Property Lien Form

Understanding the Property Lien

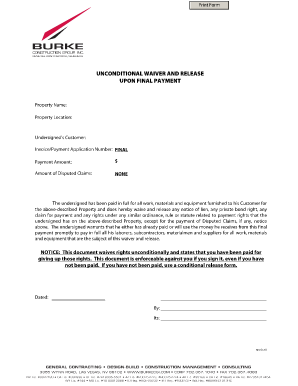

A property lien is a legal claim against a property that allows a lender or a creditor to collect a debt owed by the property owner. This claim can arise from unpaid property taxes, mortgages, or other financial obligations. When a lien is placed on a property, it can affect the owner's ability to sell or refinance the property until the debt is settled. Understanding the nature of a property lien is crucial for property owners to protect their assets and maintain financial health.

Steps to Complete the Property Lien

Completing a property lien involves several key steps to ensure that the process is legally binding and recognized by relevant authorities. Here are the essential steps:

- Gather necessary information, including property details and the amount owed.

- Draft the property lien document, ensuring all required elements are included.

- Obtain signatures from all relevant parties, which may include the creditor and the property owner.

- File the completed lien with the appropriate local government office, such as the county clerk or recorder.

- Pay any required filing fees to finalize the process.

Legal Use of the Property Lien

The legal use of a property lien is governed by state laws, which outline how liens can be created, enforced, and removed. Property liens can be used as a tool for creditors to secure debts, ensuring they have a legal claim to the property until the debt is paid. It is important for property owners to understand their rights and obligations regarding liens, as improper handling can lead to foreclosure or loss of property. Consulting with a legal professional can provide clarity on the implications of a property lien.

Filing Deadlines / Important Dates

Filing deadlines for property liens can vary by state and the type of lien being filed. It is essential to be aware of these deadlines to avoid complications. Generally, property tax liens must be filed within a specific timeframe after the taxes become delinquent. Missing these deadlines can result in the loss of the right to collect the debt. Keeping track of important dates related to property liens helps ensure compliance and protects the interests of the creditor.

Required Documents

To file a property lien, certain documents are typically required. These may include:

- A completed lien form that specifies the details of the debt.

- Proof of the debt, such as invoices or contracts.

- Identification of the property, including legal descriptions and tax identification numbers.

- Any additional documentation required by local laws or regulations.

Having these documents prepared and organized can streamline the filing process and reduce potential delays.

Examples of Using the Property Lien

Property liens can arise in various scenarios. Common examples include:

- Unpaid property taxes, where the local government places a lien to secure payment.

- Mortgages, where lenders file liens to protect their investment until the loan is repaid.

- Contractor liens, where service providers can claim a lien for unpaid work on a property.

These examples illustrate how property liens serve as a mechanism for creditors to secure their interests and ensure payment for services rendered or debts incurred.

Quick guide on how to complete property lien

Complete Property Lien effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, alter, and eSign your documents rapidly without any delays. Manage Property Lien on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign Property Lien with ease

- Obtain Property Lien and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Property Lien and guarantee seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property lien

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the date property tax and how does it affect my business?

The date property tax refers to the date by which property taxes must be collected or filed. Understanding this date is critical for businesses to manage their financial obligations effectively. airSlate SignNow can help you streamline the process of signing and eSigning documents related to property taxes, ensuring compliance with deadlines.

-

How can airSlate SignNow assist with managing my date property tax documentation?

airSlate SignNow offers a secure platform to create, send, and eSign all property tax-related documents. With features that allow for easy tracking and management, you can meet the date property tax requirement without hassle. This solution not only simplifies your documentation process but also ensures timely compliance.

-

Is there a cost associated with using airSlate SignNow for date property tax processing?

airSlate SignNow offers a cost-effective solution for managing your date property tax documents. Pricing varies based on the number of users and features needed, but it provides transparent plans that cater to different business sizes. You can choose a plan that best fits your budget while ensuring efficient management of your property tax documents.

-

What features does airSlate SignNow provide to assist with property taxes?

airSlate SignNow includes features like customizable document templates, real-time tracking, and automated reminders for important dates, such as the date property tax deadlines. These tools help businesses stay organized and meet all compliance requirements easily. The user-friendly interface further ensures that anyone can quickly adapt and utilize these features.

-

Can airSlate SignNow integrate with other applications for managing date property tax?

Yes, airSlate SignNow integrates seamlessly with various applications like CRM systems and accounting software, providing a comprehensive solution for handling your date property tax documentation. This integration allows for efficient data sharing and management, saving time and reducing errors. By connecting your tools, you can streamline your workflow related to property taxes.

-

What are the benefits of using airSlate SignNow for eSigning property tax documents?

Using airSlate SignNow for eSigning property tax documents offers numerous benefits, including faster processing times and enhanced security. With features like legally binding electronic signatures, your submissions are compliant with legal standards. Additionally, you can access documents anytime, helping you stay ahead of crucial deadlines like the date property tax.

-

How can I ensure my documents are secure when dealing with date property tax at airSlate SignNow?

airSlate SignNow prioritizes document security with advanced encryption and secure cloud storage. You can confidently manage all your date property tax documents, knowing they are protected from unauthorized access. Furthermore, the platform conforms to industry standards for data security, giving you peace of mind.

Get more for Property Lien

Find out other Property Lien

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement