09 04 Ausstellung Der Lohnsteuerbescheinigung PDF Amtsvordrucke Form

What is the Lohnsteuerbescheinigung?

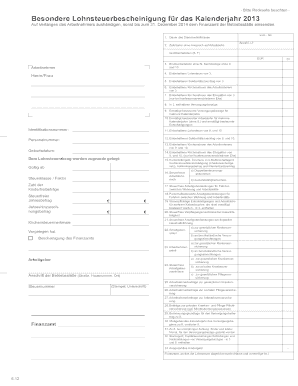

The Lohnsteuerbescheinigung is a crucial tax document in Germany, commonly referred to as the income tax certificate. It summarizes an employee's earnings and the taxes withheld during a specific tax year. This document is essential for both employees and employers, as it provides a detailed account of income and tax contributions, which is necessary for filing annual tax returns. Understanding this document is important for anyone navigating the tax system, especially for expatriates or individuals dealing with international employment situations.

How to Obtain the Lohnsteuerbescheinigung

To obtain the Lohnsteuerbescheinigung, employees typically receive it from their employer at the end of each tax year. Employers are required to issue this document to all employees who have had income tax withheld. If you have not received your certificate, it is advisable to contact your employer's payroll department. In cases where employment has ended, the employer is still obligated to provide this document. Additionally, employees can access their Lohnsteuerbescheinigung through online payroll systems if their employer offers such services.

Steps to Complete the Lohnsteuerbescheinigung

Completing the Lohnsteuerbescheinigung involves several key steps. First, gather all necessary financial documents, including your income statements and any deductions you plan to claim. Next, ensure that your personal information, such as your name, address, and tax identification number, is accurate on the form. Then, input your total earnings and the taxes withheld as reported by your employer. Finally, review the completed form for accuracy before submitting it to the relevant tax authorities or including it with your annual tax return.

Key Elements of the Lohnsteuerbescheinigung

The Lohnsteuerbescheinigung contains several key elements that are crucial for tax reporting. These include:

- Employee Information: Name, address, and tax identification number.

- Employer Information: Name and tax ID of the employer.

- Income Details: Total gross income earned during the tax year.

- Tax Withheld: Total income tax withheld by the employer.

- Social Security Contributions: Contributions to pension and health insurance.

Each of these elements plays an important role in accurately reporting income and taxes to the government.

Legal Use of the Lohnsteuerbescheinigung

The Lohnsteuerbescheinigung is legally recognized as a valid document for tax purposes in Germany. It is essential for individuals when filing their annual tax returns. The information provided must be accurate, as discrepancies can lead to penalties or audits by tax authorities. Furthermore, this document serves as proof of income for various applications, including loans and financial aid, making its accuracy and legitimacy vital.

Quick guide on how to complete 09 04 ausstellung der lohnsteuerbescheinigung pdf amtsvordrucke

Prepare 09 04 ausstellung der lohnsteuerbescheinigung pdf Amtsvordrucke effortlessly on any device

Online document administration has gained popularity among companies and individuals. It provides an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle 09 04 ausstellung der lohnsteuerbescheinigung pdf Amtsvordrucke on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to alter and electronically sign 09 04 ausstellung der lohnsteuerbescheinigung pdf Amtsvordrucke with ease

- Acquire 09 04 ausstellung der lohnsteuerbescheinigung pdf Amtsvordrucke and then click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of missing or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign 09 04 ausstellung der lohnsteuerbescheinigung pdf Amtsvordrucke to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 09 04 ausstellung der lohnsteuerbescheinigung pdf amtsvordrucke

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a lohnsteuerbescheinigung?

A lohnsteuerbescheinigung is an official tax certificate issued in Germany, detailing an employee's income and tax deductions for a specific year. airSlate SignNow allows you to easily create, send, and eSign this document electronically, streamlining your payroll process.

-

How does airSlate SignNow help with generating a lohnsteuerbescheinigung?

With airSlate SignNow, you can efficiently generate a lohnsteuerbescheinigung by using customizable templates that meet legal standards. Our platform simplifies the process of gathering employee data and ensures the document is legally binding once electronically signed.

-

What are the pricing options for using airSlate SignNow for lohnsteuerbescheinigung?

airSlate SignNow offers flexible pricing plans tailored to fit the needs of any business. From solo entrepreneurs needing basic features to large enterprises that require advanced integrations, you can choose the plan that best supports your lohnsteuerbescheinigung and other document signing needs.

-

Can I integrate airSlate SignNow with other software to manage lohnsteuerbescheinigung?

Yes, airSlate SignNow integrates seamlessly with various software tools, including HR management systems and accounting software. This capability allows you to automatically generate and send lohnsteuerbescheinigung directly from your existing platforms, enhancing efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for lohnsteuerbescheinigung?

Using airSlate SignNow for your lohnsteuerbescheinigung provides numerous benefits, including reduced processing time and enhanced security. The platform's electronic signature feature ensures compliance while maintaining the integrity of sensitive information.

-

Is airSlate SignNow secure for handling sensitive documents like lohnsteuerbescheinigung?

Absolutely! airSlate SignNow prioritizes security and compliance, employing advanced encryption protocols to protect your documents, including lohnsteuerbescheinigung. All data is stored in secure servers, ensuring that sensitive information remains confidential.

-

How easy is it to eSign a lohnsteuerbescheinigung with airSlate SignNow?

eSigning a lohnsteuerbescheinigung with airSlate SignNow is incredibly straightforward. Users can simply upload the document, add the necessary recipients, and send it for signatures, all within a few clicks, making the process quick and efficient.

Get more for 09 04 ausstellung der lohnsteuerbescheinigung pdf Amtsvordrucke

- Indiabulls housing finance limited loan application form

- Sports physical packet west orange public school district form

- R 941 form

- Pwd 930 46502726 form

- Schedule k form 990 rev december supplemental information on tax exempt bonds

- Form 990 a practical review

- Schedule o form 990 rev december supplemental information to form 990 or 990 ez

- Form 4684 casualties and thefts

Find out other 09 04 ausstellung der lohnsteuerbescheinigung pdf Amtsvordrucke

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document