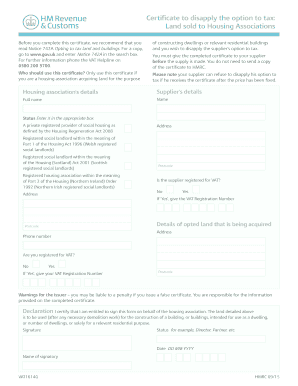

Vat1614g Form

What is the Vat1614g

The Vat1614g form is a specific document used for tax purposes in the United States. It serves as a declaration for certain tax exemptions or adjustments, particularly related to sales tax. Understanding the purpose of this form is essential for individuals and businesses that may qualify for tax relief or need to report specific transactions. Proper completion of the Vat1614g can help ensure compliance with state tax regulations and potentially reduce tax liabilities.

How to use the Vat1614g

Using the Vat1614g form involves several key steps. First, identify the specific tax situation that requires this form. Gather all necessary information, including transaction details and any relevant tax identification numbers. Next, accurately fill out the form, ensuring that all fields are completed as required. After completing the form, review it for accuracy before submission. Finally, submit the form according to the guidelines provided by the relevant tax authority, whether online or via mail.

Steps to complete the Vat1614g

Completing the Vat1614g form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including receipts and tax identification numbers.

- Fill out the form, ensuring all required fields are completed.

- Double-check all entries for accuracy to avoid errors.

- Sign and date the form as required.

- Submit the form as instructed, either online or by mail.

Legal use of the Vat1614g

The legal use of the Vat1614g form is governed by state tax laws. To ensure that the form is legally valid, it must be completed accurately and submitted within the specified deadlines. Compliance with all relevant regulations is crucial to avoid penalties. Additionally, eSigning the Vat1614g through a secure platform can enhance its legal standing, providing an electronic certificate that verifies the authenticity of the signature.

Required Documents

When preparing to complete the Vat1614g form, certain documents are typically required. These may include:

- Tax identification number or Social Security number.

- Receipts or invoices related to the transactions being reported.

- Previous tax returns or forms that may provide context for the current submission.

Having these documents on hand will facilitate a smoother completion process and help ensure compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Vat1614g form can vary by state and specific tax situation. It is essential to be aware of these deadlines to avoid late fees or penalties. Typically, forms must be submitted by the end of the tax year or as specified by the state tax authority. Keeping track of important dates and setting reminders can help ensure timely submission.

Quick guide on how to complete vat1614g

Complete Vat1614g effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle Vat1614g on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Vat1614g with ease

- Find Vat1614g and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to finalize your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Vat1614g and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat1614g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat1614g and how can airSlate SignNow help?

Vat1614g refers to a specific VAT-related document that can be efficiently managed using airSlate SignNow. Our platform simplifies the process of sending and eSigning such documents, ensuring compliance and accuracy while saving time.

-

How much does airSlate SignNow cost for handling vat1614g documents?

Pricing for airSlate SignNow varies based on your subscription plan. We offer affordable options to suit businesses of all sizes, enabling you to manage vat1614g documents without breaking the bank while enjoying all necessary features.

-

What features does airSlate SignNow offer for vat1614g management?

AirSlate SignNow includes robust features for vat1614g management, such as customizable templates, secure electronic signatures, and automated workflows. These features streamline your document processes, making them more efficient and compliant.

-

Can I integrate airSlate SignNow with other software for vat1614g processing?

Yes, airSlate SignNow seamlessly integrates with various software applications, including CRMs and ERPs, to enhance your vat1614g processing. This integration helps centralize your workflows and ensures that all necessary data is easily accessible.

-

How does eSigning vat1614g documents work with airSlate SignNow?

ESigning vat1614g documents with airSlate SignNow is straightforward. Users can upload their documents, add necessary fields for signatures, and send them to recipients for eSigning, all within a secure environment that guarantees data protection.

-

What benefits does airSlate SignNow provide for managing vat1614g documents?

AirSlate SignNow offers numerous benefits for managing vat1614g documents, including faster turnaround times, reduced paper usage, and improved accuracy. These advantages lead to an overall more efficient document management process for businesses.

-

Is there customer support available for questions about vat1614g in airSlate SignNow?

Absolutely! Our dedicated customer support team is available to assist with any queries regarding vat1614g within airSlate SignNow. Whether you need help with features or troubleshooting, we’re here to ensure you maximize your experience.

Get more for Vat1614g

Find out other Vat1614g

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later