Wage Garnishment Form 2 Word

What is the Wage Garnishment Form 2 Word

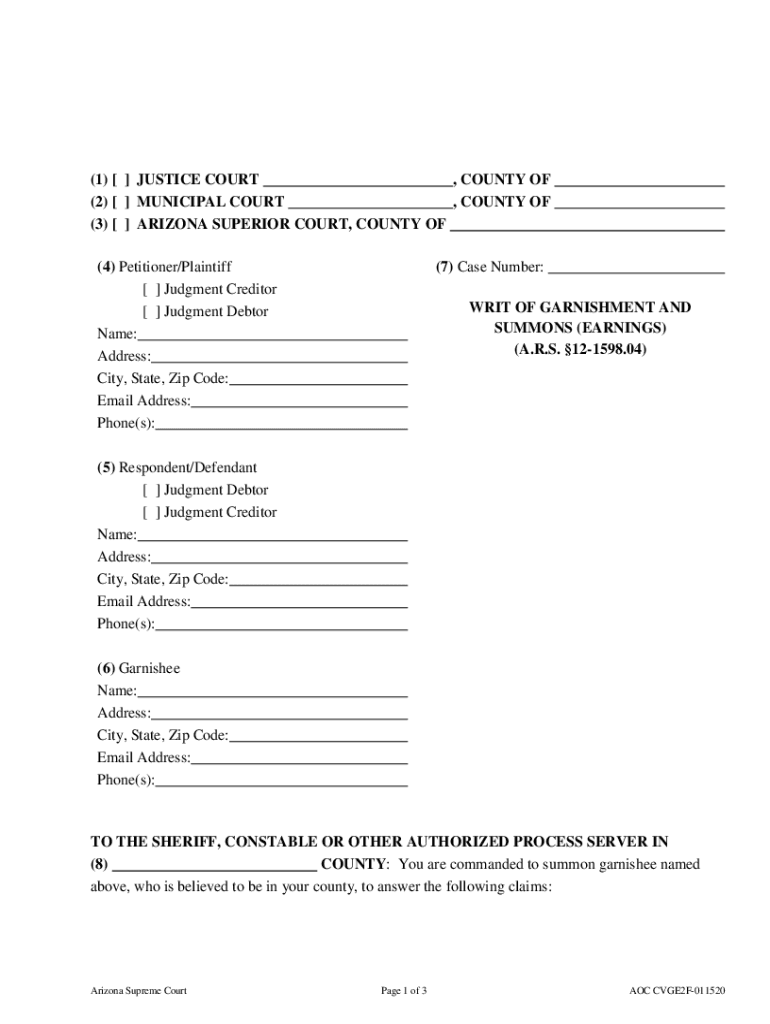

The Wage Garnishment Form 2 Word is a legal document used in the United States to initiate the process of garnishing an employee's wages. This form is typically filed by a creditor who has obtained a court judgment against a debtor. The purpose of the form is to notify the employer of the garnishment order and to provide instructions on how to withhold a portion of the employee's earnings to satisfy the debt. Understanding this form is crucial for both creditors and debtors to ensure compliance with legal requirements.

How to use the Wage Garnishment Form 2 Word

Using the Wage Garnishment Form 2 Word involves several key steps. First, the creditor must complete the form, providing necessary details such as the debtor's information, the amount owed, and the court's judgment details. Once completed, the form must be filed with the appropriate court and served to the employer. The employer is then responsible for withholding the specified amount from the debtor's wages and remitting it to the creditor. It is important to follow the correct procedures to avoid legal complications.

Steps to complete the Wage Garnishment Form 2 Word

Completing the Wage Garnishment Form 2 Word requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the debtor, including their full name, address, and Social Security number.

- Obtain the court judgment details, including the case number and the amount awarded.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- File the completed form with the appropriate court and serve a copy to the employer.

Key elements of the Wage Garnishment Form 2 Word

The Wage Garnishment Form 2 Word includes several key elements that must be accurately filled out for the form to be valid. These elements typically include:

- The creditor's name and contact information.

- The debtor's name, address, and Social Security number.

- The court's judgment details, including case number and amount owed.

- Instructions for the employer regarding the withholding process.

- Signature of the creditor or their representative, affirming the information is correct.

Legal use of the Wage Garnishment Form 2 Word

The legal use of the Wage Garnishment Form 2 Word is governed by state and federal laws. It is essential that the form is used in accordance with these laws to ensure its enforceability. Creditors must have a valid court judgment to initiate garnishment, and they must adhere to the specific procedures outlined in their state's laws. Failure to comply with these legal requirements can result in penalties or the dismissal of the garnishment request.

Who Issues the Form

The Wage Garnishment Form 2 Word is typically issued by the creditor seeking to collect a debt. This can include various entities such as banks, credit card companies, or individual lenders who have obtained a court judgment against the debtor. In some cases, the court may provide a standardized form that creditors must use, ensuring that all necessary information is included for legal compliance.

Quick guide on how to complete wage garnishment form 2 word

Prepare Wage Garnishment Form 2 Word effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute to traditional printed and signed documents, since you can locate the appropriate form and securely archive it online. airSlate SignNow provides all the necessary tools for you to create, modify, and eSign your documents swiftly without any hold-ups. Handle Wage Garnishment Form 2 Word on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest method to adjust and eSign Wage Garnishment Form 2 Word seamlessly

- Locate Wage Garnishment Form 2 Word and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Wage Garnishment Form 2 Word and ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage garnishment form 2 word

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Wage Garnishment Form 2 Word?

The Wage Garnishment Form 2 Word is a customizable document template that allows individuals to formalize wage garnishment requests. This editable Word format ensures that you can fill in the necessary information and tailor it to your specific needs, making the legal process easier to navigate.

-

How can I get a Wage Garnishment Form 2 Word?

You can easily obtain a Wage Garnishment Form 2 Word through the airSlate SignNow platform. Our service provides direct access to create, fill, and electronically sign the form, ensuring a seamless experience in managing your wage garnishment requests.

-

Is the Wage Garnishment Form 2 Word compliant with legal standards?

Yes, the Wage Garnishment Form 2 Word available from airSlate SignNow is designed to comply with legal standards. Our templates are regularly updated to reflect current laws and regulations, helping you stay compliant while completing your wage garnishment processes.

-

What features does airSlate SignNow offer for the Wage Garnishment Form 2 Word?

airSlate SignNow offers a range of features for the Wage Garnishment Form 2 Word, including easy editing, electronic signatures, and cloud storage. These features streamline the document management process, allowing for quick adjustments and secure access from anywhere.

-

Can I integrate the Wage Garnishment Form 2 Word with other software?

Yes, airSlate SignNow allows for seamless integration of the Wage Garnishment Form 2 Word with various software applications. This includes popular tools such as Google Drive, Dropbox, and other document management systems, making it easier to manage your garnishment documentation.

-

What are the benefits of using airSlate SignNow for Wage Garnishment Form 2 Word?

Using airSlate SignNow for your Wage Garnishment Form 2 Word saves you time and reduces stress. With our user-friendly platform and secure electronic signature capabilities, you can focus on your legal matters while we handle the documentation efficiently.

-

How much does it cost to use airSlate SignNow for Wage Garnishment Form 2 Word?

The costs for using airSlate SignNow for the Wage Garnishment Form 2 Word are competitively priced and vary based on your subscription plan. Our plans offer flexibility and scalability to meet the needs of both individuals and businesses, ensuring you get the best value.

Get more for Wage Garnishment Form 2 Word

Find out other Wage Garnishment Form 2 Word

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy