Iht406 2015-2026

What is the IHT406?

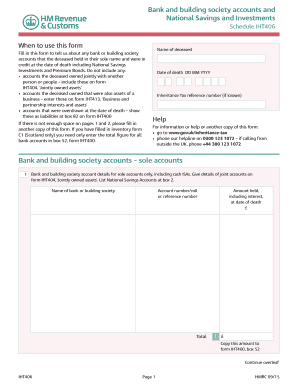

The IHT406 form is a crucial document used in the United Kingdom for reporting the value of an estate for inheritance tax purposes. It is typically required when an individual passes away, and their estate exceeds a certain threshold. The form provides detailed information about the deceased's assets, liabilities, and any exemptions that may apply. Understanding the IHT406 is essential for ensuring compliance with inheritance tax regulations and for the accurate assessment of the tax owed by the estate.

How to use the IHT406

Using the IHT406 form involves several key steps. First, gather all necessary financial information related to the deceased's estate, including property values, bank accounts, investments, and any debts. Next, complete the form by accurately reporting these details, ensuring that all figures are correct and supported by relevant documentation. After filling out the IHT406, it must be submitted to the appropriate tax authority, typically along with any other required forms. It is advisable to seek assistance from a tax professional if needed to ensure that the form is completed accurately.

Steps to complete the IHT406

Completing the IHT406 form involves a systematic approach:

- Gather all relevant financial documents, including bank statements, property deeds, and investment statements.

- Determine the value of the estate by assessing all assets and liabilities.

- Fill out the IHT406 form, ensuring that all information is accurate and complete.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the relevant tax authority, along with any supporting documents.

Legal use of the IHT406

The IHT406 form has legal significance as it serves as an official declaration of the estate's value for tax purposes. When completed correctly, it helps ensure that the estate complies with inheritance tax laws. The information provided in the form can be used by tax authorities to assess the tax owed and to verify that the estate has been administered in accordance with legal requirements. Proper use of the IHT406 can prevent potential legal disputes and penalties associated with inaccurate reporting.

Key elements of the IHT406

Several key elements must be included when completing the IHT406 form:

- Personal Information: Details about the deceased, including name, date of birth, and date of death.

- Asset Valuation: A comprehensive list of all assets, including real estate, bank accounts, and personal property, along with their respective values.

- Liabilities: Any debts or obligations that the deceased had at the time of death.

- Exemptions: Information on any applicable exemptions or reliefs that may reduce the taxable value of the estate.

Filing Deadlines / Important Dates

It is important to be aware of the deadlines associated with the IHT406 form to avoid penalties. Generally, the form must be submitted within six months of the date of death. If the form is not submitted on time, interest may accrue on any tax owed. Additionally, if the estate is not settled within the specified timeframe, further legal complications may arise. Keeping track of these deadlines ensures compliance and helps facilitate the smooth administration of the estate.

Quick guide on how to complete iht406 350004270

Complete Iht406 easily on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Iht406 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Iht406 effortlessly

- Obtain Iht406 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, the hassle of searching for forms, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Iht406 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht406 350004270

Create this form in 5 minutes!

How to create an eSignature for the iht406 350004270

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht406 and how does it relate to airSlate SignNow?

The iht406 is a specific regulatory requirement that certain businesses must adhere to when managing electronic signatures. airSlate SignNow simplifies compliance with iht406 by offering secure and legally binding eSignature solutions designed to meet these standards, making it easier for businesses to stay compliant while saving time.

-

What features does airSlate SignNow offer to meet iht406 requirements?

airSlate SignNow includes features like customizable workflows, audit trails, and secure storage that cater to iht406 requirements. These features help ensure that every digital transaction is documented and can withstand scrutiny, allowing businesses to operate confidently within compliance.

-

How much does airSlate SignNow cost, especially for iht406 compliance?

Pricing for airSlate SignNow varies depending on the plan you choose. However, customers often find the investment worthwhile as it not only helps with eSigning documents, but also aids in meeting iht406 compliance economically, allowing for enhanced efficiency without breaking the bank.

-

Can airSlate SignNow help my business streamline the iht406 eSignature process?

Absolutely! airSlate SignNow is designed to streamline the entire eSignature process in compliance with iht406 regulations. With its user-friendly interface and automated workflows, businesses can send, sign, and manage documents quickly, leading to improved turnaround times and reduced administrative burdens.

-

What are the benefits of using airSlate SignNow for iht406 compliance?

Using airSlate SignNow for iht406 compliance provides numerous benefits, including ensuring document security, creating legally enforceable agreements, and enhancing overall operational efficiency. By leveraging its robust eSignature capabilities, businesses can focus on growth while maintaining compliance with necessary regulations.

-

Does airSlate SignNow integrate with other software to support iht406 compliance?

Yes, airSlate SignNow offers seamless integrations with various software solutions, such as CRM systems and document management tools, thereby supporting iht406 compliance. These integrations help businesses create an efficient digital workflow that enhances productivity while ensuring signatures are compliant.

-

How secure is airSlate SignNow when dealing with iht406 documents?

airSlate SignNow employs state-of-the-art security measures to protect documents related to iht406 compliance. End-to-end encryption, secure cloud storage, and compliance with industry standards ensure that all transactions are safe and that sensitive information is safeguarded.

Get more for Iht406

- Bosch wiper blade rebate form

- Copy certification by document custodian form

- Financial statement other than bank pictures form

- Blank k 9 training case recorddoc sardoc form

- Guide for observing and noting reading behaviors form

- Neighbor consent form

- Dbs bank letterhead form

- Partnership llc agreement template form

Find out other Iht406

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form