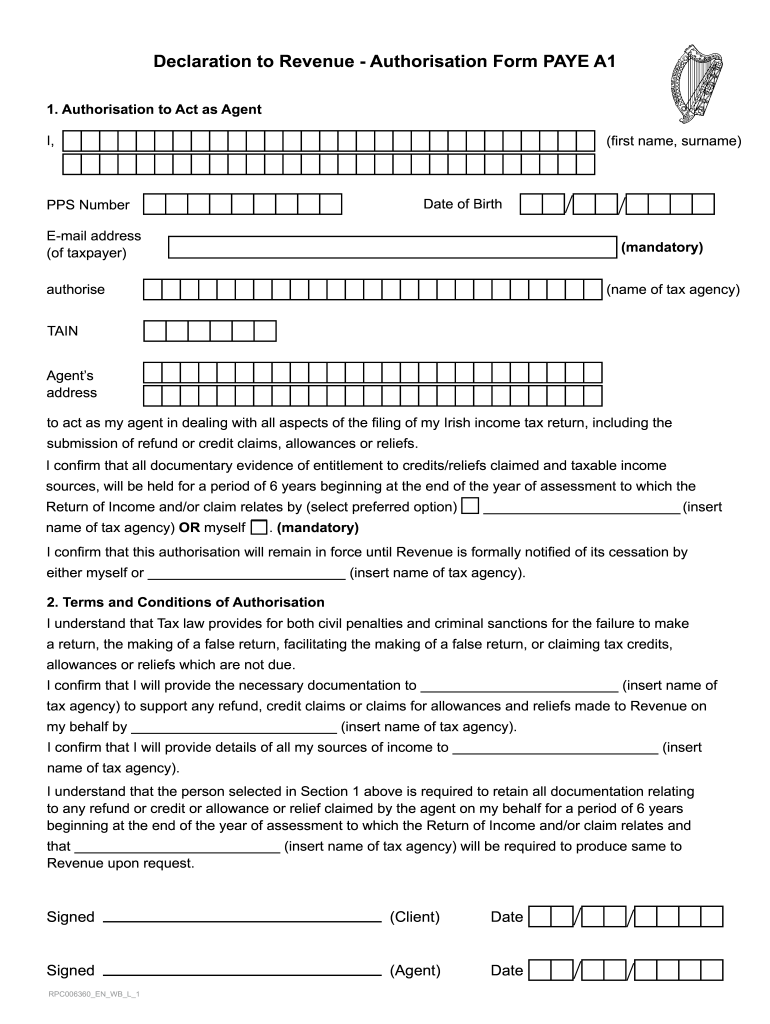

The PAYE A1 form is a crucial document used for tax purposes, particularly for individuals working temporarily in another country while remaining employed in their home country. It serves to confirm the individual's social security coverage and ensures that they are not subject to double taxation. This form is essential for those who are part of the Pay As You Earn (PAYE) system, allowing them to maintain their tax obligations while working abroad.

How to use the PAYE A1

Using the PAYE A1 form involves a straightforward process. First, individuals must determine their eligibility based on their employment status and the nature of their work abroad. Once eligibility is confirmed, the form can be completed with the necessary personal and employment information. It is important to submit the form to the relevant tax authority in your home country to ensure compliance and avoid any issues with tax obligations.

Steps to complete the PAYE A1

Completing the PAYE A1 form requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including your full name, address, and tax identification number.

- Provide details about your employer, including their name and address.

- Specify the nature of your work and the duration of your assignment abroad.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to your local tax authority or the designated office responsible for processing such forms.

Legal use of the PAYE A1

The legal use of the PAYE A1 form is governed by international tax agreements and domestic laws. It is essential to ensure that the form is used correctly to avoid legal complications. The form helps to establish that the individual remains under the social security system of their home country, thus preventing double taxation. Compliance with the regulations surrounding the PAYE A1 form is crucial for maintaining legal status while working abroad.

Required Documents

When applying for the PAYE A1 form, certain documents are typically required to support your application. These may include:

- A valid identification document, such as a passport or driver's license.

- Proof of employment, such as a contract or letter from your employer.

- Any previous tax documents that may be relevant to your application.

Having these documents ready can streamline the application process and ensure compliance with all requirements.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines associated with the PAYE A1 form. Generally, the form should be submitted before the individual begins their work assignment abroad. Specific deadlines may vary depending on the local tax authority, so it is advisable to check with them for the most accurate information. Missing these deadlines can result in penalties or complications regarding tax obligations.

Quick guide on how to complete paye a1

Complete Paye A1 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the correct format and securely save it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and electronically sign your documents promptly without interruptions. Manage Paye A1 on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign Paye A1 with ease

- Locate Paye A1 and then click Get Form to begin.

- Employ the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate reprinting new copies of documents. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign Paye A1 and guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct paye a1

Create this form in 5 minutes!

How to create an eSignature for the paye a1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the A1 form revenue and how does it work?

The A1 form revenue is a key document used for tax and revenue identification in various business transactions. It serves as proof of compliance for international transactions, ensuring that revenue is correctly reported according to regulations. Using airSlate SignNow, you can easily create, send, and eSign A1 forms efficiently to streamline your revenue processes.

-

How can airSlate SignNow help with managing A1 form revenue?

With airSlate SignNow, managing your A1 form revenue becomes seamless. Our platform allows for quick creation, sharing, and signing of A1 forms, ensuring compliance and reducing errors. Automated workflows help you track your documents, promoting efficient management of your revenue processes.

-

Is there a cost associated with using airSlate SignNow for A1 form revenue?

Yes, airSlate SignNow offers flexible pricing plans designed to fit different business needs, including those specifically handling A1 form revenue. Our cost-effective solutions ensure you get the best value while streamlining your document management processes. You can choose a plan that best suits your company's size and requirements.

-

What features does airSlate SignNow offer for A1 form revenue management?

AirSlate SignNow provides a range of features tailored for A1 form revenue management, such as customizable templates, real-time tracking, and secure eSigning capabilities. These features enhance accuracy and compliance, allowing your team to focus on core business activities rather than manual processing. Additionally, you can integrate various tools to further optimize your workflows.

-

Are there any integrations available to support A1 form revenue processes?

Yes, airSlate SignNow supports numerous integrations that can enhance your A1 form revenue processes. You can seamlessly connect with popular CRM and accounting tools to ensure that all revenue-related documents are handled efficiently. This integration helps maintain consistency across your business operations and provides a holistic view of your revenue data.

-

What benefits do businesses receive from using airSlate SignNow for A1 form revenue?

By leveraging airSlate SignNow for A1 form revenue, businesses benefit from improved efficiency, accuracy, and compliance. The platform's user-friendly interface ensures that all team members can navigate the process easily, saving time and resources. Furthermore, electronic signatures reduce turnaround times, allowing for quicker revenue recognition.

-

How secure is using airSlate SignNow for A1 form revenue documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive A1 form revenue documents. We implement robust encryption methods and secure servers to protect your data from unauthorized access. With compliance certifications, you can trust that your revenue documents are safe throughout the signing and storage process.

Get more for Paye A1

Find out other Paye A1

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT